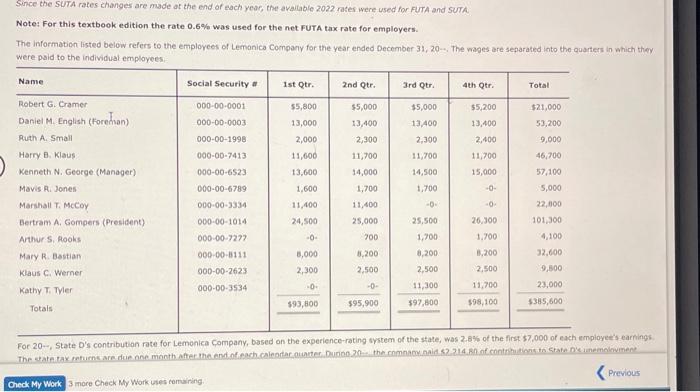

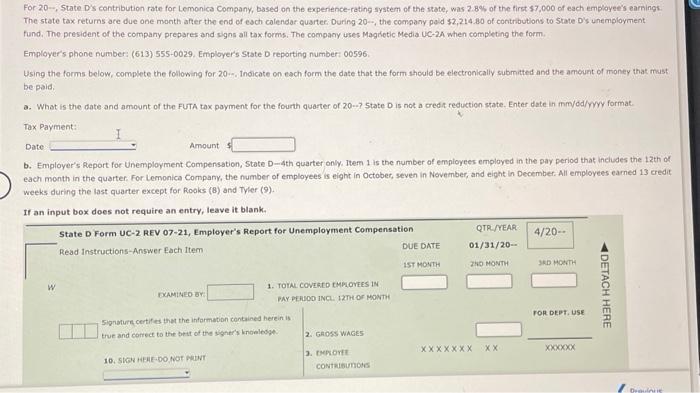

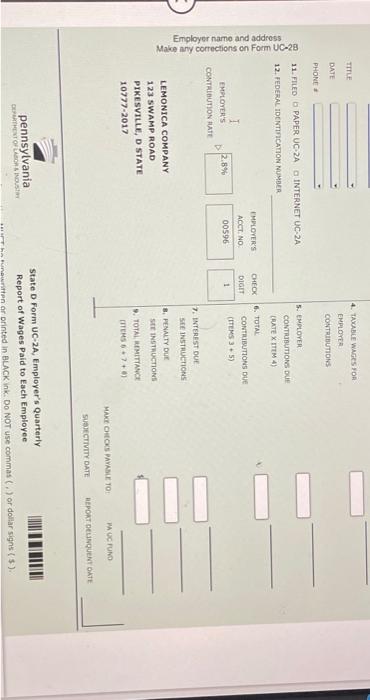

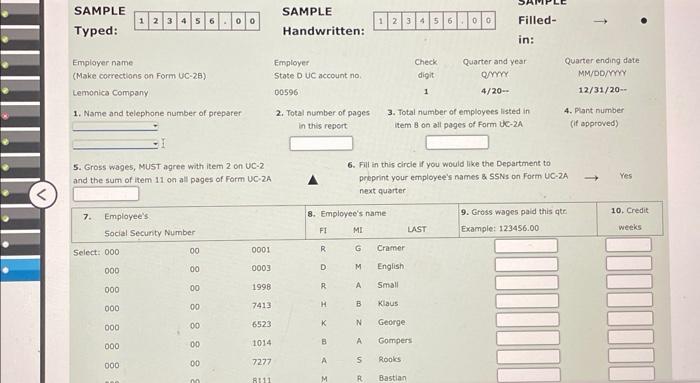

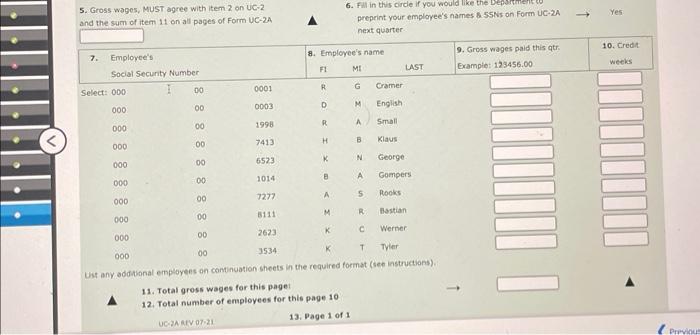

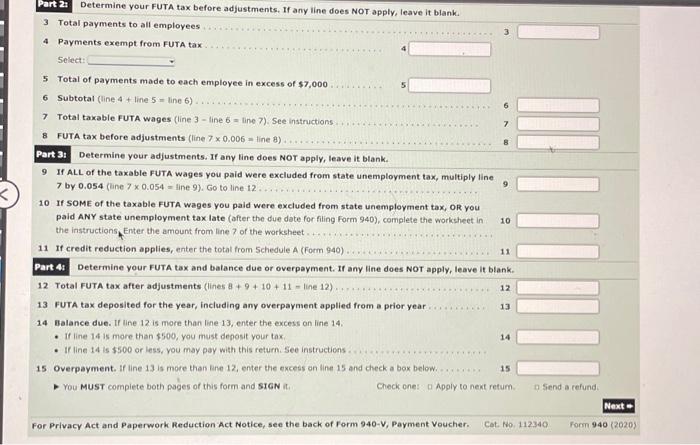

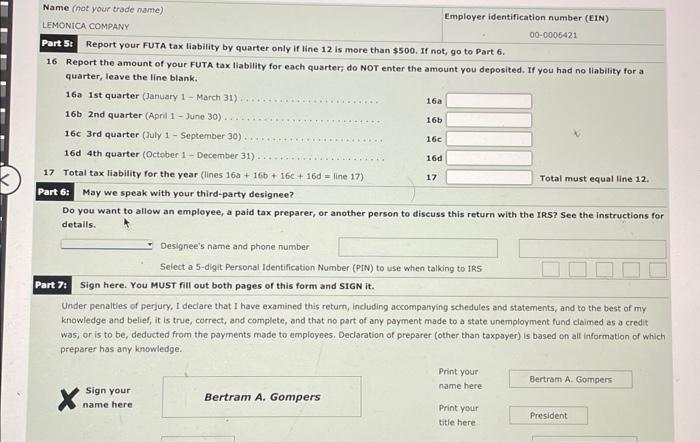

For 20 -, State D's contribution rate for Lemonica Company, based on the expenence-rating system of the state, was 2.8% of the first $7.000 of each employee's earnings. The state tax returns are due one month after the end of esch calendar quarter, During 20--, the company pad $2,214.20 of contributions to 5tate DS unemployment fund. The president of the company prepares and signs all tax forms. The company uses Magdetic Media uc-2A when completing the form. Emplover's phone number: (613) 555-0029. Emplover's state D reporting number: 00596. Using the forms below, complete the following for 20. Theicate on each form the date that the form should be electronically submitted and the amount of money that must be paid: a. What is the date and amount of the FUTA tax payment for the fourth quarter of 20 ? State D is not a credit reduction state. Enter date in inm/dd/myy format. Tax Payment: Date Amount 5 b. Employer's Report for Unemployment Compensation, State D-4th quarter only, lrem 1 is the number of employees employed in the pay period that includes the 12 th of each month in the quarter. For Lemonica Company, the number of employees is eight in October, seven in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Rooks (8) and Tyler (9). 5. Gross wages, MUST agree with item 2 on UC-2 6. Fill in this circle if you would like the Department to and the sum of item 11 on all pages of Form UC-2A proprint your employee's names \& SSNs on Form UC-2A Tes next quarter Part 2a Determine your FUTA tax before adjustments, If any line does NOT apply, leave it blank. 3 Total payments to all employees 3 4 Payments exempt from FUTA tax 4 Select: 5 Total of payments made to each employee in excess of $7,000 5 6 Subtotal (line 4+ line 5 = line 6) 6 7 Total taxable FUTA wages (line 3 line 5= line 7 ). See instructions 7 8 FUTA tax before adjustments (line 70,006= line 8 ) B Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 70.054= line 9 ). Go to line 12 9 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, oR you paid ANY state unemployment tax late (after the due date for filing form 940), complete the worksheet in 10 the instructions, Enter the amount from line ? of the worksheet. 11 If credit reduction applies, enter the total from 5 chedule A (form 940) 11 Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8+9+10+11= line 12) 13 FUTA tax deposited for the year, including any overpayment applied from a prior year.......... 13 14 Balance due. If line 12 is more than line 13, enter the excess on line 14. - If line 14 is more than $500, you must deposit your tax. 14 - Ir line 14 is $500 or less, you may pay with this return. See instructions. 15 Overpayment. If tine 13 is more then line 12 , enter the excess on line 15 and check a box below......... 15 You MUST complete both pages of this form and siGN it. Check one: a Mpgly to next retum. a Siend a refund: Wext : For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940V, Payment Voucher. Cot No, 112340 Form 940 (2020) - Gross wages, MUST agree with item 2 on UC-2 6. Fill in this circle if you would like the Depsermente to nd the sum of item 11 on all pages of Form ve-2h prepeint your employee's names B 55N on form UC-2A Yes next quarter- Wit any adduanal employens on cominuation sheets in the required format (beo instructions): 11. Tetal gross wages for this page! 12. Total number of employees for this page 10 vozuarv 07.21 13. Page 1 of 1 11. FILEO D PAPER UC-2A O INIERNET UC-2A 12. FEOERAL IDENTINICADON NUMAER May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for detalls. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS art 7: Sign here. You MUST fill out both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on ail information of which preparer has any knowledge. Since the SUTA rates changes are made of the end of each year, the avaltable 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. The information listed below refers to the employees of Lemanica Company for the year ended Decimber 31, 20-3, The wages are separated into the quarters in which they were paid to the individual employees: For 20-, State D's contribution rate for Lemonica Company, based on the experience-rating system of the state, was 2.8% of the firs: 57,000 or each employets eartings. 3 more Check My Work utes tomairing. Previous For 20 -, State D's contribution rate for Lemonica Company, based on the expenence-rating system of the state, was 2.8% of the first $7.000 of each employee's earnings. The state tax returns are due one month after the end of esch calendar quarter, During 20--, the company pad $2,214.20 of contributions to 5tate DS unemployment fund. The president of the company prepares and signs all tax forms. The company uses Magdetic Media uc-2A when completing the form. Emplover's phone number: (613) 555-0029. Emplover's state D reporting number: 00596. Using the forms below, complete the following for 20. Theicate on each form the date that the form should be electronically submitted and the amount of money that must be paid: a. What is the date and amount of the FUTA tax payment for the fourth quarter of 20 ? State D is not a credit reduction state. Enter date in inm/dd/myy format. Tax Payment: Date Amount 5 b. Employer's Report for Unemployment Compensation, State D-4th quarter only, lrem 1 is the number of employees employed in the pay period that includes the 12 th of each month in the quarter. For Lemonica Company, the number of employees is eight in October, seven in November, and eight in December. All employees earned 13 credit weeks during the last quarter except for Rooks (8) and Tyler (9). 5. Gross wages, MUST agree with item 2 on UC-2 6. Fill in this circle if you would like the Department to and the sum of item 11 on all pages of Form UC-2A proprint your employee's names \& SSNs on Form UC-2A Tes next quarter Part 2a Determine your FUTA tax before adjustments, If any line does NOT apply, leave it blank. 3 Total payments to all employees 3 4 Payments exempt from FUTA tax 4 Select: 5 Total of payments made to each employee in excess of $7,000 5 6 Subtotal (line 4+ line 5 = line 6) 6 7 Total taxable FUTA wages (line 3 line 5= line 7 ). See instructions 7 8 FUTA tax before adjustments (line 70,006= line 8 ) B Part 3: Determine your adjustments. If any line does NOT apply, leave it blank. 9 If ALL of the taxable FUTA wages you paid were excluded from state unemployment tax, multiply line 7 by 0.054 (line 70.054= line 9 ). Go to line 12 9 10 If SOME of the taxable FUTA wages you paid were excluded from state unemployment tax, oR you paid ANY state unemployment tax late (after the due date for filing form 940), complete the worksheet in 10 the instructions, Enter the amount from line ? of the worksheet. 11 If credit reduction applies, enter the total from 5 chedule A (form 940) 11 Part 4: Determine your FUTA tax and balance due or overpayment. If any line does NOT apply, leave it blank. 12 Total FUTA tax after adjustments (lines 8+9+10+11= line 12) 13 FUTA tax deposited for the year, including any overpayment applied from a prior year.......... 13 14 Balance due. If line 12 is more than line 13, enter the excess on line 14. - If line 14 is more than $500, you must deposit your tax. 14 - Ir line 14 is $500 or less, you may pay with this return. See instructions. 15 Overpayment. If tine 13 is more then line 12 , enter the excess on line 15 and check a box below......... 15 You MUST complete both pages of this form and siGN it. Check one: a Mpgly to next retum. a Siend a refund: Wext : For Privacy Act and Paperwork Reduction Act Notice, see the back of Form 940V, Payment Voucher. Cot No, 112340 Form 940 (2020) - Gross wages, MUST agree with item 2 on UC-2 6. Fill in this circle if you would like the Depsermente to nd the sum of item 11 on all pages of Form ve-2h prepeint your employee's names B 55N on form UC-2A Yes next quarter- Wit any adduanal employens on cominuation sheets in the required format (beo instructions): 11. Tetal gross wages for this page! 12. Total number of employees for this page 10 vozuarv 07.21 13. Page 1 of 1 11. FILEO D PAPER UC-2A O INIERNET UC-2A 12. FEOERAL IDENTINICADON NUMAER May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the IRS? See the instructions for detalls. Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to IRS art 7: Sign here. You MUST fill out both pages of this form and SIGN it. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete, and that no part of any payment made to a state unemployment fund claimed as a credit was, or is to be, deducted from the payments made to employees. Declaration of preparer (other than taxpayer) is based on ail information of which preparer has any knowledge. Since the SUTA rates changes are made of the end of each year, the avaltable 2022 rates were used for FUTA and SUTA. Note: For this textbook edition the rate 0.6% was used for the net FUTA tax rate for employers. The information listed below refers to the employees of Lemanica Company for the year ended Decimber 31, 20-3, The wages are separated into the quarters in which they were paid to the individual employees: For 20-, State D's contribution rate for Lemonica Company, based on the experience-rating system of the state, was 2.8% of the firs: 57,000 or each employets eartings. 3 more Check My Work utes tomairing. Previous