Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for 2019 Jones is seriously ill and has $6 million of property that he wants to leave to his four children. He is considering making

for 2019

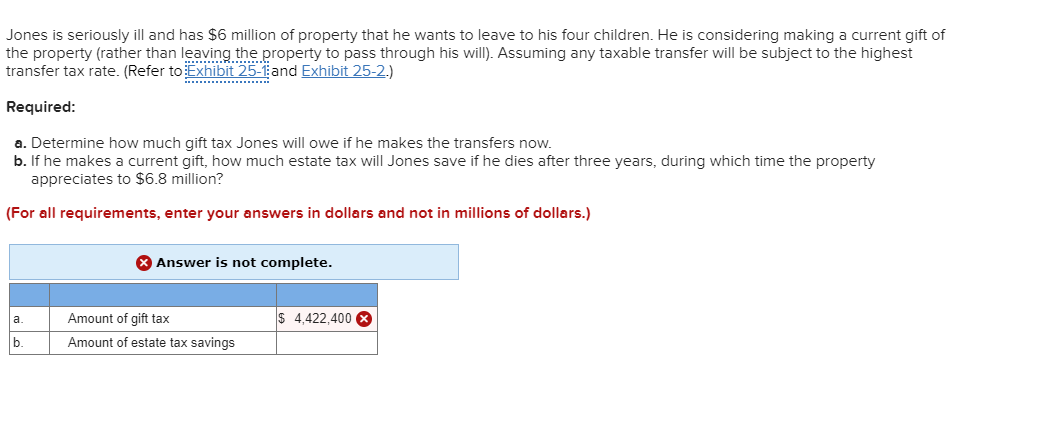

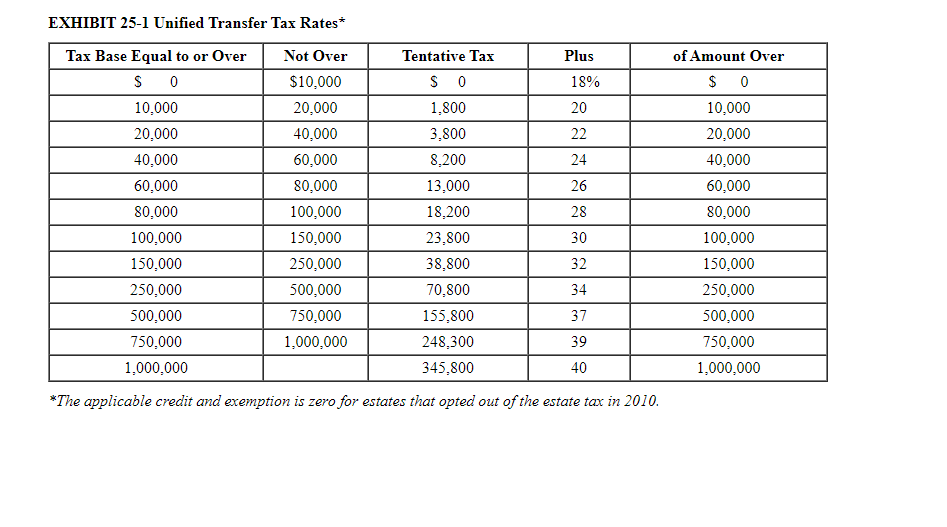

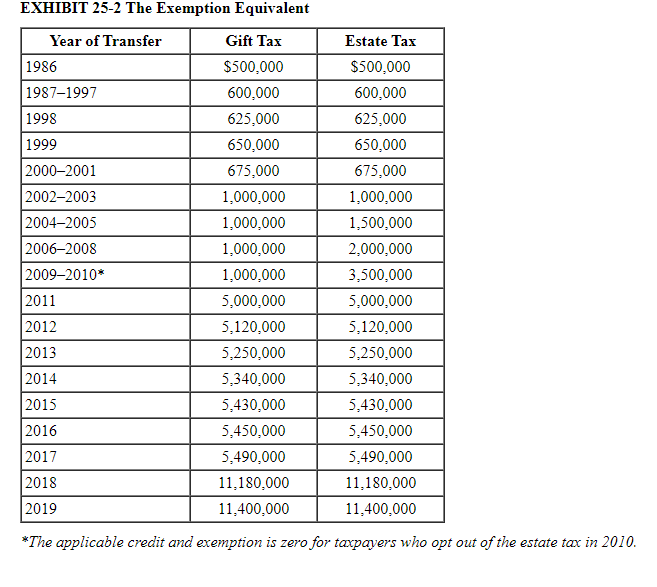

Jones is seriously ill and has $6 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Assuming any taxable transfer will be subject to the highest transfer tax rate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Required: a. Determine how much gift tax Jones will owe if he makes the transfers now. b. If he makes a current gift, how much estate tax will Jones save if he dies after three years, during which time the property appreciates to $6.8 million? (For all requirements, enter your answers in dollars and not in millions of dollars.) Answer is not complete. $ 4,422,400 Amount of gift tax Amount of estate tax savings Plus 18% EXHIBIT 25-1 Unified Transfer Tax Rates* | Tax Base Equal to or Over Not Over S 0 $10,000 10,000 20,000 20.000 40,000 40.000 60,000 60.000 80,000 80.000 100,000 100,000 150,000 150.000 250,000 250.000 500,000 500.000 750,000 750,000 1,000,000 1,000,000 Tentative Tax S 0 1.800 3.800 8.200 13,000 18.200 23.800 38.800 70.800 155.800 248,300 345.800 of Amount Over $ 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 - 32 - 34 37 39 40 *The applicable credit and exemption is zero for estates that opted out of the estate tax in 2010. 0 EXHIBIT 25-2 The Exemption Equivalent Year of Transfer Gift Tax Estate Tax 1986 $500.000 $500,000 19871997 600,000 600,000 1998 625,000 625,000 1999 650,000 650,000 2000-2001 675,000 675.000 2002-2003 1,000,000 1,000,000 2004-2005 1,000,000 1,500,000 2006-2008 1,000,000 2,000,000 2009-2010* 1,000,000 3,500,000 2011 5,000,000 5,000,000 2012 5,120,000 5,120,000 2013 5,250,000 5,250,000 2014 5,340,000 5,340,000 2015 5,430,000 5,430,000 2016 5,450,000 5,450,000 2017 5,490,000 5,490,000 2018 11.180,000 11.180.000 2019 11,400,000 11,400,000 *The applicable credit and exemption is zero for taxpayers who opt out of the estate tax in 2010. 2,120,VUU Jones is seriously ill and has $6 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Assuming any taxable transfer will be subject to the highest transfer tax rate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Required: a. Determine how much gift tax Jones will owe if he makes the transfers now. b. If he makes a current gift, how much estate tax will Jones save if he dies after three years, during which time the property appreciates to $6.8 million? (For all requirements, enter your answers in dollars and not in millions of dollars.) Answer is not complete. $ 4,422,400 Amount of gift tax Amount of estate tax savings Plus 18% EXHIBIT 25-1 Unified Transfer Tax Rates* | Tax Base Equal to or Over Not Over S 0 $10,000 10,000 20,000 20.000 40,000 40.000 60,000 60.000 80,000 80.000 100,000 100,000 150,000 150.000 250,000 250.000 500,000 500.000 750,000 750,000 1,000,000 1,000,000 Tentative Tax S 0 1.800 3.800 8.200 13,000 18.200 23.800 38.800 70.800 155.800 248,300 345.800 of Amount Over $ 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 - 32 - 34 37 39 40 *The applicable credit and exemption is zero for estates that opted out of the estate tax in 2010. 0 EXHIBIT 25-2 The Exemption Equivalent Year of Transfer Gift Tax Estate Tax 1986 $500.000 $500,000 19871997 600,000 600,000 1998 625,000 625,000 1999 650,000 650,000 2000-2001 675,000 675.000 2002-2003 1,000,000 1,000,000 2004-2005 1,000,000 1,500,000 2006-2008 1,000,000 2,000,000 2009-2010* 1,000,000 3,500,000 2011 5,000,000 5,000,000 2012 5,120,000 5,120,000 2013 5,250,000 5,250,000 2014 5,340,000 5,340,000 2015 5,430,000 5,430,000 2016 5,450,000 5,450,000 2017 5,490,000 5,490,000 2018 11.180,000 11.180.000 2019 11,400,000 11,400,000 *The applicable credit and exemption is zero for taxpayers who opt out of the estate tax in 2010. 2,120,VUUStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started