Answered step by step

Verified Expert Solution

Question

1 Approved Answer

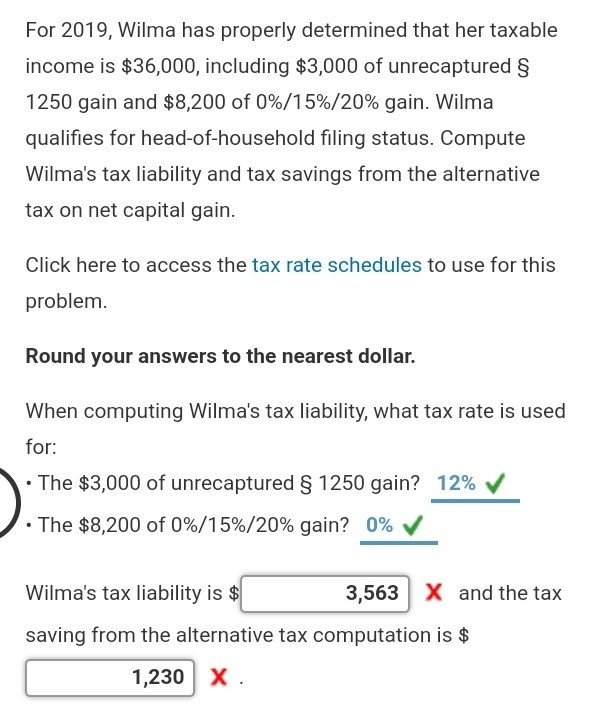

For 2019, Wilma has properly determined that her taxable income is $36,000, including $3,000 of unrecaptured & 1250 gain and $8,200 of 0%/15%/20% gain. Wilma

For 2019, Wilma has properly determined that her taxable income is $36,000, including $3,000 of unrecaptured & 1250 gain and $8,200 of 0%/15%/20% gain. Wilma qualifies for head-of-household filing status. Compute Wilma's tax liability and tax savings from the alternative tax on net capital gain. Click here to access the tax rate schedules to use for this problem. Round your answers to the nearest dollar. When computing Wilma's tax liability, what tax rate is used for: The $3,000 of unrecaptured 1250 gain? 12% The $8,200 of 0%/15%/20% gain? 0% Wilma's tax liability is $ 3,563 X and the tax saving from the alternative tax computation is $ 1,230 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started