Answered step by step

Verified Expert Solution

Question

1 Approved Answer

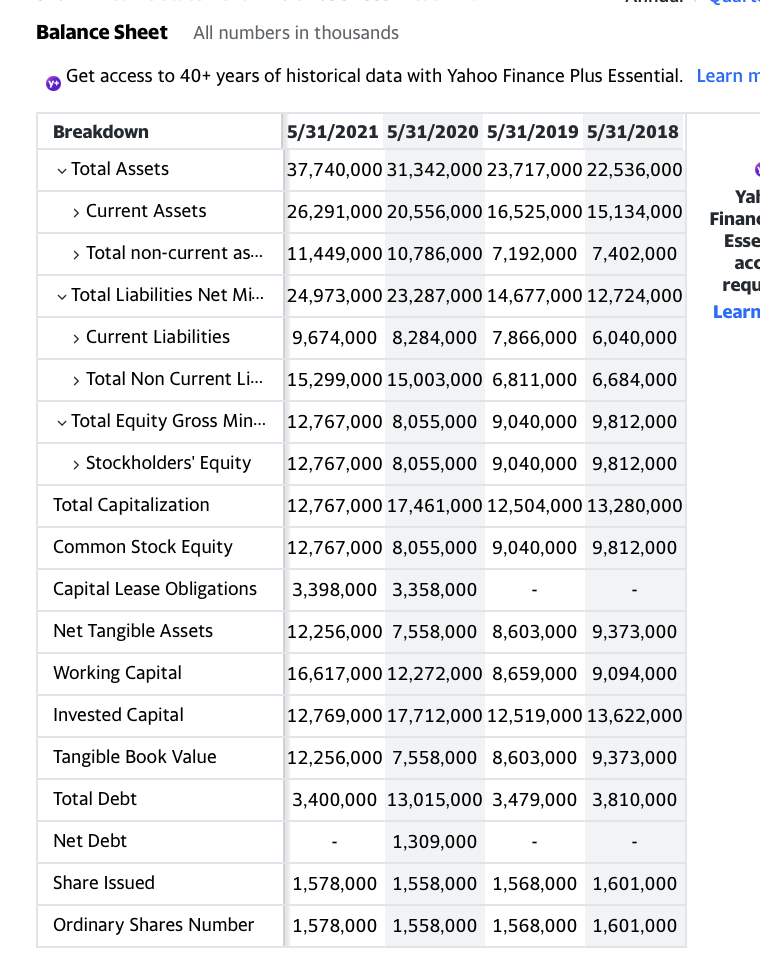

FOR 2020, CALCULATE THE: - ROE --> NI/COMMON EQUITY - OPERATION MANAGEMENT --> NI/SALES - ASSET MANAGEMENT --> SALES/ASSETS -LEVERAGE MANAGEMENT --> ASSETS/COMMON EQUITY PLEASE

FOR 2020, CALCULATE THE:

- ROE --> NI/COMMON EQUITY

- OPERATION MANAGEMENT --> NI/SALES

- ASSET MANAGEMENT --> SALES/ASSETS

-LEVERAGE MANAGEMENT --> ASSETS/COMMON EQUITY

PLEASE SHOW CALCULATIONS!!!!!

NIKE

Balance Sheet All numbers in thousands V Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Learn m Breakdown 5/31/2021 5/31/2020 5/31/2019 5/31/2018 Total Assets 37,740,000 31,342,000 23,717,000 22,536,000 > Current Assets 26,291,000 20,556,000 16,525,000 15,134,000 > Total non-current as... 11,449,000 10,786,000 7,192,000 7,402,000 Yal Finand Esse requ Learn Total Liabilities Net Mi... 24,973,000 23,287,000 14,677,000 12,724,000 > Current Liabilities 9,674,000 8,284,000 7,866,000 6,040,000 > Total Non Current Li... 15,299,000 15,003,000 6,811,000 6,684,000 Total Equity Gross Min... 12,767,000 8,055,000 9,040,000 9,812,000 > Stockholders' Equity 12,767,000 8,055,000 9,040,000 9,812,000 Total Capitalization 12,767,000 17,461,000 12,504,000 13,280,000 Common Stock Equity 12,767,000 8,055,000 9,040,000 9,812,000 Capital Lease Obligations 3,398,000 3,358,000 Net Tangible Assets 12,256,000 7,558,000 8,603,000 9,373,000 Working Capital 16,617,000 12,272,000 8,659,000 9,094,000 Invested Capital 12,769,000 17,712,000 12,519,000 13,622,000 Tangible Book Value 12,256,000 7,558,000 8,603,000 9,373,000 Total Debt 3,400,000 13,015,000 3,479,000 3,810,000 Net Debt 1,309,000 Share Issued 1,578,000 1,558,000 1,568,000 1,601,000 Ordinary Shares Number 1,578,000 1,558,000 1,568,000 1,601,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started