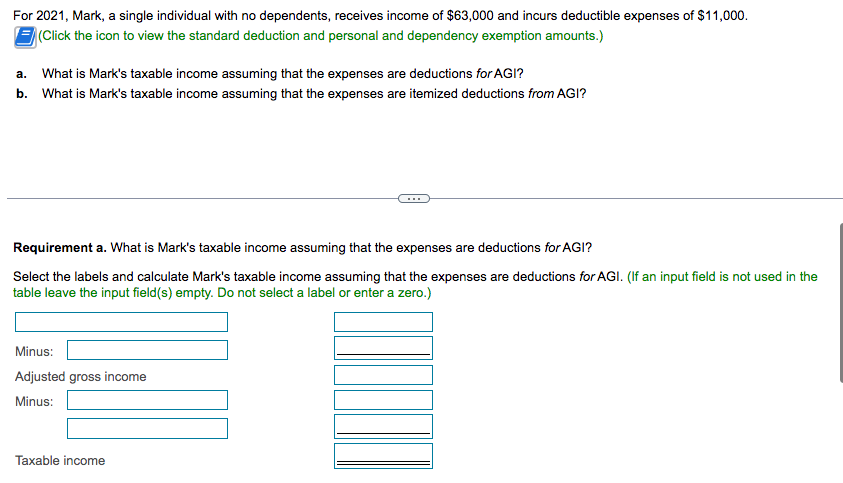

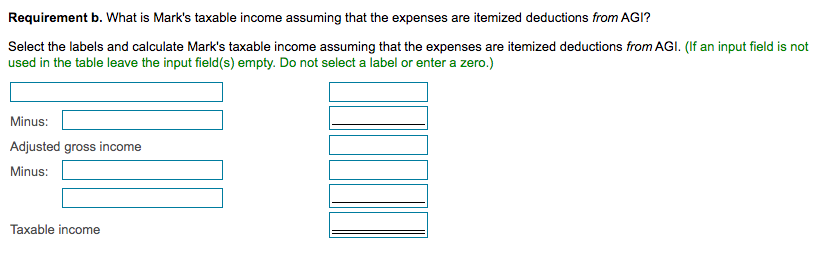

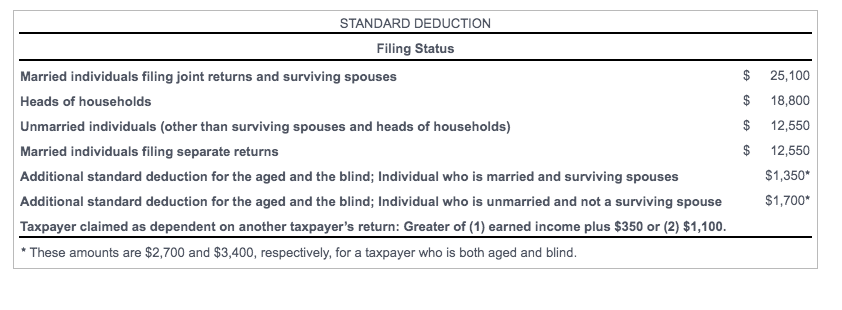

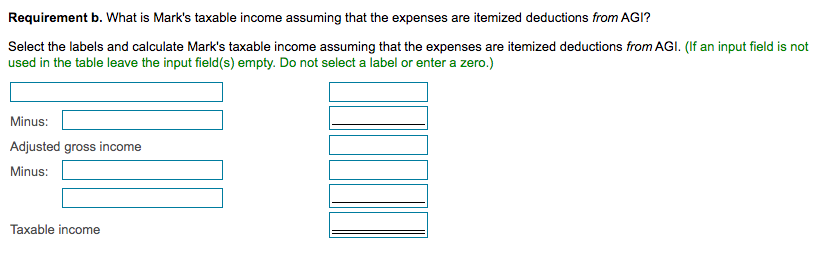

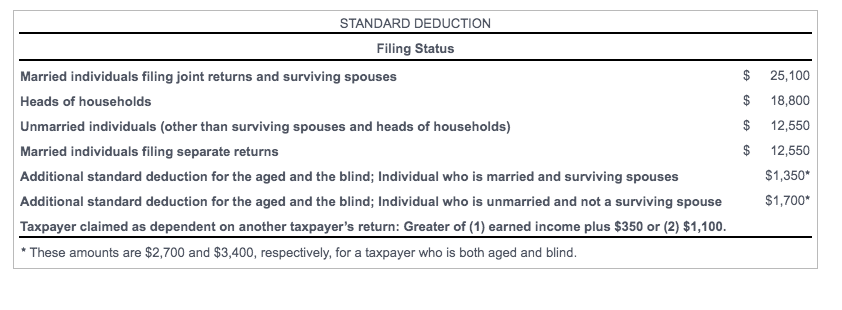

For 2021, Mark, a single individual with no dependents, receives income of $63,000 and incurs deductible expenses of $11,000. (Click the icon to view the standard deduction and personal and dependency exemption amounts.) a. What is Mark's taxable income assuming that the expenses are deductions for AGI? b. What is Mark's taxable income assuming that the expenses are itemized deductions from AGI? Requirement a. What is Mark's taxable income assuming that the expenses are deductions for AGI? Select the labels and calculate Mark's taxable income assuming that the expenses are deductions for AGI. (If an input field is not used in the table leave the input field(s) empty. Do not select a label or enter a zero.) Requirement b. What is Mark's taxable income assuming that the expenses are itemized deductions from AGI? Select the labels and calculate Mark's taxable income assuming that the expenses are itemized deductions from AGI. (If an input field is not used in the table leave the input field(s) empty. Do not select a label or enter a zero.) * These amounts are $2,700 and $3,400, respectively, for a taxpayer who is both aged and blind. For 2021, Mark, a single individual with no dependents, receives income of $63,000 and incurs deductible expenses of $11,000. (Click the icon to view the standard deduction and personal and dependency exemption amounts.) a. What is Mark's taxable income assuming that the expenses are deductions for AGI? b. What is Mark's taxable income assuming that the expenses are itemized deductions from AGI? Requirement a. What is Mark's taxable income assuming that the expenses are deductions for AGI? Select the labels and calculate Mark's taxable income assuming that the expenses are deductions for AGI. (If an input field is not used in the table leave the input field(s) empty. Do not select a label or enter a zero.) Requirement b. What is Mark's taxable income assuming that the expenses are itemized deductions from AGI? Select the labels and calculate Mark's taxable income assuming that the expenses are itemized deductions from AGI. (If an input field is not used in the table leave the input field(s) empty. Do not select a label or enter a zero.) * These amounts are $2,700 and $3,400, respectively, for a taxpayer who is both aged and blind