Answered step by step

Verified Expert Solution

Question

1 Approved Answer

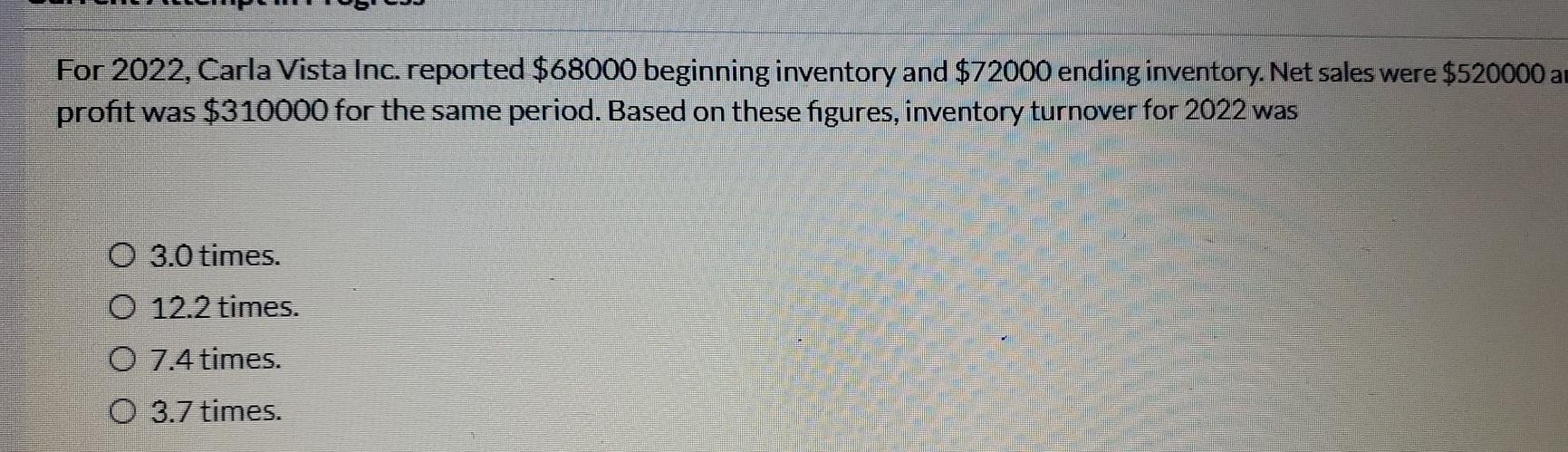

For 2022, Carla Vista Inc. reported $68000 beginning inventory and $72000 ending inventory. Net sales were $520000 a profit was $310000 for the same period.

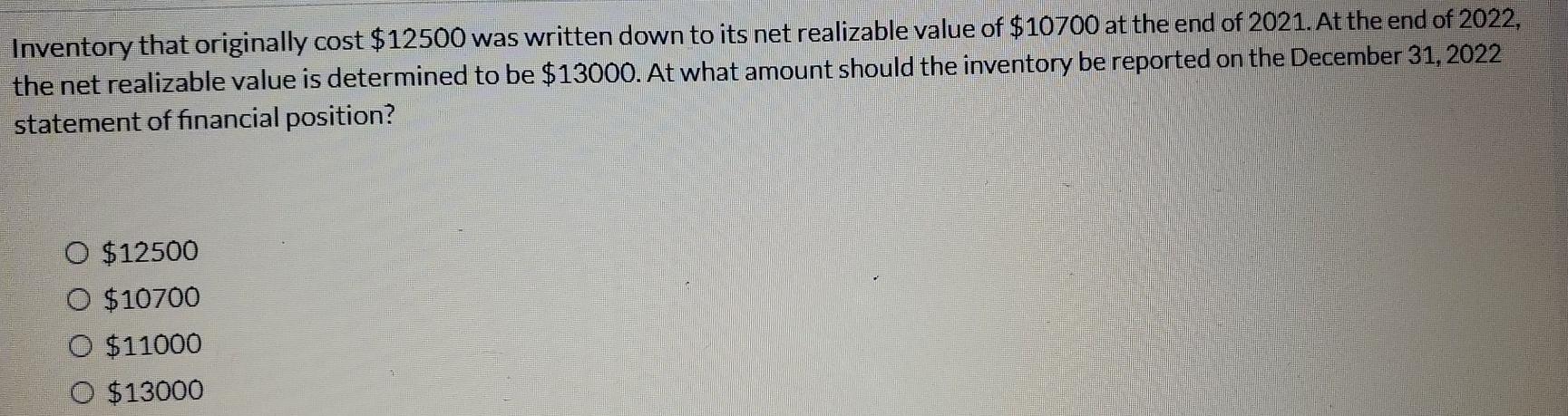

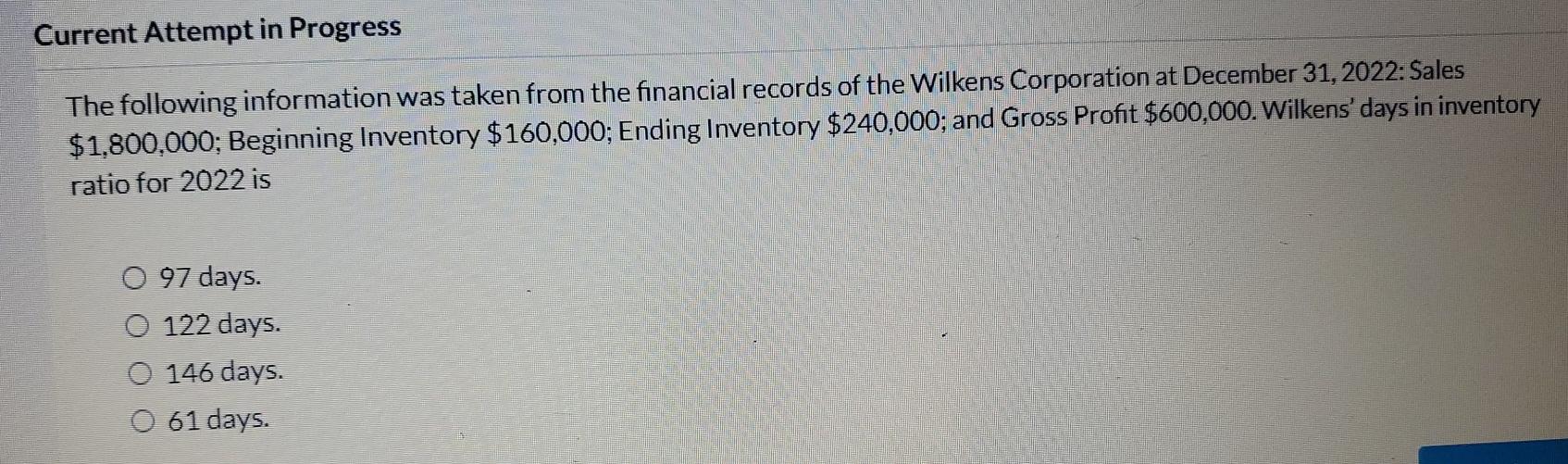

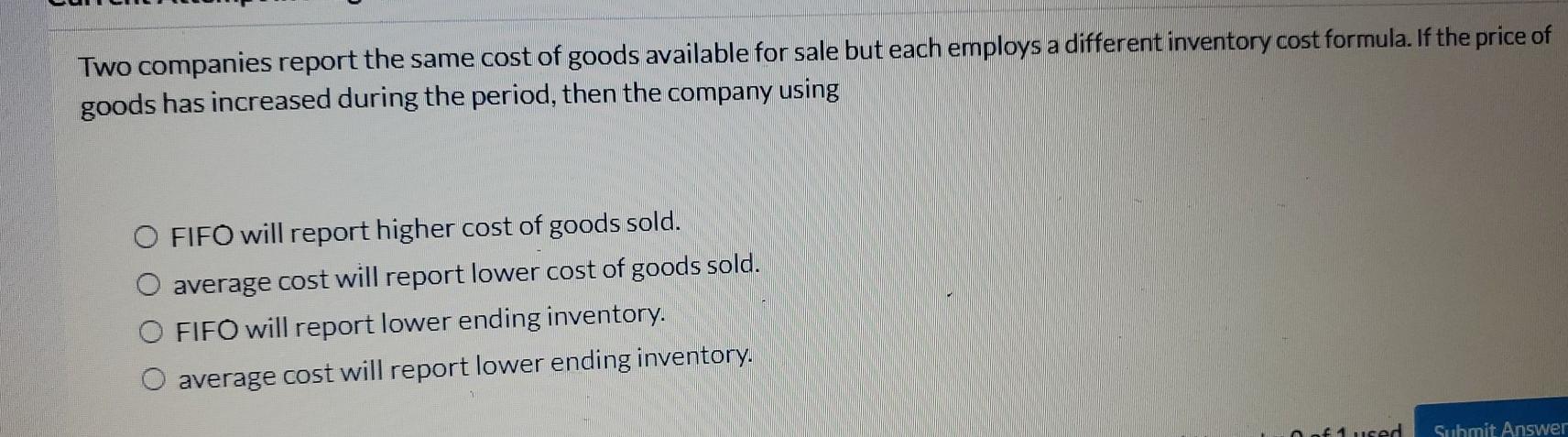

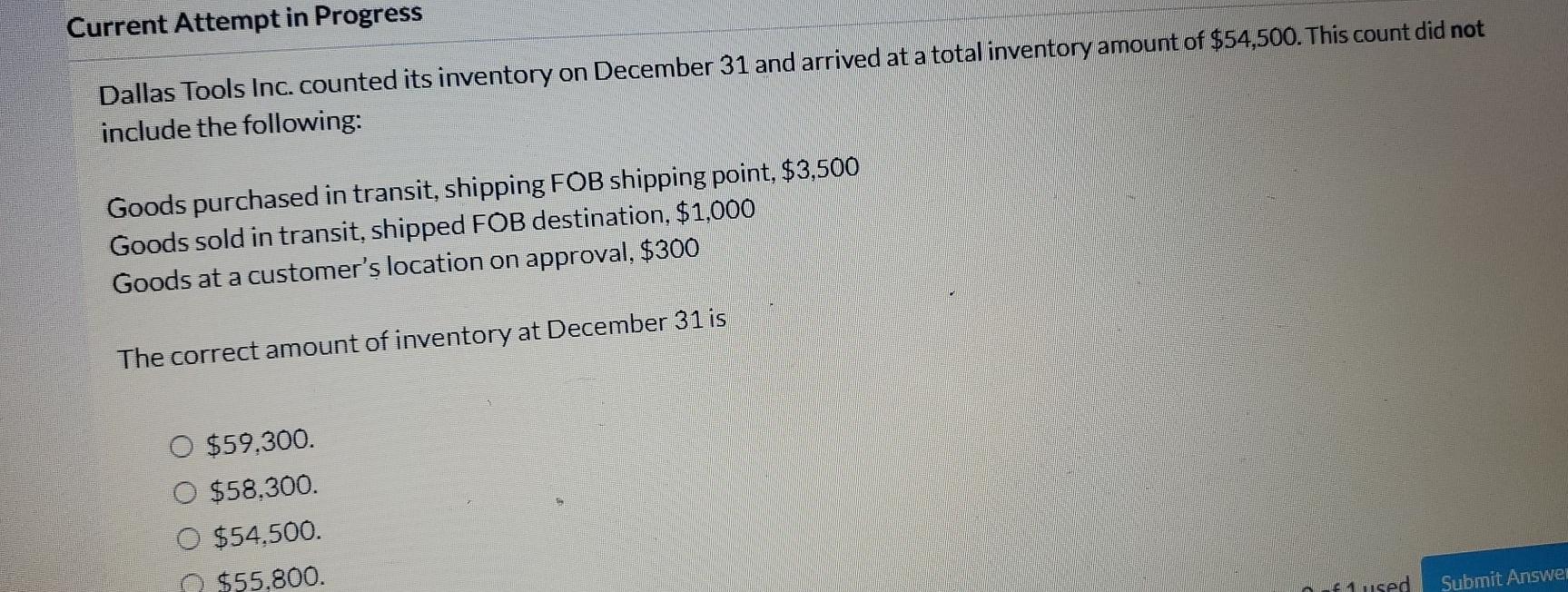

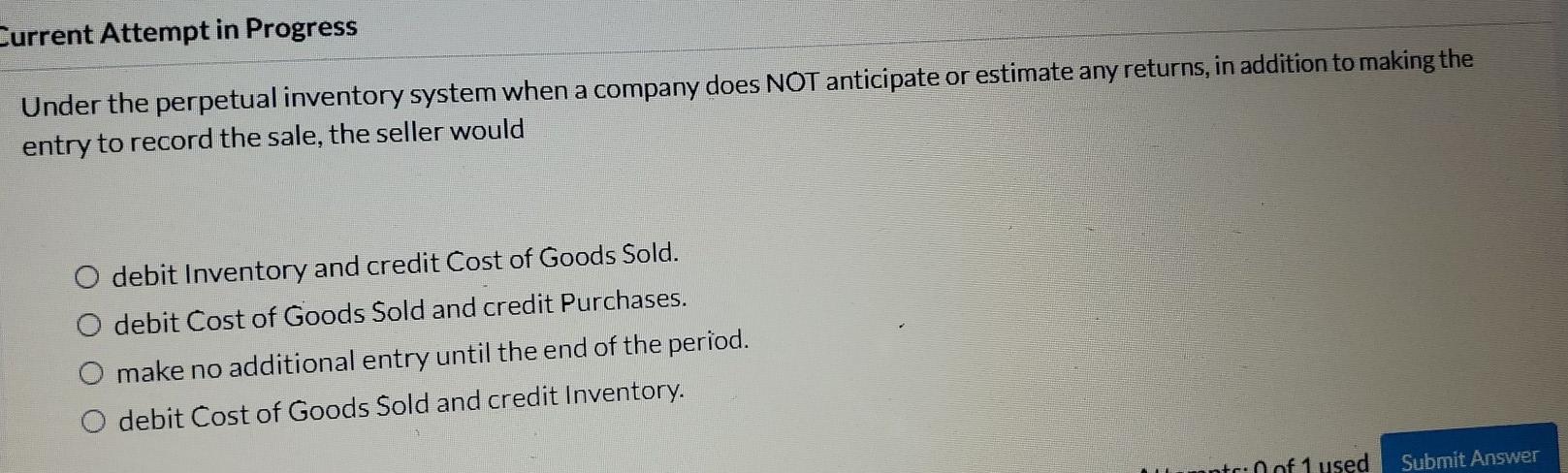

For 2022, Carla Vista Inc. reported $68000 beginning inventory and $72000 ending inventory. Net sales were $520000 a profit was $310000 for the same period. Based on these figures, inventory turnover for 2022 was O 3.0 times. O 12.2 times. O 7.4 times. O 3.7 times. Inventory that originally cost $12500 was written down to its net realizable value of $10700 at the end of 2021. At the end of 2022, the net realizable value is determined to be $13000. At what amount should the inventory be reported on the December 31, 2022 statement of financial position? O $12500 O $10700 O $11000 $13000 Current Attempt in Progress The following information was taken from the financial records of the Wilkens Corporation at December 31, 2022: Sales $1,800,000; Beginning Inventory $160,000; Ending Inventory $240,000; and Gross Profit $600,000. Wilkens' days in inventory ratio for 2022 is O 97 days. 122 days. O 146 days. 0 61 days. Two companies report the same cost of goods available for sale but each employs a different inventory cost formula. If the price of goods has increased during the period, then the company using O FIFO will report higher cost of goods sold. average cost will report lower cost of goods sold. O FIFO will report lower ending inventory. average cost will report lower ending inventory. f 1 used Submit Answer Current Attempt in Progress Dallas Tools Inc. counted its inventory on December 31 and arrived at a total inventory amount of $54,500. This count did not include the following: Goods purchased in transit, shipping FOB shipping point, $3,500 Goods sold in transit, shipped FOB destination, $1,000 Goods at a customer's location on approval, $300 The correct amount of inventory at December 31 is $59,300. $58,300. $54.500. $55.800. fused Submit Answer Current Attempt in Progress Under the perpetual inventory system when a company does NOT anticipate or estimate any returns, in addition to making the entry to record the sale, the seller would debit Inventory and credit Cost of Goods Sold. O debit Cost of Goods Sold and credit Purchases. make no additional entry until the end of the period. O debit Cost of Goods Sold and credit Inventory. mnt: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started