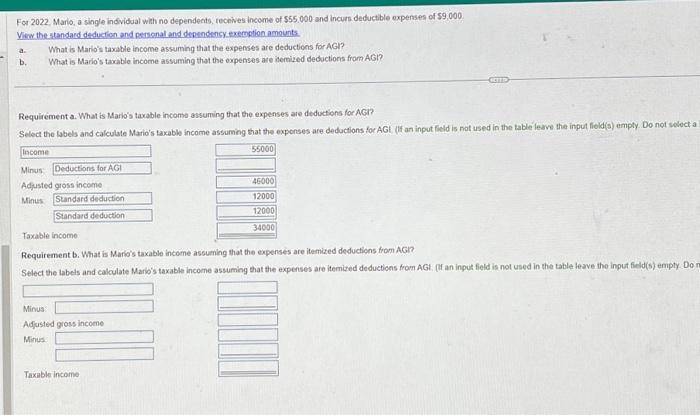

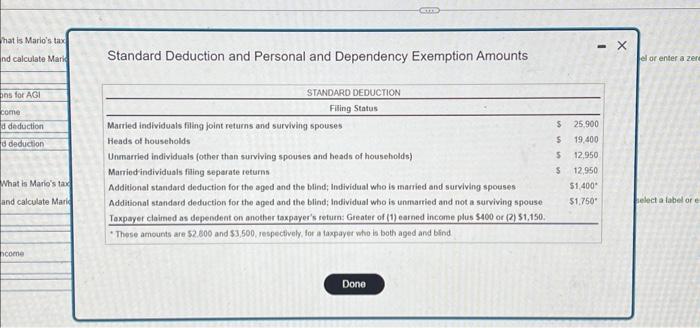

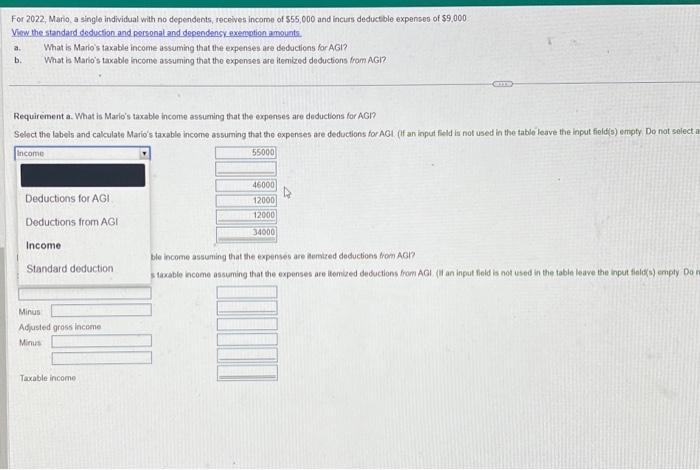

For 2022, Mario, a single individual with no dependects, receives income of $55,000 and incurs deductible expenses of $9,000 View the standard deduclion and persanal and denendency exemption amounts. a. What is Marlo's taxable income assuming that the expenses are deductions for AGI? b. What is Mario's tarable income assuming that the expenses are Berized deductions from AGI? Requirement a. What is Mario's taxable income assuming that the expenses are deductions for AGr? Select the Wbels and calculate Mario's taxable income assuming that the expenses are dedoctions for AGI (if an input field is not used in the table leave the input field(s) empty Do not solect Requirement b. What is Mario's taxable income assuming that the expenses are itemized deductions from AGr? Select the labels and cakulate Marb's taxable income assuming that the expenses are itemized deductices from AGt. (ff an input field is not used in the table leave the input field(s) empty Do hat is Mario's tax nd calculate Maris pos for AGI come d deduction Soduction What is Mario's tang and calculate Mar Standard Deduction and Personal and Dependency Exemption Amounts STANDARD DEDUCTION Filing Status Married individuals filling foint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of housebolds) Marriedindividuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Gieater of (1) earned income plus 5400 or (2) 51,150. - These amounts are $2.800 and $3,500, respectively, for a taxpayer who is both aged and bind el or enter a zer Done For 2022, Mario, a single individual with no dependents, receives income of $55,000 and incirs deductble expenseo of $9,000 View the standard deduction and porsonal and dependansy exemotion amounts. a. What is Mario's taxable income assuming that the expenses are deducions for AGI? b. What is Mario's taxable income assuming that the expenses are itemized deductions from AGI? Requirement a. What is Mario's taxable income assuming that the expenses are deductions for AGI? Seloct the labels and calculate Mario's taxable income assurning that the expenses are deductions for AOr (if an input field is not used in the tablo leave the input fieldis) ermpty. Do not select