Answered step by step

Verified Expert Solution

Question

1 Approved Answer

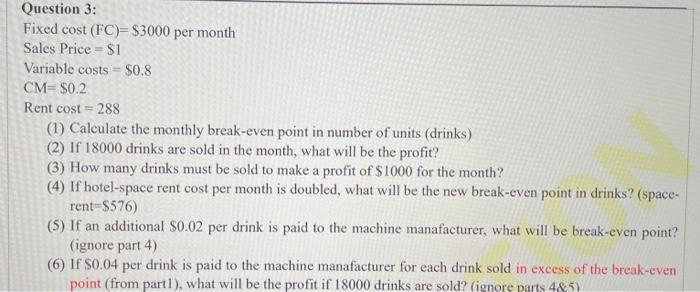

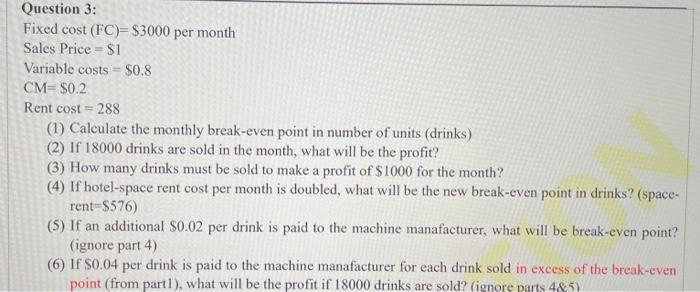

For 6 Questionwhy not subtract TFC Question 3: Fixed cost (FC)= $3000 per month Sales Price =$1 Variable costs $0.8 CM=$0.2 Rent cost = 288

For 6 Questionwhy not subtract TFC

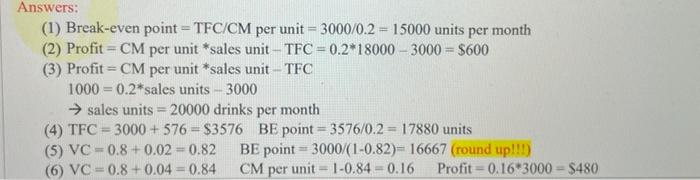

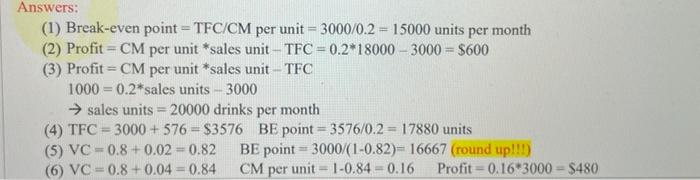

Question 3: Fixed cost (FC)= $3000 per month Sales Price =$1 Variable costs $0.8 CM=$0.2 Rent cost = 288 (1) Calculate the monthly break-even point in number of units (drinks) (2) If 18000 drinks are sold in the month, what will be the profit? (3) How many drinks must be sold to make a profit of $1000 for the month? (4) If hotel-space rent cost per month is doubled, what will be the new break-even point in drinks? (space- rent-$576) (5) If an additional $0.02 per drink is paid to the machine manafacturer, what will be break-even point? (ignore part 4) (6) If $0.04 per drink is paid to the machine manafacturer for each drink sold in excess of the break-even point (from partl), what will be the profit if 18000 drinks are sold? (ignore parts 4&5) Answers: (1) Break-even point = TFC/CM per unit = 3000/0.2 = 15000 units per month (2) Profit=CM per unit *sales unit TFC = 0.2*18000 - 3000 = $600 (3) Profit= CM per unit *sales unit - TFC 1000 = 0.2* sales units - 3000 sales units = 20000 drinks per month (4) TFC = 3000 + 576 = $3576 BE point=3576/0.2 = 17880 units (5) VC -0.8 +0.02 = 0.82 BE point=3000/(1-0.82)=16667 (round up!!!) (6) VC -0.8 +0.04 = 0.84 CM per unit - 1-0.84 -0.16 Profit=0.16 3000 = $480

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started