Answered step by step

Verified Expert Solution

Question

1 Approved Answer

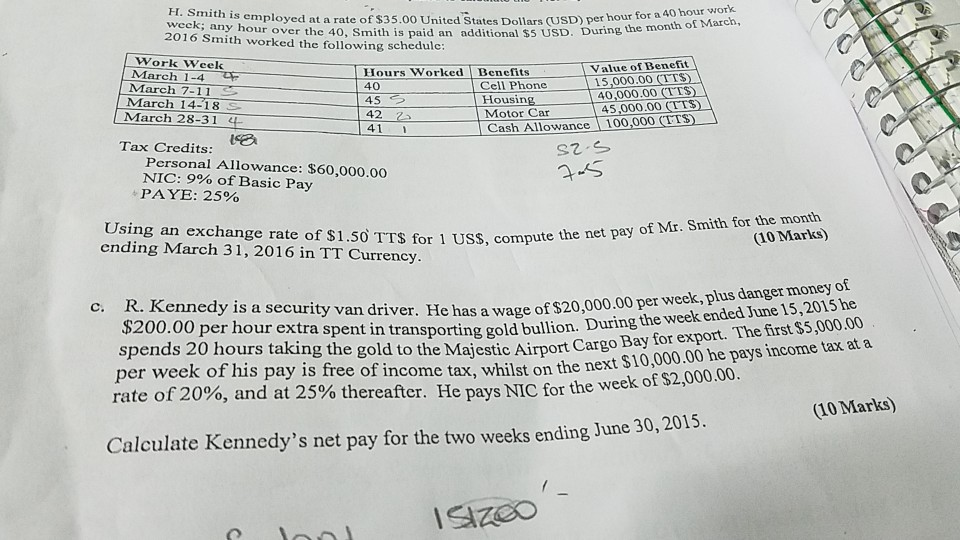

for a 40 hour work is employed at a rate of $35.00 United States Dollars (USD) per hour hour over the 40, Smith is paid

for a 40 hour work is employed at a rate of $35.00 United States Dollars (USD) per hour hour over the 40, Smith is paid an additional $5 USD. During the week; any 20 month of March, 0 Smith worked the following schedulc Work Week March 1-4 Value of Benefit Hours Worked Benefits 40 45 42 Cell Phone March 7-11 40,000.00 TTS Housin Motor Car Cash Allowance | 100,000 (TT$ March 14-18 S March 28-31 4 Tax Credits B Personal Allowance: $60,000.00 NIC: 9% of Basic Pay PAYE: 25% Using an exchange rate of $1.50 TTS for 1 USs, compute the net pay ot ending March 31, 2016 in TT Currency (10 Marks) R. Kennedy is a security van driver. He h $200.00 per hour extra spent in transporting gold bullion. During spends 20 hours taking the gold to the Majestic Airport Cargo Bay per week of his pay is free of income tax, whilst on the next rate of20%, and at 25% thereafter. He pays NIC for th c. as a wage of $20,000.00 per week, plus danger money of the week ended June 15,2015he $10,000.00 he pays income tax at a e week of $2,000.00. (10 Marks) Calculate Kennedy's net pay for the two weeks ending June 30, 2015

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started