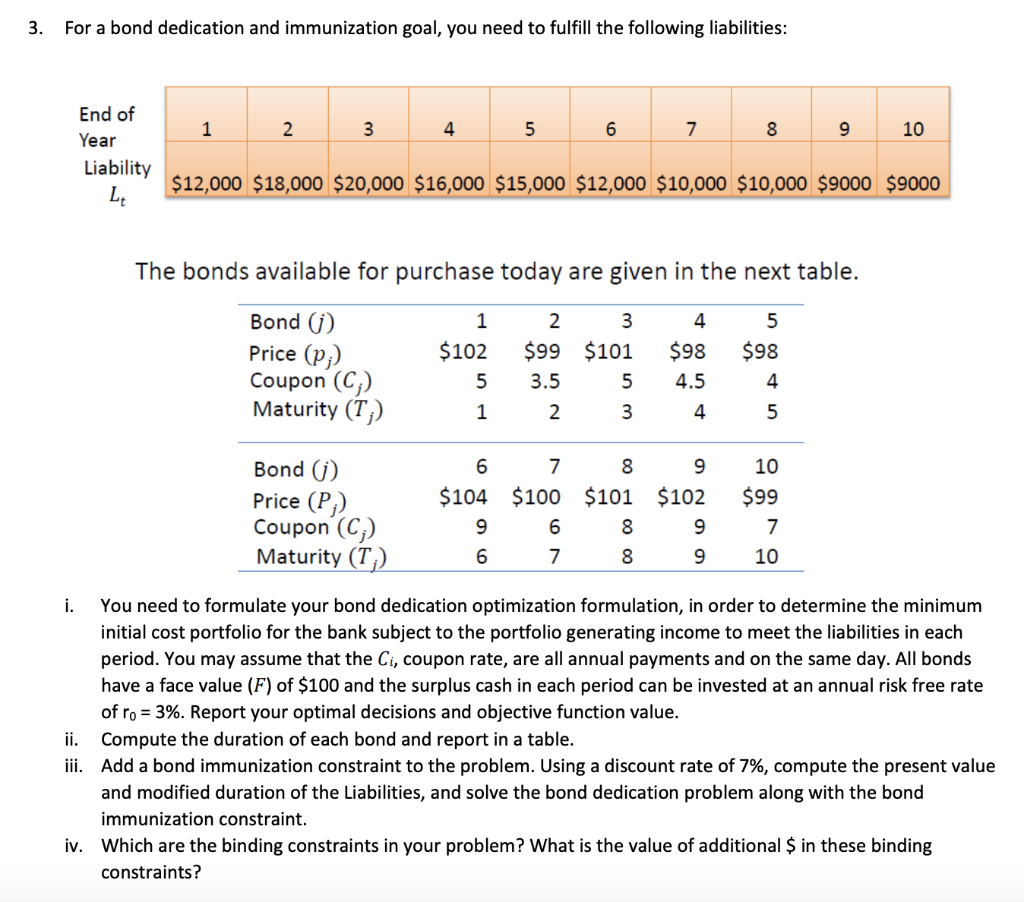

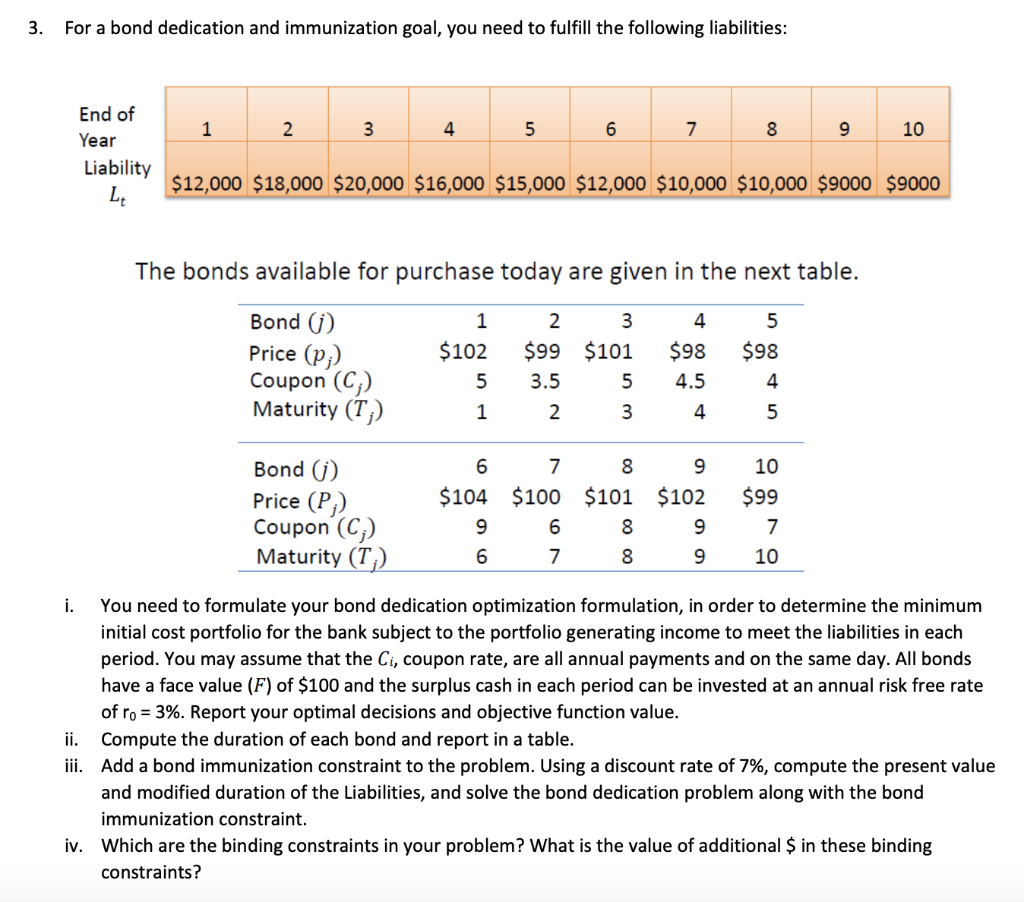

For a bond dedication and immunization goal, you need to fulfill the following liabilities: End of Year Liability Lt The bonds available for purchase today are given in the next table. i. You need to formulate your bond dedication optimization formulation, in order to determine the minimum initial cost portfolio for the bank subject to the portfolio generating income to meet the liabilities in each period. You may assume that the Ci, coupon rate, are all annual payments and on the same day. All bonds have a face value (F) of $100 and the surplus cash in each period can be invested at an annual risk free rate of r0=3%. Report your optimal decisions and objective function value. ii. Compute the duration of each bond and report in a table. iii. Add a bond immunization constraint to the problem. Using a discount rate of 7%, compute the present value and modified duration of the Liabilities, and solve the bond dedication problem along with the bond immunization constraint. iv. Which are the binding constraints in your problem? What is the value of additional \$ in these binding constraints? For a bond dedication and immunization goal, you need to fulfill the following liabilities: End of Year Liability Lt The bonds available for purchase today are given in the next table. i. You need to formulate your bond dedication optimization formulation, in order to determine the minimum initial cost portfolio for the bank subject to the portfolio generating income to meet the liabilities in each period. You may assume that the Ci, coupon rate, are all annual payments and on the same day. All bonds have a face value (F) of $100 and the surplus cash in each period can be invested at an annual risk free rate of r0=3%. Report your optimal decisions and objective function value. ii. Compute the duration of each bond and report in a table. iii. Add a bond immunization constraint to the problem. Using a discount rate of 7%, compute the present value and modified duration of the Liabilities, and solve the bond dedication problem along with the bond immunization constraint. iv. Which are the binding constraints in your problem? What is the value of additional \$ in these binding constraints