Answered step by step

Verified Expert Solution

Question

1 Approved Answer

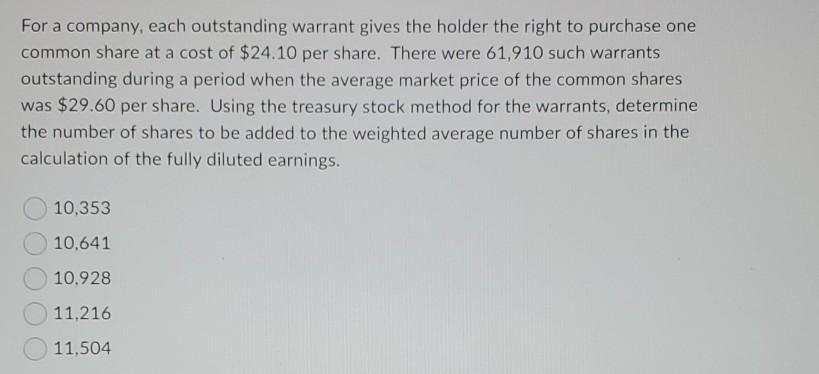

For a company, each outstanding warrant gives the holder the right to purchase one common share at a cost of $24.10 per share. There were

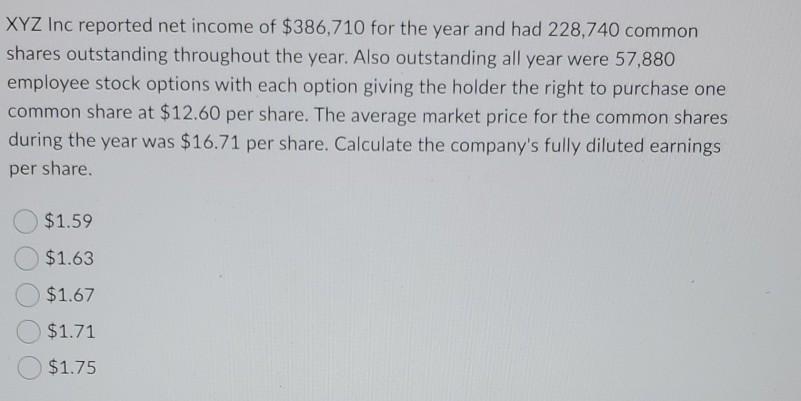

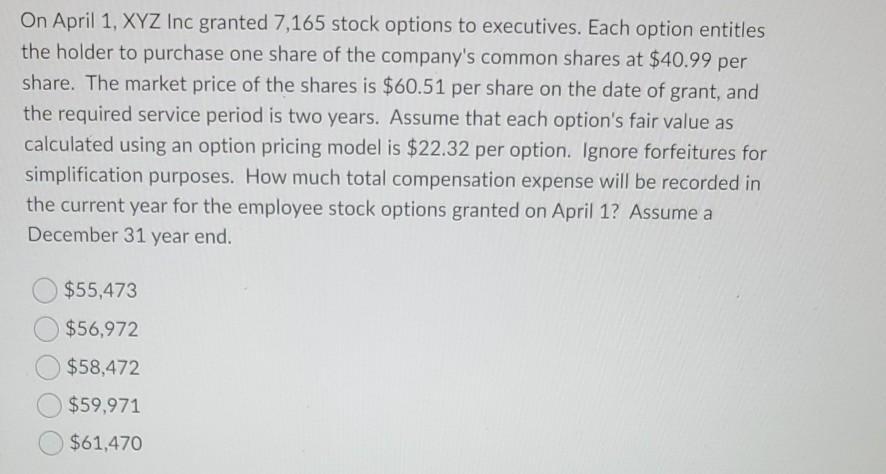

For a company, each outstanding warrant gives the holder the right to purchase one common share at a cost of $24.10 per share. There were 61,910 such warrants outstanding during a period when the average market price of the common shares was $29.60 per share. Using the treasury stock method for the warrants, determine the number of shares to be added to the weighted average number of shares in the calculation of the fully diluted earnings. 10,353 10,641 10,928 11,216 11,504 XYZ Inc reported net income of $386,710 for the year and had 228,740 common shares outstanding throughout the year. Also outstanding all year were 57,880 employee stock options with each option giving the holder the right to purchase one common share at $12.60 per share. The average market price for the common shares during the year was $16.71 per share. Calculate the company's fully diluted earnings per share. $1.59 $1.63 $1.67 $1.71 $1.75 On April 1, XYZ Inc granted 7,165 stock options to executives. Each option entitles the holder to purchase one share of the company's common shares at $40.99 per share. The market price of the shares is $60.51 per share on the date of grant, and the required service period is two years. Assume that each option's fair value as calculated using an option pricing model is $22.32 per option. Ignore forfeitures for simplification purposes. How much total compensation expense will be recorded in the current year for the employee stock options granted on April 1? Assume a December 31 year end. $55,473 $56,972 $58,472 $59,971 $61,470

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started