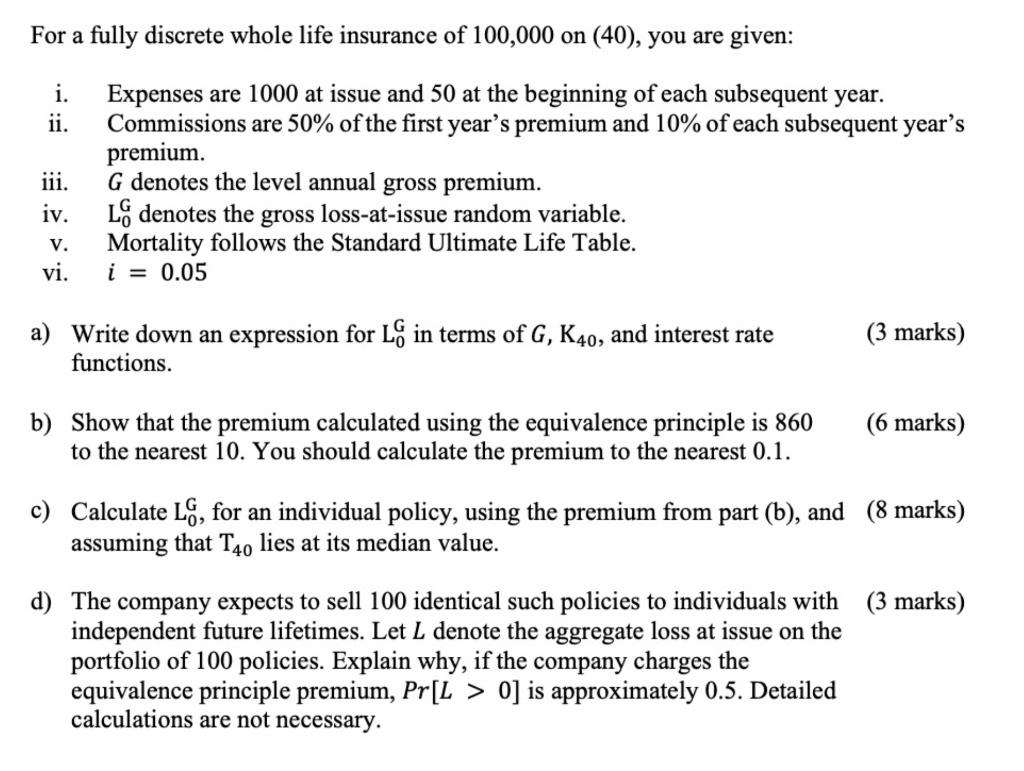

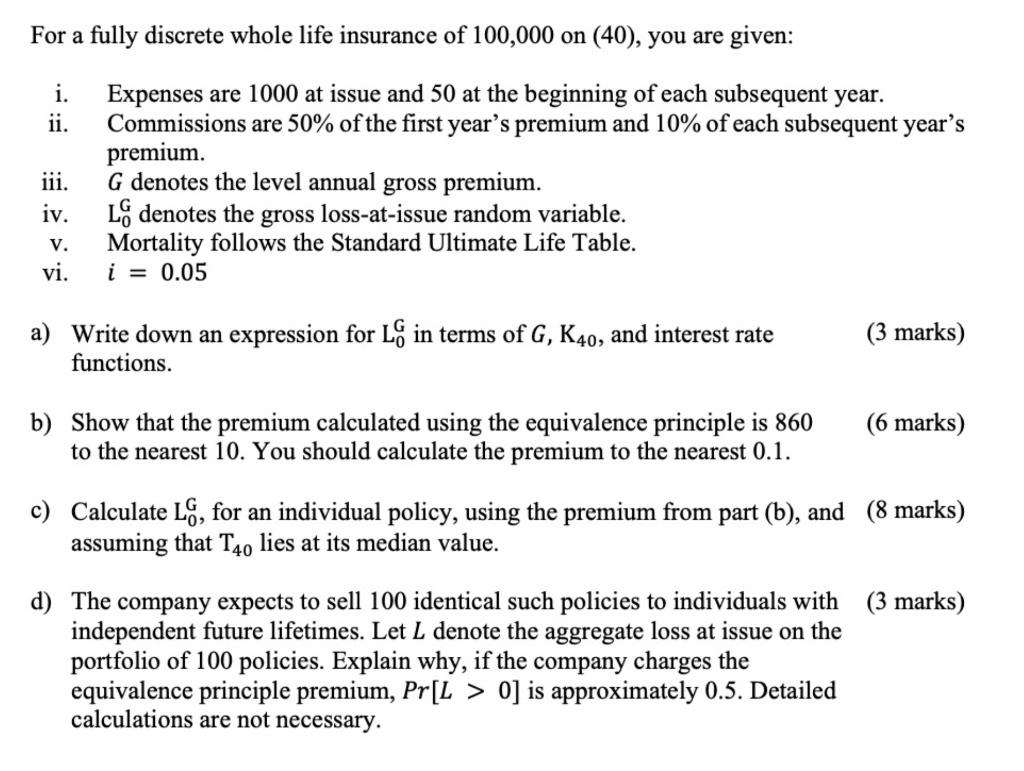

For a fully discrete whole life insurance of 100,000 on (40), you are given: i. ii. iii. iv. V. vi. Expenses are 1000 at issue and 50 at the beginning of each subsequent year. Commissions are 50% of the first year's premium and 10% of each subsequent year's premium. G denotes the level annual gross premium. LS denotes the gross loss-at-issue random variable. Mortality follows the Standard Ultimate Life Table. i = 0.05 a) Write down an expression for Lg in terms of G, K40, and interest rate functions. (3 marks) b) Show that the premium calculated using the equivalence principle is 860 to the nearest 10. You should calculate the premium to the nearest 0.1. (6 marks) c) Calculate LS, for an individual policy, using the premium from part (b), and (8 marks) assuming that T40 lies at its median value. d) The company expects to sell 100 identical such policies to individuals with (3 marks) independent future lifetimes. Let L denote the aggregate loss at issue on the portfolio of 100 policies. Explain why, if the company charges the equivalence principle premium, Pr[L > 0) is approximately 0.5. Detailed calculations are not necessary. For a fully discrete whole life insurance of 100,000 on (40), you are given: i. ii. iii. iv. V. vi. Expenses are 1000 at issue and 50 at the beginning of each subsequent year. Commissions are 50% of the first year's premium and 10% of each subsequent year's premium. G denotes the level annual gross premium. LS denotes the gross loss-at-issue random variable. Mortality follows the Standard Ultimate Life Table. i = 0.05 a) Write down an expression for Lg in terms of G, K40, and interest rate functions. (3 marks) b) Show that the premium calculated using the equivalence principle is 860 to the nearest 10. You should calculate the premium to the nearest 0.1. (6 marks) c) Calculate LS, for an individual policy, using the premium from part (b), and (8 marks) assuming that T40 lies at its median value. d) The company expects to sell 100 identical such policies to individuals with (3 marks) independent future lifetimes. Let L denote the aggregate loss at issue on the portfolio of 100 policies. Explain why, if the company charges the equivalence principle premium, Pr[L > 0) is approximately 0.5. Detailed calculations are not necessary