For a the original journal entry was for a

Cash 5500

Service revenue 5500

c. the second note is for 40,000, 9 month note at 6%

D. Equipment 1. purchased 1/1/19 was bought for 60,000

Equipment 2 purchased for 45,000 on 12/1/19

J. 12/1 last pay day for this employee was on 12/27

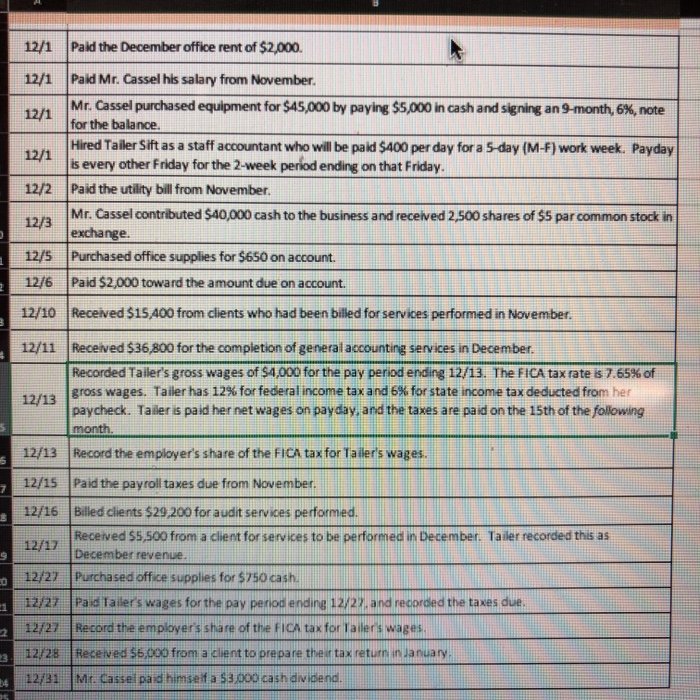

| Hired Tailer Sift as a staff accountant who will be paid $400 per day for a 5-day (M-F) work week. Payday is every other Friday for the 2-week period ending on that Friday. |

| Recorded Tailer's gross wages of $4,000 for the pay period ending 12/13. The FICA tax rate is 7.65% of gross wages. Tailer has 12% for federal income tax and 6% for state income tax deducted from her paycheck. Tailer is paid her net wages on payday, and the taxes are paid on the 15th of the following month. |

I think this is all the info needed to complete these journal entries, We have them done but can't figure out where our numbers are off. If you need any more information to answer these questions please let me know.

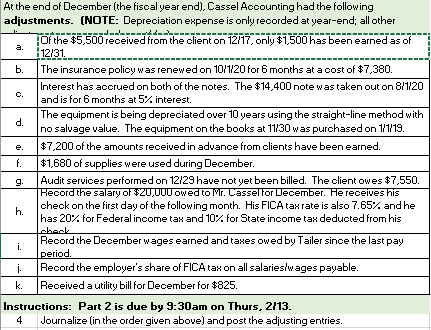

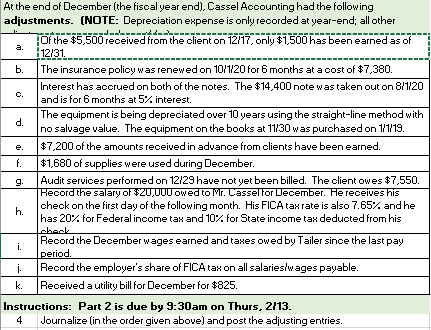

At the end of December (the fiscal year end), Cassel Accounting had the following adjustments. (NOTE: Depreciation expense is only recorded at year-end, all other Of the $5,500 received from the client on 12/17, only $1,500 has been earned as of 12/31.. The insurance policy was renewed on 10/1/20 for 6 months at a cost of $7,380. Interest has accrued on both of the notes. The $14,400 note was taken out on 8/1/20 and is for 6 months at 5% interest. The equipment is being depreciated over 10 years using the straight-line method with no salvage value. The equipment on the books at 11/30 was purchased on 1/1/19 $7,200 of the amounts received in advance from clients have been earned f $1,680 of supplies were used during December. Audit services performed on 12/29 have not yet been billed. The client owes $7,550. Hecord the salary of $20,UUU Owed to Mr. Cassel for December. He receives his check on the first day of the following month. His FICA tax rate is also 7.65%. and he has 20% for Federal income tax and 10% for State income tax deducted from his abael Record the December wages earned and taxes owed by Tailer since the last pay period Record the employer's share of FICA tax on all salarieslwages payable. Received a utility bill for December for $825. Instructions: Part 2 is due by 9:30am on Thurs, 2/13 4 Journalize in the order given above) and post the adjusting entries. 12/1 Paid the December office rent of $2,000 12/1 Paid Mr. Cassel his salary from November 12/1 Mr. Cassel purchased equipment for $45,000 by paying $5,000 in cash and signing an 9-month, 6%, note for the balance. Hired Tailer Sift as a staff accountant who will be paid $400 per day for a 5-day (M-F) work week. Payday| 12/1 is every other Friday for the 2-week period ending on that Friday. 12/2 Paid the utility bill from November 12/3 Mr. Cassel contributed $40,000 cash to the business and received 2,500 shares of $5 par common stock in exchange. 12/5 Purchased office supplies for $650 on account 1276 Paid $2,000 toward the amount due on account. 12/10 Received $15.400 from clients who had been billed for services performed in November. 12/11 Received $36,800 for the completion of general accounting services in December. Recorded Tailer's gross wages of $4,000 for the pay period ending 12/13. The FICA tax rate is 7.65% of gross wages. Tailer has 12% for federalincome tax and 6% for state income tax deducted from her 12/13 paycheck. Tailer is paid her net wages on payday, and the taxes are paid on the 15th of the following month 12/13 Record the employer's share of the FICA tax for Tailer's wages. 12/15 Paid the payroll taxes due from November. 12/16 Billed clients $29,200 for audit services performed Received 55,500 from a client for services to be performed in December. Tailer recorded this as 12/17 December revenue. 12/27 Purchased office supplies for $750 cash, 12/27 Paid Tailer's wages for the pay period ending 12/27 and recorded the taxes due. 12/27 Record the employer's share of the FICA tax for it ilers wages 12/28 Received $5,000 from a client to prepare their tax return in January 12/31 Mr. Cassel pad himself a $3.000 cash dividend