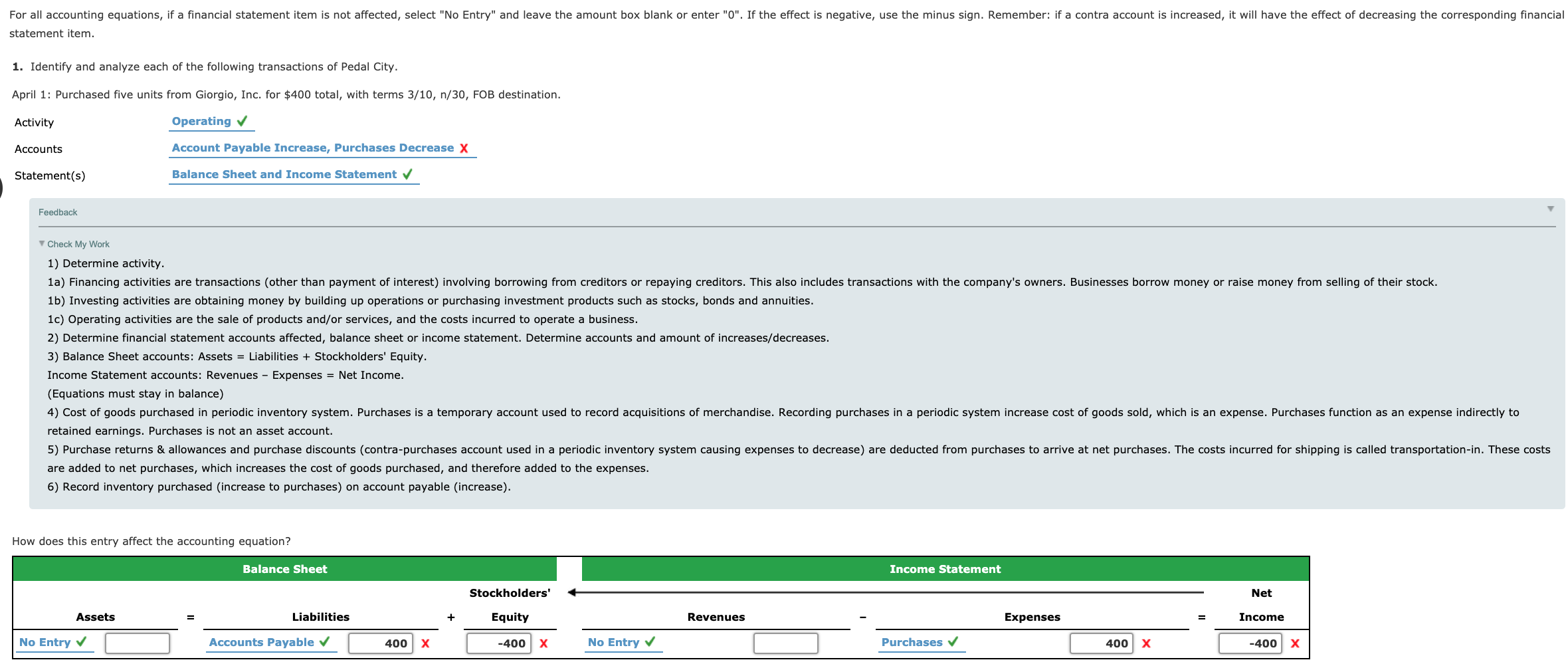

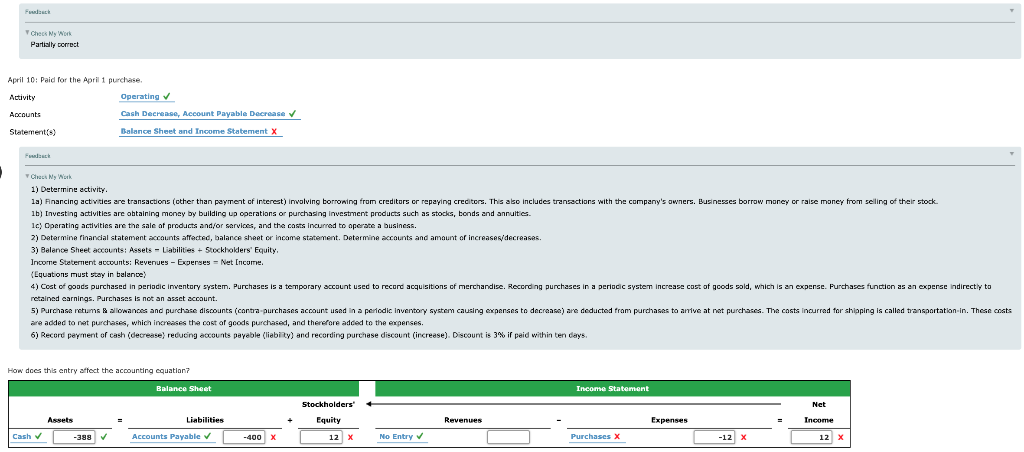

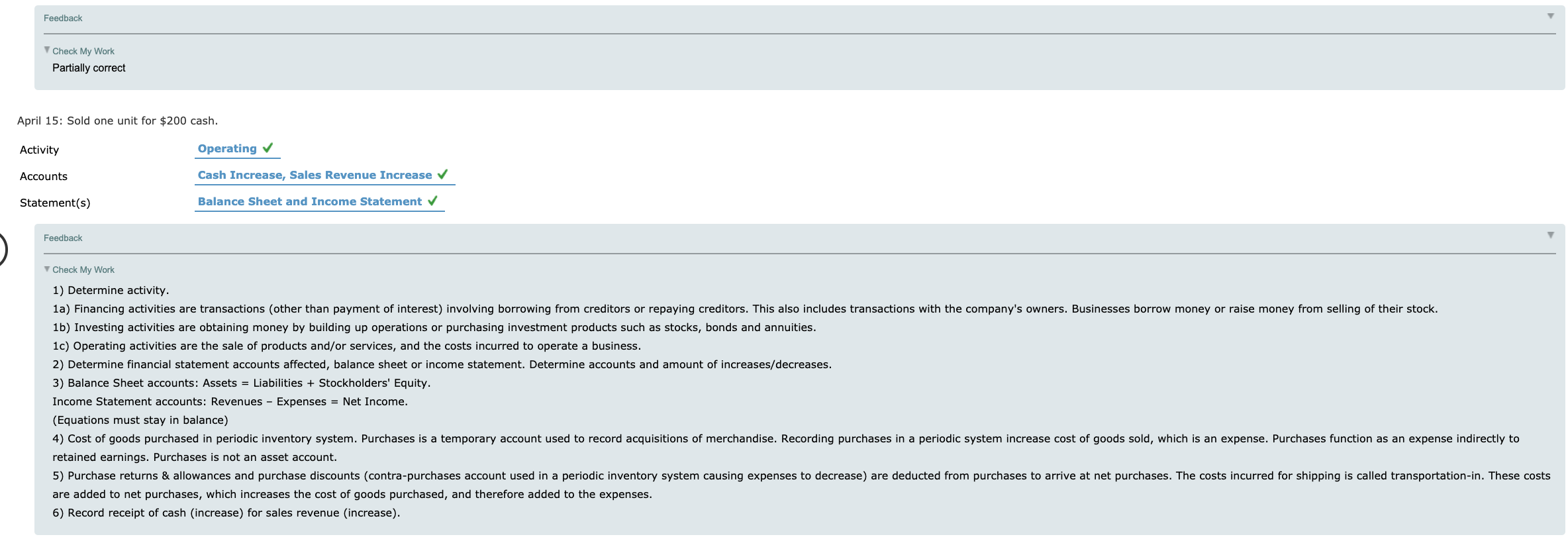

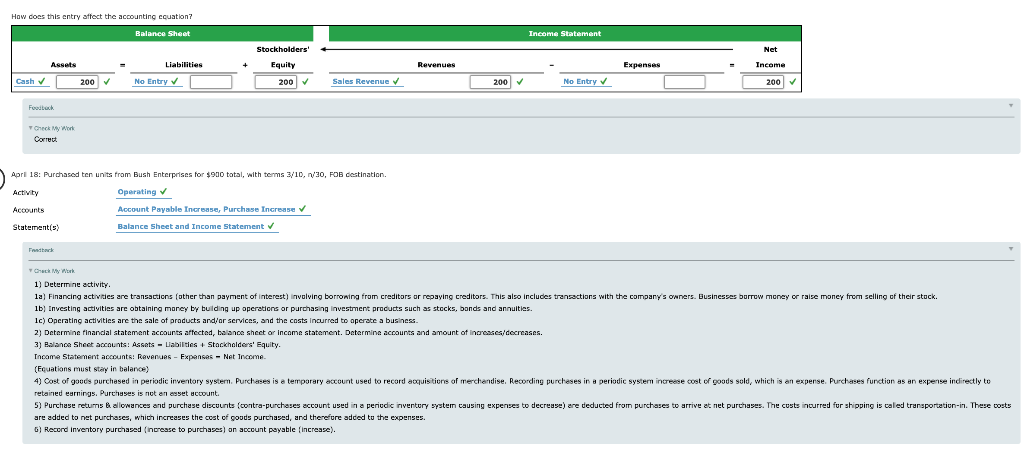

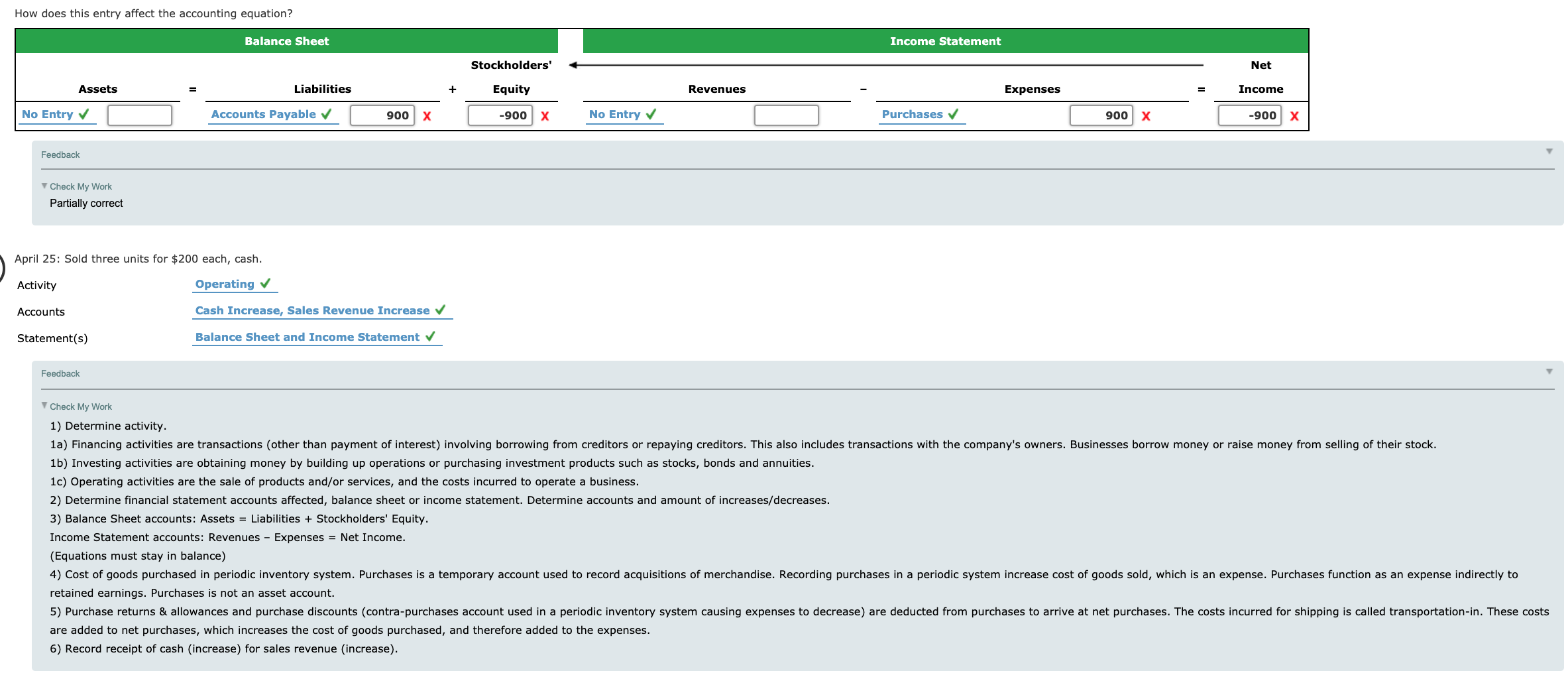

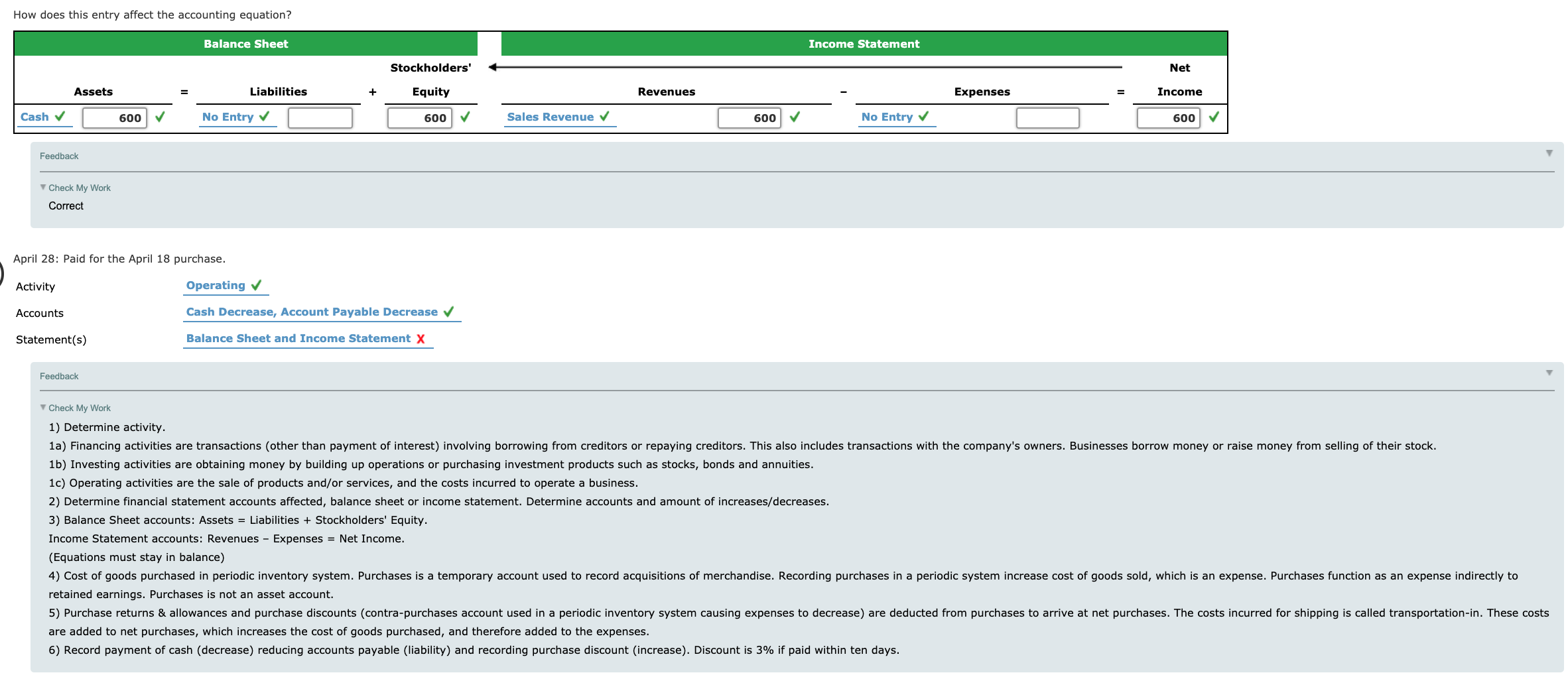

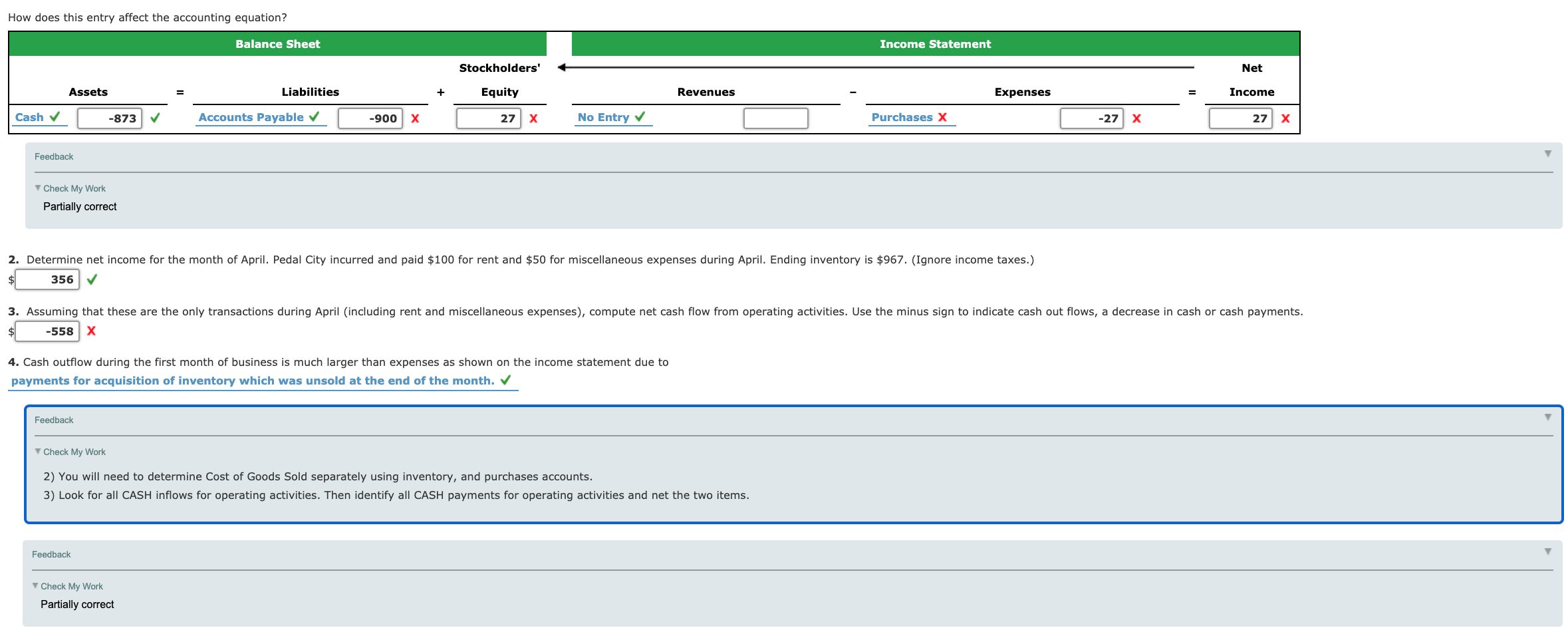

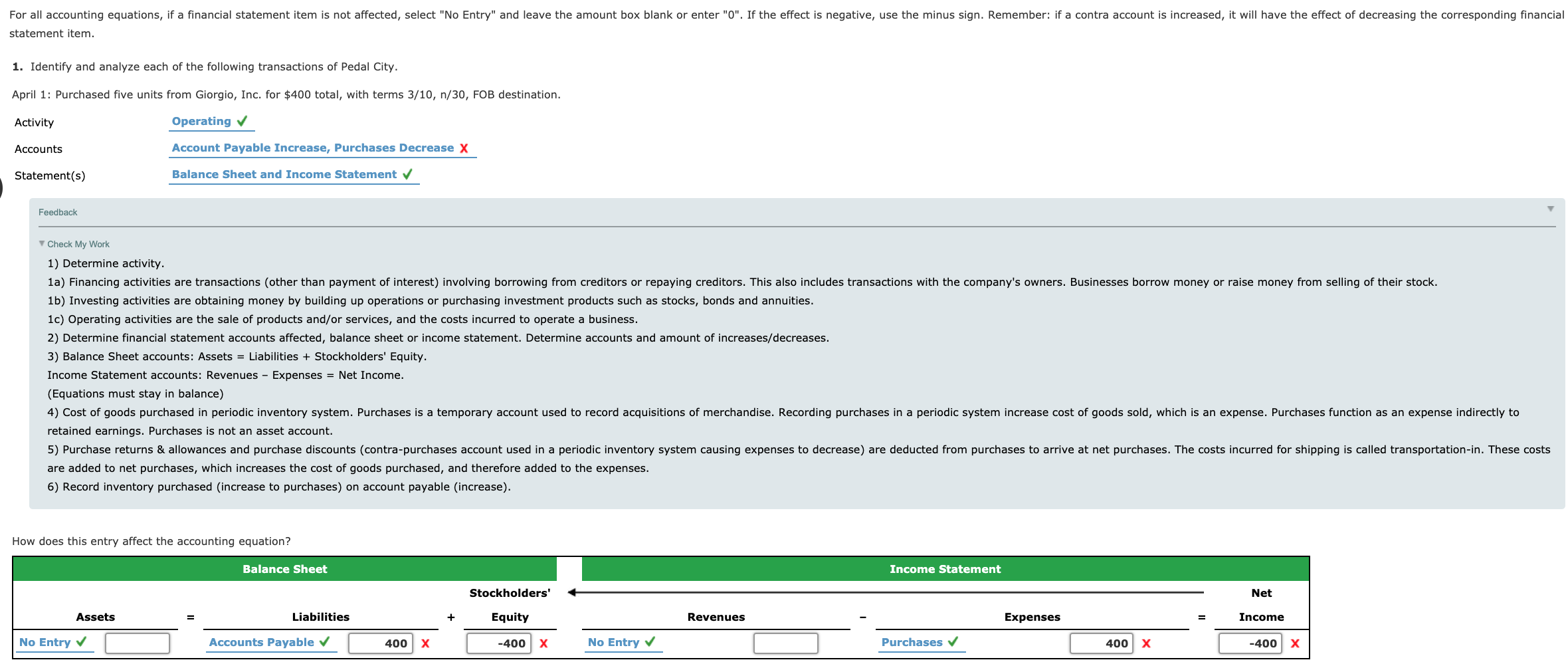

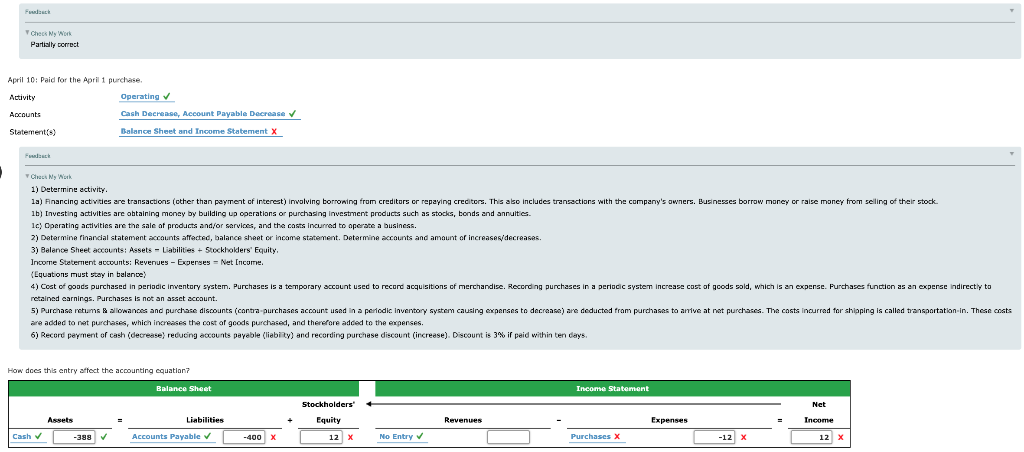

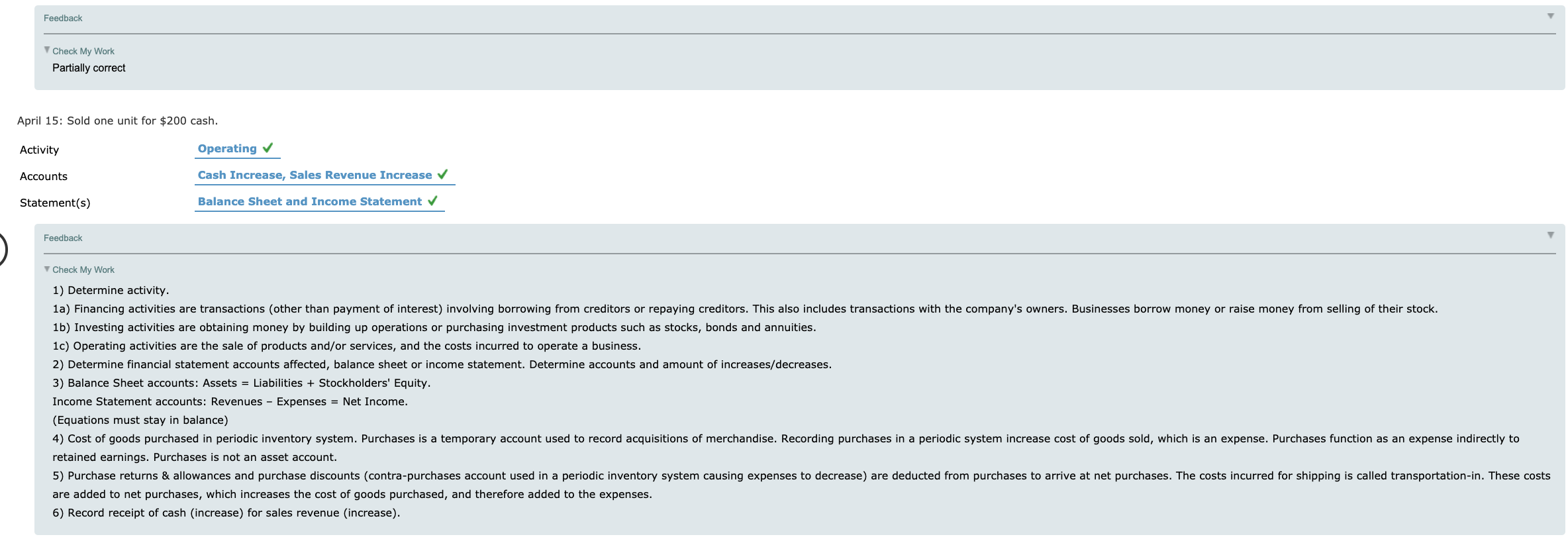

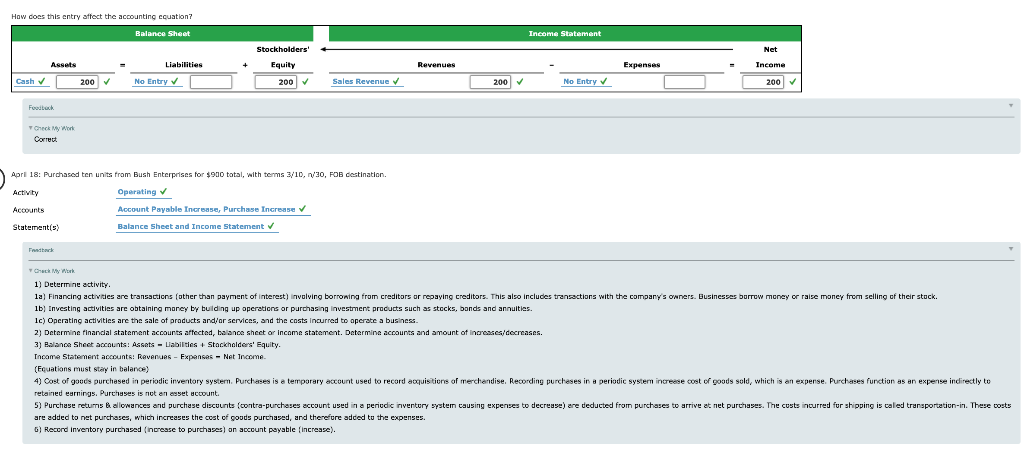

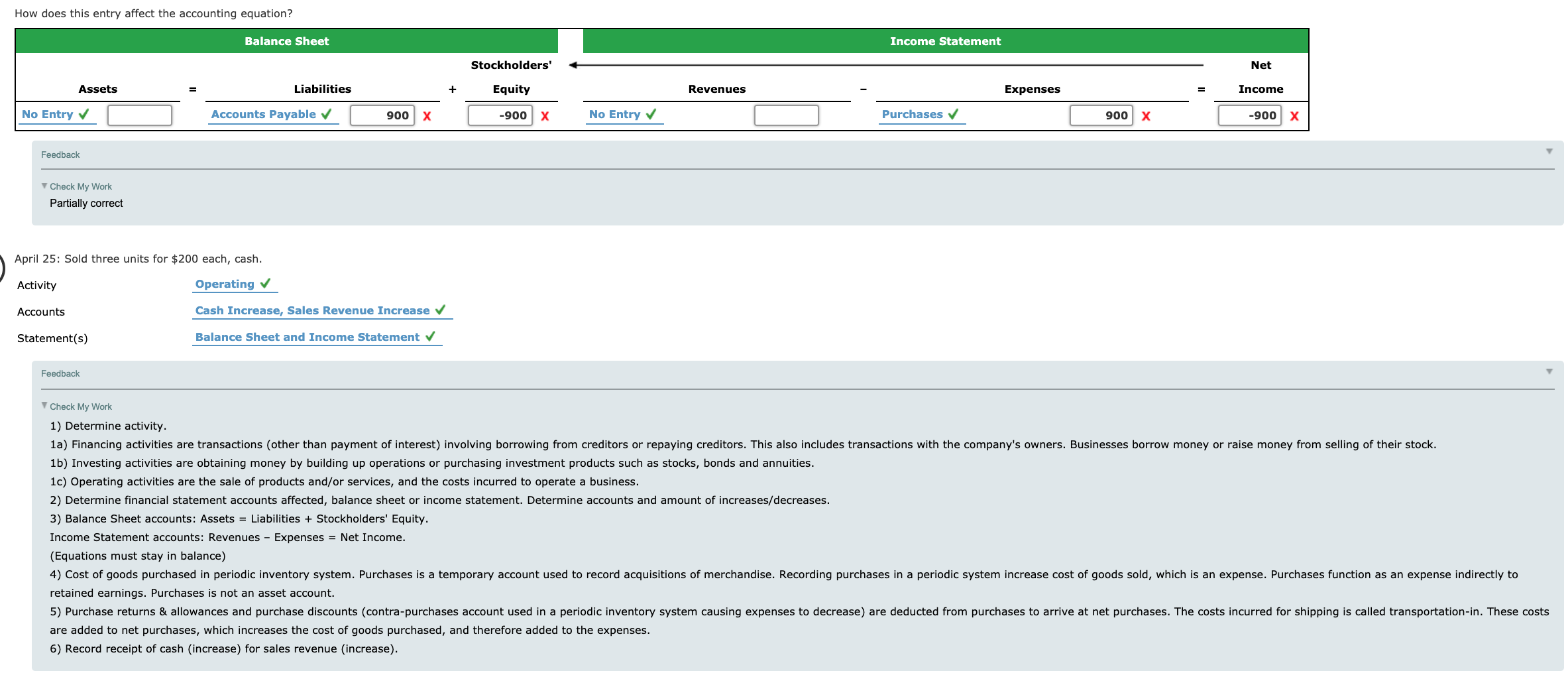

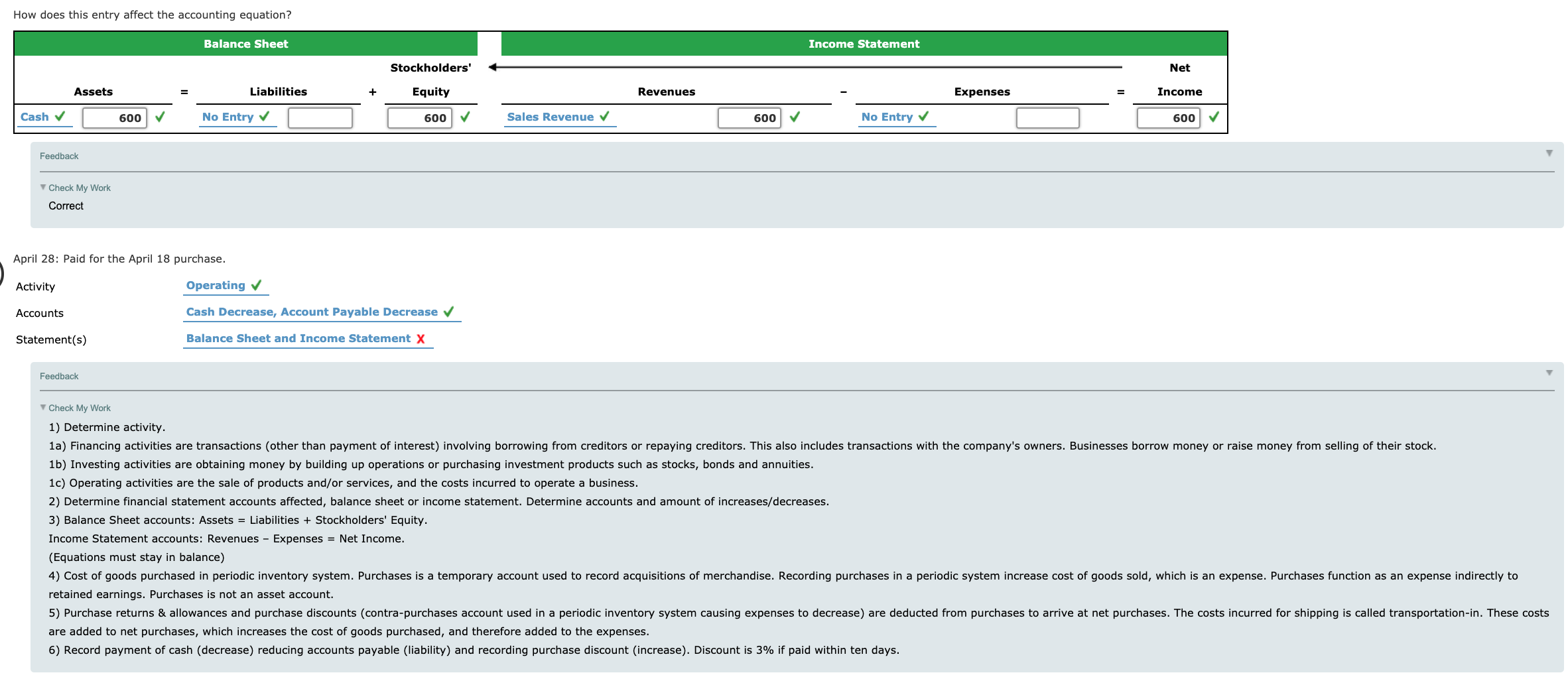

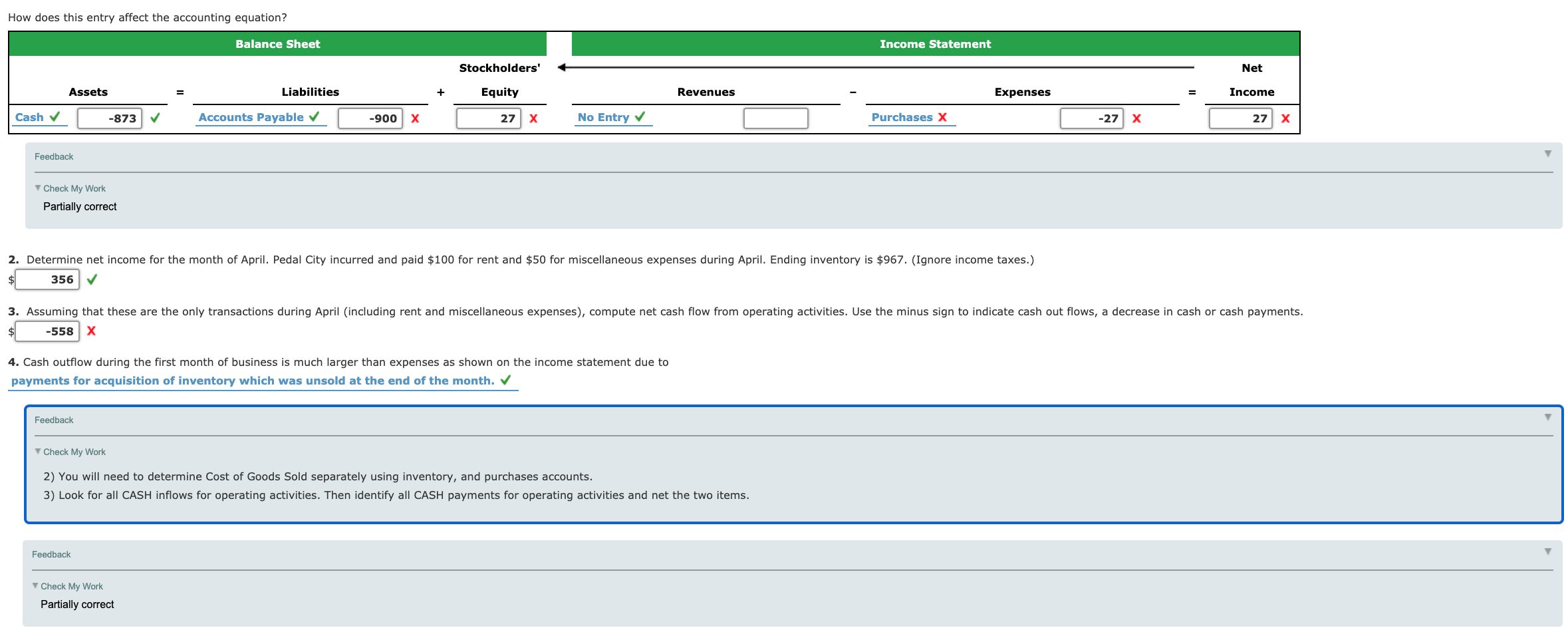

For all accounting equations, if a financial statement item is not affected, select "No Entry" and leave the amount box blank or enter "0". If the effect is negative, use the minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. 1. Identify and analyze each of the following transactions of Pedal City. April 1: Purchased five units from Giorgio, Inc. for $400 total, with terms 3/10, n/30, FOB destination. Activity Operating Accounts Account Payable Increase, Purchases Decrease X Statement(s) Balance Sheet and Income Statement Feedback Check My Work 1) Determine activity. 1a) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 1c) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets = Liabilities + Stockholders' Equity. Income Statement accounts: Revenues - Expenses = Net Income. (Equations must stay in balance) 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense. Purchases function as an expense indirectly to retained earnings. Purchases is not an asset account. 5) Purchase returns & allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at net purchases. The costs incurred for shipping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record inventory purchased (increase to purchases) on account payable (increase). How does this entry affect the accounting equation? Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income No Entry Accounts Payable 400 X -400 No Entry Purchases 400 -400 x Fuck Check My Work Partially correct April 10: Paid for the April 1 purchase Activity Operating Accounts Cash Decrease, Account Payable Decrease Statements) Balance Sheet and Income Statement X Fuck Check My Work 1) Determine activity la) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 1c) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets - Liabilities + Stockhoklers' Equity, Income Statement accounts: Revenues - Experses = Net Income. (Equations must stay in balance 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense. Purchases function as an experse indirectly to retained carnings. Purchases is not an asset account. 5) Purchase returns allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at net purchases. The casts incurred for shaping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record peyment of cash (decrease) reducing accounts payable (liability) and recording purchase discount (increase). Discount is 3% if peid within ten days. How does this entry affect the accounting equation? Balance Sheet Income Statement Net Assets Stockholders' Equity 12 X Revenues Expenses Liabilities Accounts Payable Income Cash -388 -400 x No Entry Purchases X -12 x 12 X Feedback Check My Work Partially correct April 15: Sold one unit for $200 cash. Activity Operating Accounts Cash Increase, Sales Revenue Increase Statement(s) Balance Sheet and Income Statement Feedback Check My Work 1) Determine activity. 1a) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 1c) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets = Liabilities + Stockholders' Equity. Income Statement accounts: Revenues Expenses = Net Income. (Equations must stay in balance) 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense. Purchases function as an expense indirectly to retained earnings. Purchases is not an asset account. 5) Purchase returns & allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at net purchases. The costs incurred for shipping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record receipt of cash (increase) for sales revenue (increase). How does this entry affect the accounting equation? Balance Sheet Income Statement Net Stockholders' Equity Assets Liabilities Revenues Expenses Income Cash 200 No Entry 200 Sales Revenue 200 No Entry 200 2007 Fooback Check My Work Correct Apr 18: Purchased ton units from Bush Enterprises for $900 total, with terms 3/10, 1/30, FOB destination. Activity Operating Accounts Account Payable Increase, Purchase Increase Statement(s) Balance Sheet and Income Statement Fredak Check 1) Determine activity la) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 1c) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets - Liabilities + Stackholders' Equity. Income Statement accounts: Revenues - Expenses - Net Income (Equations must stay in balance) 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense Purchases function as an expense indirectly to retained earnings. Purchases is not an esset account 5) Purchase retums & allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at met purchases. The custs incurred for shipping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record inventory purchased (increase to purchases) on account payable increase). How does this entry affect the accounting equation? Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income No Entry Accounts Payable 900 -900 X No Entry Purchases 900 x -900 x Feedback Check My Work Partially correct April 25: Sold three units for $200 each, cash. Activity Operating Accounts Cash Increase, Sales Revenue Increase Statement(s) Balance Sheet and Income Statement Feedback Check My Work 1) Determine activity. 1a) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 1c) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets = Liabilities + Stockholders' Equity. Income Statement accounts: Revenues Expenses = Net Income. (Equations must stay in balance) 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense. Purchases function as an expense indirectly to retained earnings. Purchases is not an asset account. 5) Purchase returns & allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at net purchases. The costs incurred for shipping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record receipt of cash (increase) for sales revenue (increase). How does this entry affect the accounting equation? Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income Cash 600 No Entry 600 Sales Revenue 600 No Entry 600 Feedback Check My Work Correct April 28: Paid for the April 18 purchase. Activity Operating Cash Decrease, Account Payable Decrease Accounts Statement(s) Balance Sheet and Income Statement X Feedback Check My Work 1) Determine activity. 1a) Financing activities are transactions (other than payment of interest) involving borrowing from creditors or repaying creditors. This also includes transactions with the company's owners. Businesses borrow money or raise money from selling of their stock. 1b) Investing activities are obtaining money by building up operations or purchasing investment products such as stocks, bonds and annuities. 10) Operating activities are the sale of products and/or services, and the costs incurred to operate a business. 2) Determine financial statement accounts affected, balance sheet or income statement. Determine accounts and amount of increases/decreases. 3) Balance Sheet accounts: Assets = Liabilities + Stockholders' Equity. Income Statement accounts: Revenues Expenses = Net Income. (Equations must stay in balance) 4) Cost of goods purchased in periodic inventory system. Purchases is a temporary account used to record acquisitions of merchandise. Recording purchases in a periodic system increase cost of goods sold, which is an expense. Purchases function as an expense indirectly to retained earnings. Purchases is not an asset account. 5) Purchase returns & allowances and purchase discounts (contra-purchases account used in a periodic inventory system causing expenses to decrease) are deducted from purchases to arrive at net purchases. The costs incurred for shipping is called transportation-in. These costs are added to net purchases, which increases the cost of goods purchased, and therefore added to the expenses. 6) Record payment of cash (decrease) reducing accounts payable (liability) and recording purchase discount (increase). Discount is 3% if paid within ten days. How does this entry affect the accounting equation? Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income Cash -873 Accounts Payable -900 X 27 No Entry Purchases X -27 x 27 X Feedback Check My Work Partially correct 2. Determine net income for the month of April. Pedal City incurred and paid $100 for rent and $50 for miscellaneous expenses during April. Ending inventory is $967. (Ignore income taxes.) 356 3. Assuming that these are the only transactions during April (including rent and miscellaneous expenses), compute net cash flow from operating activities. Use the minus sign to indicate cash out flows, a decrease in cash or cash payments. -558 X 4. Cash outflow during the first month of business is much larger than expenses as shown on the income statement due to payments for acquisition of inventory which was unsold at the end of the month. Feedback Check My Work 2) You will need to determine Cost of Goods Sold separately using inventory, and purchases accounts. 3) Look for all CASH inflows for operating activities. Then identify all CASH payments for operating activities and net the two items. Feedback Check My Work Partially correct