Question

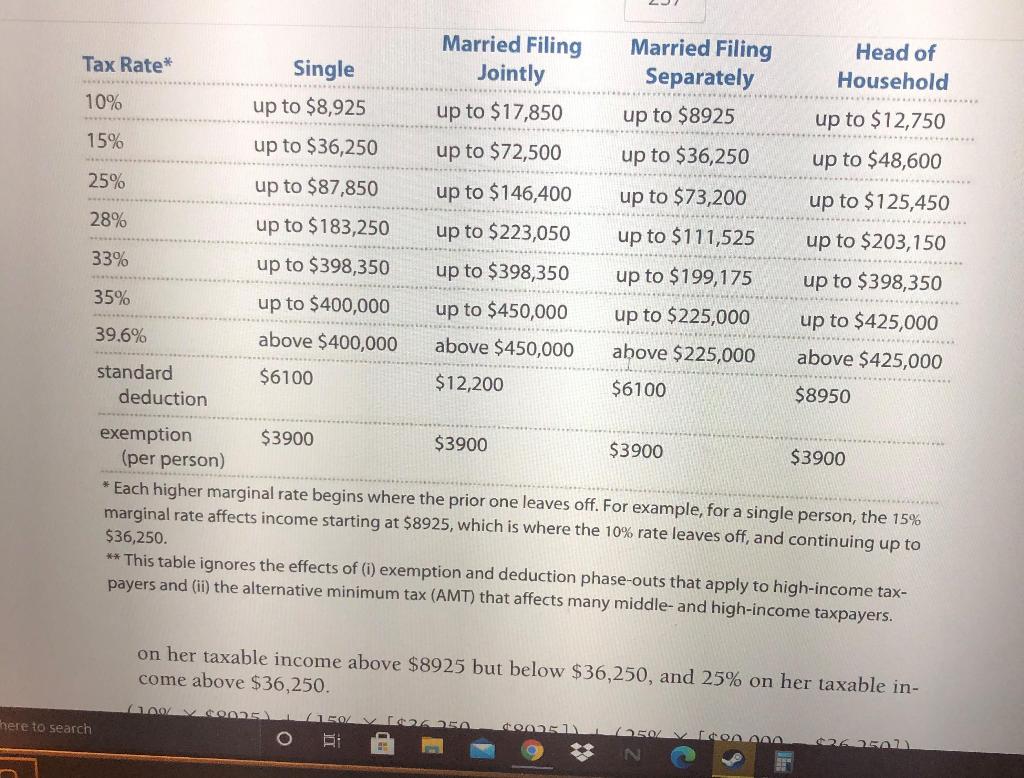

For all income tax calculations, use the table in your book, page 257. I am needing help with question 4. I was wondering if someone

For all income tax calculations, use the table in your book, page 257.

I am needing help with question 4. I was wondering if someone could please help me.

1) Assume that you are in the 15% tax bracket for capital gains tax. You have an investment of $1000 which has growth of 50% to $1500. You sell your investment and pay long term capital gains tax of 15%, which is .15 * $1500 = $225. You now have $1500 - $225 = $1275.

a) What is wrong with the scenario above?

-The taxes should be applied to the entire income not just on the gained profits.

b) After you figure out what is wrong, compute the taxes correctly and find out what you finally walk away with.

- $1500.00 (initial investment) -$1000.00 (growth investment) = $500.00 worth of profits

- 0.15*$500= $75.00 of long-term capital gains tax.

- $1500.00-$75.00= $1425.00

2) Assume you are single and your taxable income is $15,000. Compute your tax owed.

- .10*$8,925+.15($36,250-$15,000)

- .10*$8,925+.15($21,250)

- $892.50+$3187.50=

- $4,080.00

3) Assume you are single, and your taxable income is $150,000.

- Find the tax owed.

.10*$8,925+.15($36,250-$8,925)+.25($87,850-$36,250)+.28($183,250-$150,000)

.10*$8,925+.15(27,325)+.25(51,600)+.28(33,250)

892.50+4,098.75+12,900+9,310= $27,201.25

b) Assume that you also have a tax deduction of $3000. Compute your tax owed.

$27,201.25-$3,000.00= $24,201.25

c) Instead of a tax deduction of $3000 you have a tax credit of $3000. Compute your tax owed.

$27,201.25-$3,000.00= $24,201.25

d) Assume you have no tax deductions or credits. Suppose you got a $1000 raise, so your taxable income is now $151,000. How much of this $1000 raise goes to income tax?

.10*$8,925+.15($36,250-$8,925)+.25($87,850-$36,250)+.28($183,250-$151,000)

892.50+4,098.75+12,900+9,030= $26,921.25

$27,201.25-$26,921.25= $280.00 computing the difference between the original amount to that of the raise it looks as though $280.00 of the raise goes towards taxes.

e) Assume taxable income is $150,000. If you decide to put $1000 into an IRA, does this change your taxable income? How much does this save you in federal taxes?

.28*$1,000.00=$280

1,000.00-$280.00= $720.00 this would save him $720.00 on his taxes.

4) Note that your highest marginal tax rate is the percent at which the highest portion of your income is taxed. By referring to problem 3 above, explain why the highest marginal tax rate is the rate that affects your raises, bonuses, and deductions.

Because bonuses, deductions, raises are being taxed at the highest rate

5) Assume you are single and your taxable income is $34,000. Compute your tax owed.

.10(8925)+.15(36250-34000)

892.50+337.50= $1,230.00

6) Assume you are single, and your taxable income is $113,000.

a) Find the tax owed.

.10 (8925) + .15 (36250-8925) + .25 (87850-36250) + .28 (183250-113000)=

892.50+ .15(27325) + .25 (51600) + .28 (70250)=

892.50+4098.75+12900+19670= $37,561.25

b) Assume that you are itemizing deductions and you have an additional deduction of $2000. Compute your tax owed.

$37,561.25-$2,000.00(additional deduction)= $35,561.25

c) Instead of a tax deduction of $2000 you have a tax credit of $2000. Compute your tax owed.

$37,561.25-$2,000.00(tax credit)= $35,561.25

d) Assume you have no tax deductions or credits. Suppose you got a $800 raise, so your taxable income is now $113,800. How much of this $800 raise goes to income tax?

.10 (8925) + .15 (36250-8925) + .25 (87850-36250) + .28 (183250-113800)=

892.50 + 4,098.75 + 12,900 + 19,446= $37,337.25

$37,561.25-$37,337.25= $224.00 out of the $800.00 would go to taxes.

e) Assume taxable income is $113,000. If you decide to put $3000 into an IRA, does this change your taxable income? How much does this save you in federal taxes?

Tax Rate* Single up to $8,925 Married Filing Separately Head of Household 10% up to $8925 15% up to $36,250 up to $12,750 up to $48,600 up to $36,250 25% up to $87,850 up to $73,200 Married Filing Jointly up to $17,850 up to $72,500 up to $146,400 up to $223,050 up to $398,350 up to $450,000 above $450,000 $12,200 up to $125,450 28% up to $183,250 up to $111,525 up to $203,150 33% up to $199,175 35% up to $398,350 up to $400,000 above $400,000 $6100 up to $398,350 up to $425,000 up to $225,000 39.6% above $225,000 above $425,000 standard deduction $6100 $8950 exemption $3900 $3900 $3900 $3900 (per person) * Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the 15% marginal rate affects income starting at $8925, which is where the 10% rate leaves off, and continuing up to $36,250. ** This table ignores the effects of (1) exemption and deduction phase-outs that apply to high-income tax- payers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers. on her taxable income above $8925 but below $36,250, and 25% on her taxable in- come above $36,250. 100% doma >, 655] here to search IRO BE Vidon 200 262507 NStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started