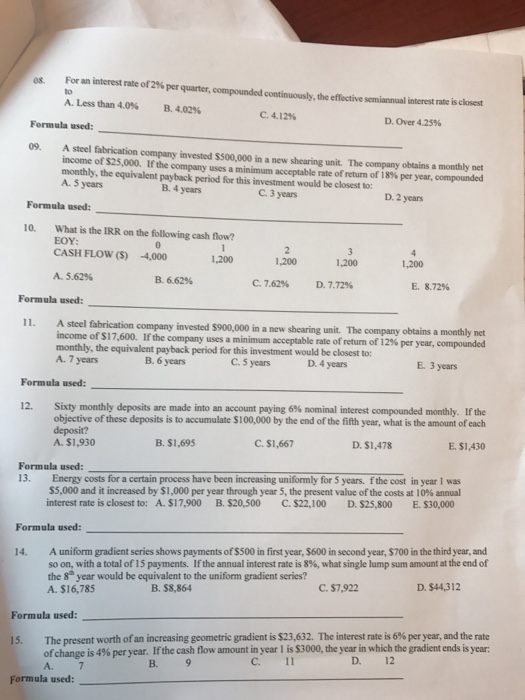

For an interest rate of 2% per quarter, compounded continuously, the effective semiannual interest rate is closest to A. Less than 4.0% B. 4.02% C. 4.12% D. Over 4.25% A steel fabrication company invested $900,000 in a new shearing unit. The company obtains a monthly net income of $25,000. If the company uses a minimum acceptable rate of return of 18% per year, compounded monthly, the equivalent payback period for this investment would be closest to: A. 5 years B. 4 years C. 3 years D. 2 years Formula used: __________ What is the IRR on the following cash flow? EOY: 0 1 2 3 4 CASH FLOW($) -4,000 1,200 1,200 1,200 1,200 A. 5.62% B. 6.62% C. 7.62% D. 7.72% E. 8.72% A steel fabrication company invested $900,000 in a new shearing unit. The company obtains a monthly net income of $17,600. If the company uses a minimum acceptable rate of return of 12% per year, compounded monthly, the equivalent payback period for this investment would be closest to: A. 7 years B. 6 years C. 5 years D. 4 years E. 3 years Formula used: ________ Sixty monthly deposits are made into an account paying 6% nominal interest compounded monthly. If the objective of these deposits is to accumulate $100,000 by the end of the fifth year, what is the amount of each deposit? A. $1,930 B $1,695 C. $1,667 D. $1,478 E. $1,430 Formula used: __________ Energy costs for a certain process have been increasing uniformly for 5 years, f the cost in year 1 was $5,000 and it increased by $1,000 per year through year 5, the present value of the costs at 10% annual interest rate is closest to: A. $17,900 B. $20,500 C. $22,100 D. $25,800 E $30,000 Formula used: __________ A uniform gradient series shows payments of $500 in first year, $600 in second year, $700 in the third year, and soon, with a total of 15 payments. If the annual interest rate is 8%, what single lump sum amount at the end of the 8^th year would be equivalent to the uniform gradient series? A. $16,785 B. $8,864 C. $7,922 D. $44,312 Formula used: ________ The present worth of an increasing geometric gradient is $23,632. The interest rate is 6% per year, and the rate of change is 4% per year. If the cash flow amount in year 1 is $3000, the year in which the gradient ends is year. A. 7 B. 9 C. 11 D. 12 Formula used ________