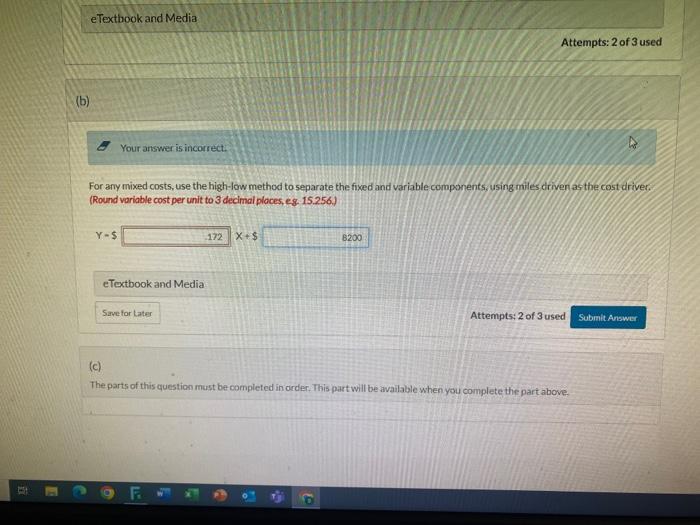

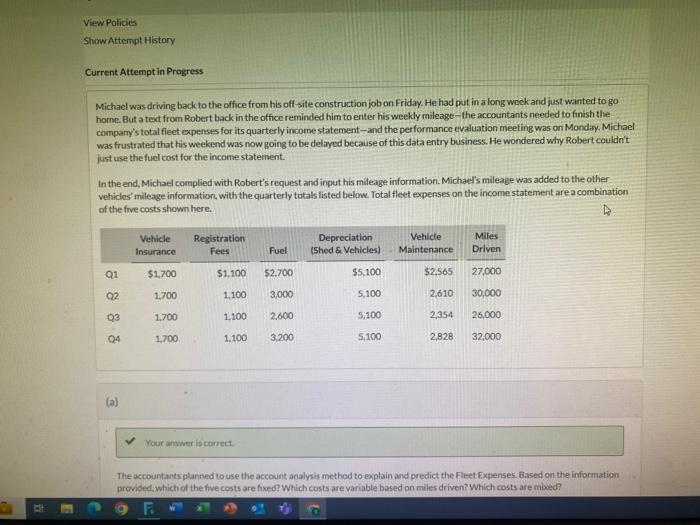

For any mixed costs, use the high-low method to separate the fixed and variable components, using miles criven as the cost ariver. (Round variable cost per unit to 3 decimal ploces, eg 15.256 .) eTextbook and Media Attempts: 2 of 3 used (c) The parts of this question must be completed in order. This part will be available when you complete the part above. Michael was driving back to the office from his off-site construction job on Friday. He had put in a long weck and just wanted to go home. But a text from Robert back in the office reminded him to enter his weekly mileage- the accountants needed to finish the compary's total fleet expenses for its quarterly income statement-and the performance evaluation meeting was on Monday. Michael was frustrated that his weekend was now going to be delayed because of this data entry business. He wondered why Robert couldn't just use the fuel cost for the income statement. In the end, Michael complied with Robert's request and input his mileage information. Michael's mileage was added to the other vehicles' mileage information, with the quarterly totals listed below. Total fleet expenses on the income statement are a combination of the five costs shown here. (a) The accountants planned to use the account analysis method to explain and predict the Fleet Expenses. Eased on the information provided. Which of the fwe costs are fixed? Which costs are variable based on miles driven? Which costs are mbed? For any mixed costs, use the high-low method to separate the fixed and variable components, using miles criven as the cost ariver. (Round variable cost per unit to 3 decimal ploces, eg 15.256 .) eTextbook and Media Attempts: 2 of 3 used (c) The parts of this question must be completed in order. This part will be available when you complete the part above. Michael was driving back to the office from his off-site construction job on Friday. He had put in a long weck and just wanted to go home. But a text from Robert back in the office reminded him to enter his weekly mileage- the accountants needed to finish the compary's total fleet expenses for its quarterly income statement-and the performance evaluation meeting was on Monday. Michael was frustrated that his weekend was now going to be delayed because of this data entry business. He wondered why Robert couldn't just use the fuel cost for the income statement. In the end, Michael complied with Robert's request and input his mileage information. Michael's mileage was added to the other vehicles' mileage information, with the quarterly totals listed below. Total fleet expenses on the income statement are a combination of the five costs shown here. (a) The accountants planned to use the account analysis method to explain and predict the Fleet Expenses. Eased on the information provided. Which of the fwe costs are fixed? Which costs are variable based on miles driven? Which costs are mbed