Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For both machines use income tax rate of 40% and MARR of 10% a) Set up the table for the computation on ATCF for defender

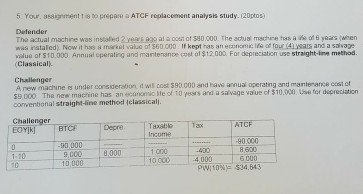

For both machines use income tax rate of 40% and MARR of 10% a) Set up the table for the computation on ATCF for defender and using challenger PW determine whatever replacement can be made or not. Remember challenger table is already done.

5 Your. assignment ATCF replacement analysis study. (20ptos) ala oost ot sa0000 The actua machine tas aiifin of B years When Tha actual machine was instaled 2 yea was installed Now value kept has an ic of four4lygaDi and a salvage econom of s 0.000 Annual operating and mantenance cost of$12 000 For depreciation use straight-line method. Classical Challenger operating and mantenance cost of it wil cost $30.000 and have annual machine is under oonsideration e value of $10,000 Use for depreciation e of 10 years and asa ss.000 The new machine has an economic onal straight-line method Iclassical Challenger T BTCP Depre Taxable TaxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started