Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For both Question 1 and 2, thanks! Beauty Company closes its books at the end of the year. The trial balance on December 31, 2022

For both Question 1 and 2, thanks!

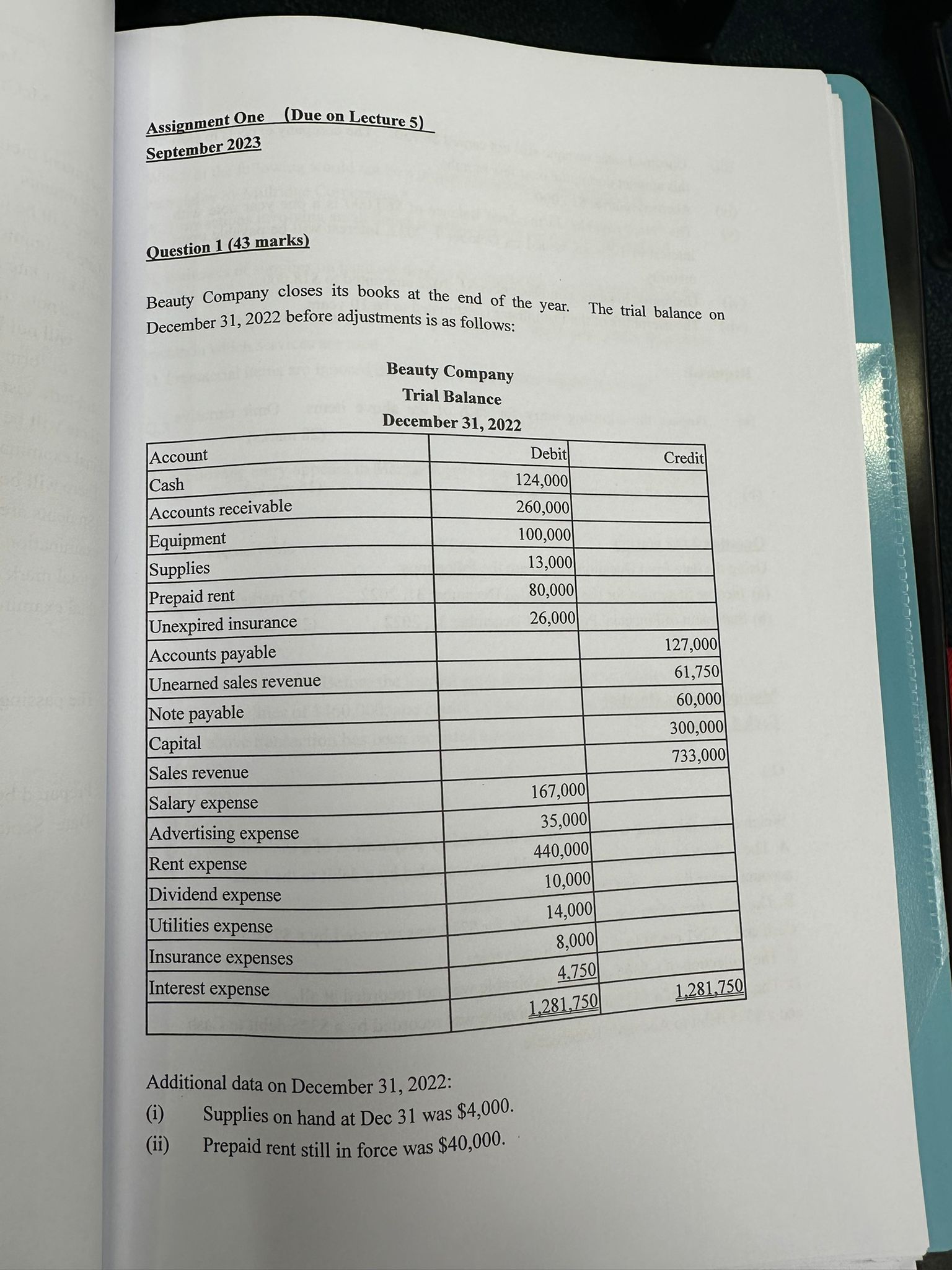

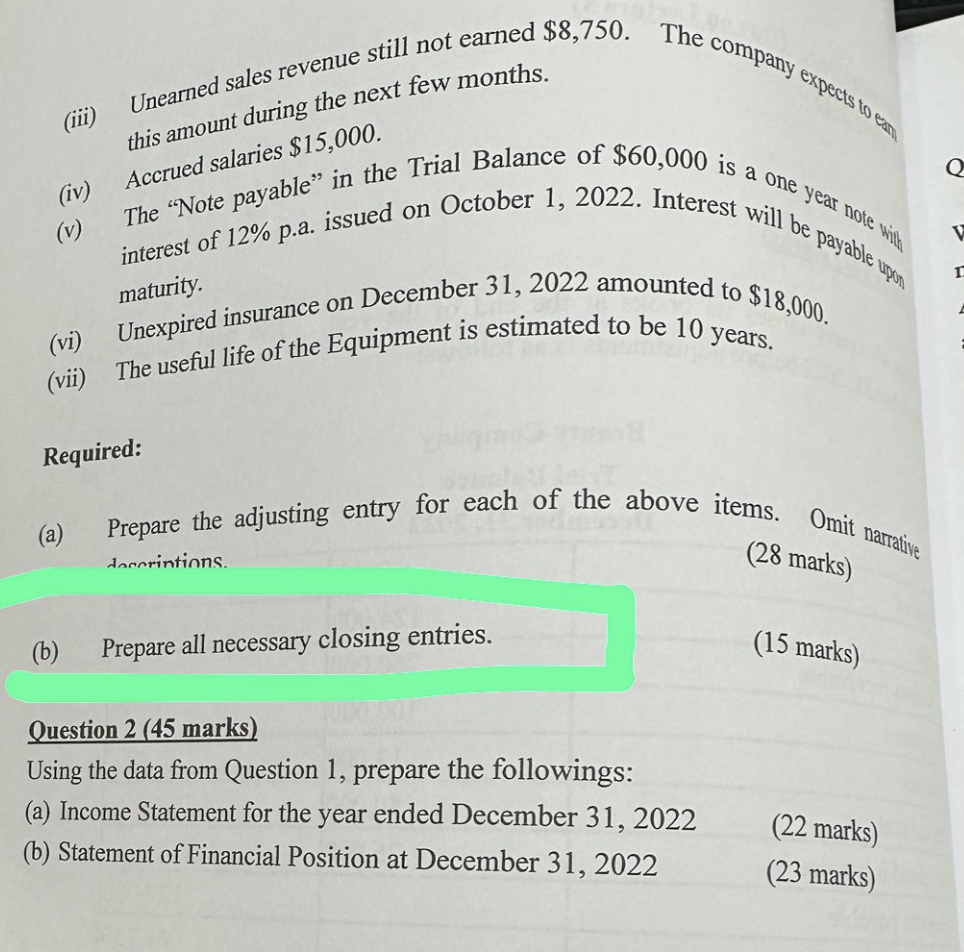

Beauty Company closes its books at the end of the year. The trial balance on December 31, 2022 before adjustments is as follows: Beauty Company Trial Balance. Additional data on December 31, 2022: (i) Supplies on hand at Dec 31 was $4,000. (ii) Prepaid rent still in force was $40,000. this amount duriaries $15,000 (v) The "Note payable" in the Trial Balance of $60,000 is a one year note interest of 12% p.a. issued on October 1, 2022. Interest will be payable maturity. (vi) Unexpired insurance on December 31, 2022 amounted to $18,000. (vii) The useful life of the Equipment is estimated to be 10 years. Required: (a) Prepare the adjusting entry for each of the above items. Omit narrati dacrrintions. (28 marks) (b) Prepare all necessary closing entries. (15 marks) Question 2 (45 marks) Using the data from Question 1, prepare the followings: (a) Income Statement for the year ended December 31, 2022 (b) Statement of Financial Position at December 31, 2022 (22 marks) (23 marks)

Beauty Company closes its books at the end of the year. The trial balance on December 31, 2022 before adjustments is as follows: Beauty Company Trial Balance. Additional data on December 31, 2022: (i) Supplies on hand at Dec 31 was $4,000. (ii) Prepaid rent still in force was $40,000. this amount duriaries $15,000 (v) The "Note payable" in the Trial Balance of $60,000 is a one year note interest of 12% p.a. issued on October 1, 2022. Interest will be payable maturity. (vi) Unexpired insurance on December 31, 2022 amounted to $18,000. (vii) The useful life of the Equipment is estimated to be 10 years. Required: (a) Prepare the adjusting entry for each of the above items. Omit narrati dacrrintions. (28 marks) (b) Prepare all necessary closing entries. (15 marks) Question 2 (45 marks) Using the data from Question 1, prepare the followings: (a) Income Statement for the year ended December 31, 2022 (b) Statement of Financial Position at December 31, 2022 (22 marks) (23 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started