Question

For December 31, 2000, the balance sheet of the Baxter Corporation is as follows: Sales for the year 2011 were $220,000, and the cost of

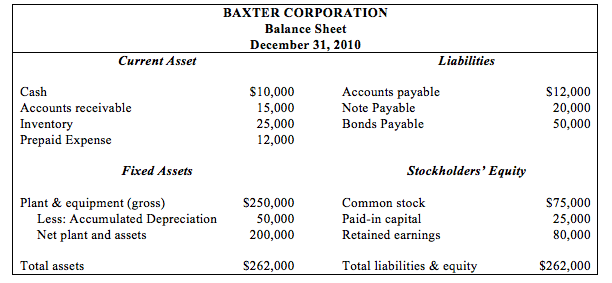

For December 31, 2000, the balance sheet of the Baxter Corporation is as follows:

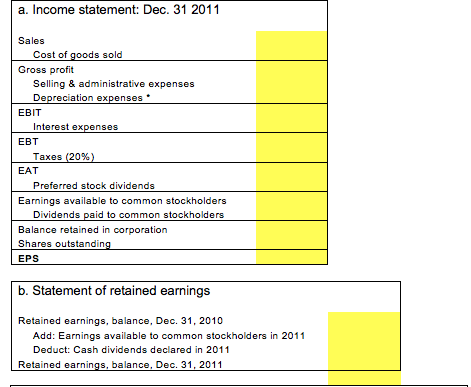

Sales for the year 2011 were $220,000, and the cost of goods sold was 60% of sales. Selling and administrative expense was $22,000. Depreciation expense was 8% of gross plant and equipment at the be-ginning of the year. Interest expense for the notes payable was 10%, and interest on the bonds payable was 12%. These interest expenses are based on December 31, 2010, balances. The tax rate averaged 20%.

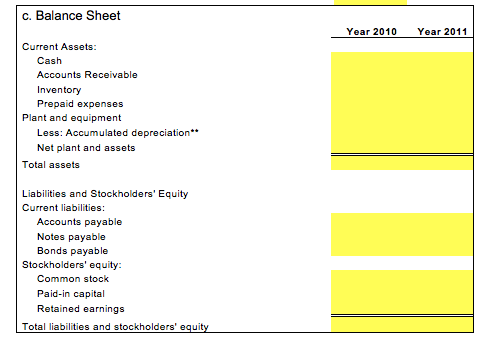

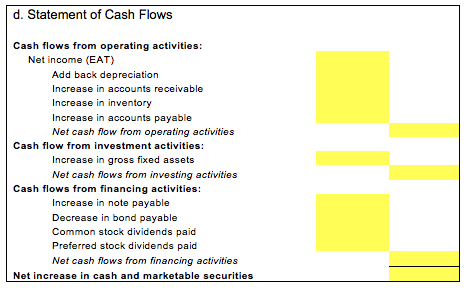

$2,000 in preferred stock dividends were paid and $8,400 in dividends were paid to common stockholders. There were 10,000 shares of common stock outstanding. During 2011, the cash balance and pre-paid expenses balance were unchanged. Accounts receivable and inventory increased by 10%.

A new machine was purchased on December 31, 2011, at a cost of $35,000, for which depreciation would start from year 2012. Accounts payable increased by 25%. Notes payable increased by $6,000 and bonds payable decreased by $10,000, both at the end of the year. The common stock and paid-in capital in excess of par accounts did not change.

A. Prepare an income statement for 2011.

B. Prepare a statement of retained earnings for 2011.

C. Prepare a balance sheet as of December 31, 2011.

D. Prepare a statement of cash flow for 2011.

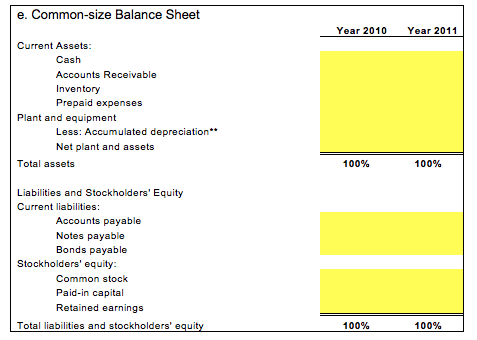

E. Prepare a common-size income statement for both 2010 and 2011.

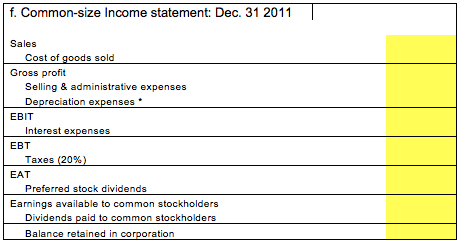

F. Prepare a common-size balance sheet for 2011.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started