Answered step by step

Verified Expert Solution

Question

1 Approved Answer

----------- for drop down 1) 1.67/2.00/1.78/1.72 2) 24.43/23.72/53.75/16.8 3) 22.16/23.67/26.83/28.40 ----- for dropdown 1) 36.49/30.05/51.25/42.93 2) 27.9/30.73/10.91/29.84 3) 8.37/9.22/0.00/10.53 4) 23.92/42.93/12.40/29.84 One of the most

-----------

for drop down

1) 1.67/2.00/1.78/1.72

2) 24.43/23.72/53.75/16.8

3) 22.16/23.67/26.83/28.40

-----

for dropdown

1) 36.49/30.05/51.25/42.93

2) 27.9/30.73/10.91/29.84

3) 8.37/9.22/0.00/10.53

4) 23.92/42.93/12.40/29.84

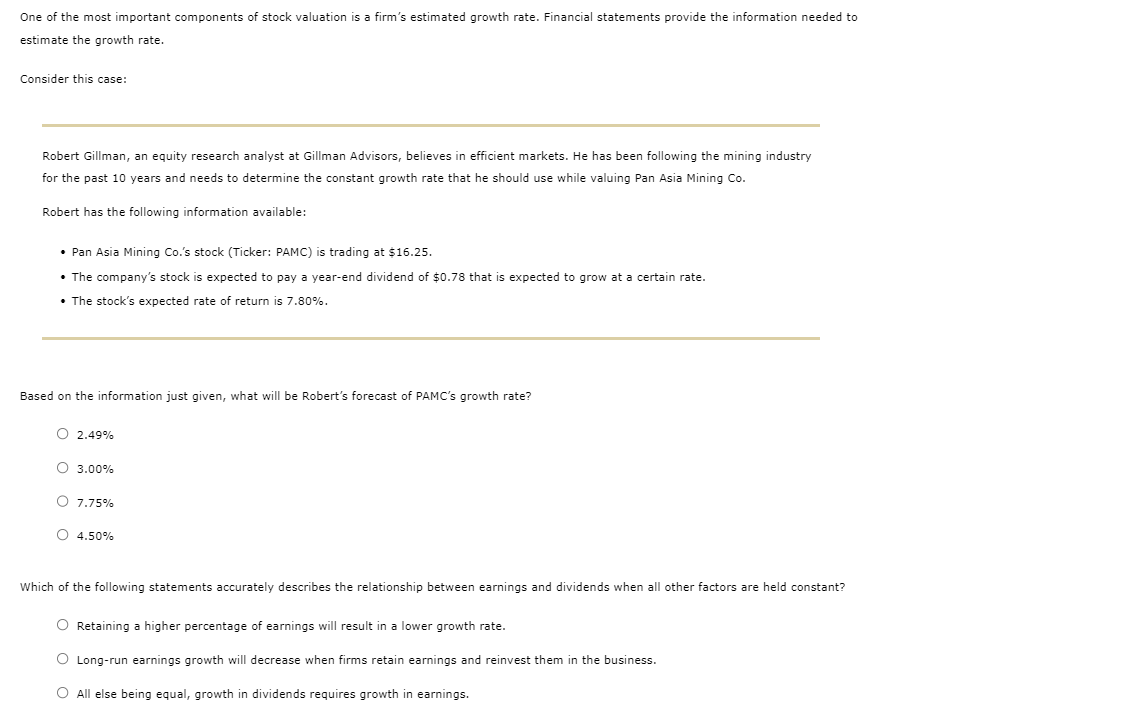

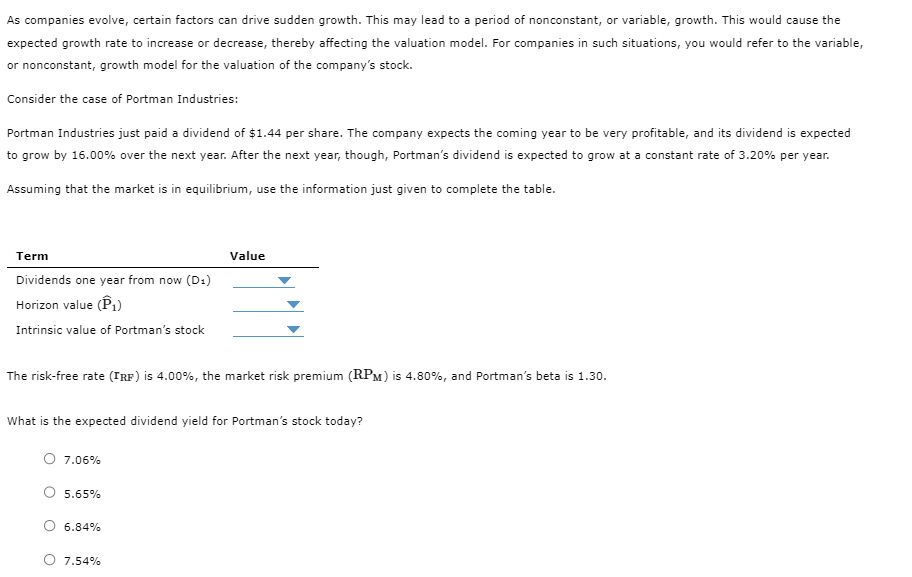

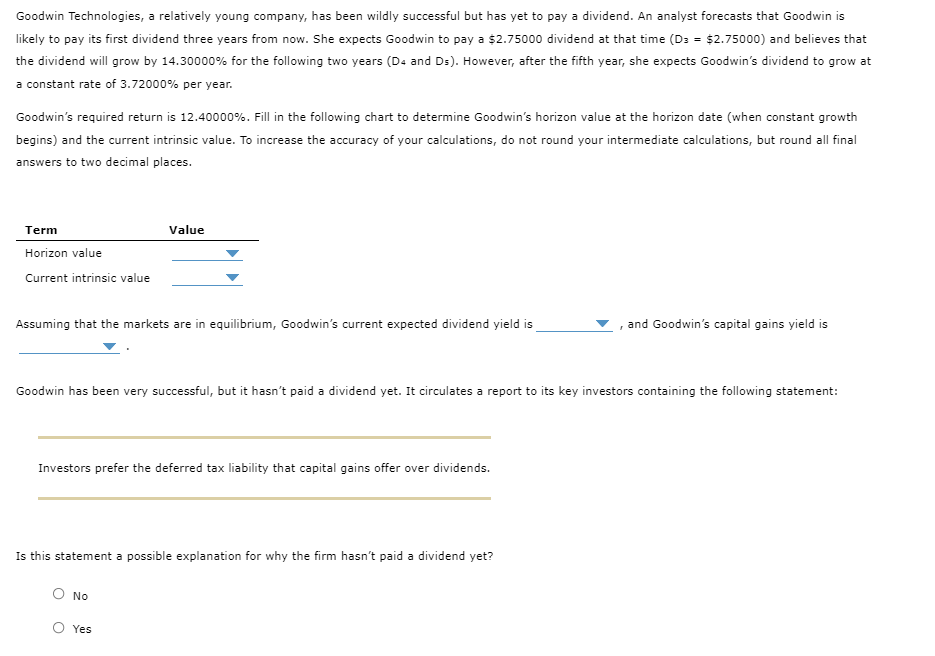

One of the most important components of stock valuation is a firm's estimated growth rate. Financial statements provide the information needed to estimate the growth rate. Consider this case: Robert Gillman, an equity research analyst at Gillman Advisors, believes in efficient markets. He has been following the mining industry for the past 10 years and needs to determine the constant growth rate that he should use while valuing Pan Asia Ming Co. Robert has the following information available: - Pan Asia Mining Co.'s stock (Ticker: PAMC) is trading at $16.25. - The company's stock is expected to pay a year-end dividend of $0.78 that is expected to grow at a certain rate. - The stock's expected rate of return is 7.80%. Based on the information just given, what will be Robert's forecast of PAMC's growth rate? 2.49%3.00%7.75%4.50% Which of the following statements accurately describes the relationship between earnings and dividends when all other factors are held constant? Retaining a higher percentage of earnings will result in a lower growth rate. Long-run earnings growth will decrease when firms retain earnings and reinvest them in the business. All else being equal, growth in dividends requires growth in earnings. As companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $1.44 per share. The company expects the coming year to be very profitable and its dividend expected to grow by 16.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate 3.20% per year. Assuming that the market is in equilibrium, use the information just given to complete the table. The risk-free rate ( IRF) is 4.00%, the market risk premium ( RPM ) is 4.80%, and Portman's beta is 1.30. What is the expected dividend yield for Portman's stock today? 7.06%5.65%6.84%7.54% Goodwin Technologies, a relatively young company, has been wildly successful but has yet to pay a dividend. An analyst forecasts that Goodwin is likely to pay its first dividend three years from now. She expects Goodwin to pay a $2.75000 dividend at that time (Dz =$2.75000) and believes that the dividend will grow by 14.30000% for the following two years (D4 and Ds). However, after the fifth year, she expects Goodwin's dividend to grow at a constant rate of 3.72000% per year. Goodwin's required return is 12.40000%. Fill in the following chart to determine Goodwin's horizon value at he hate constant grow begins) and the current intrinsic value. To increase the accuracy of your calculations, do not round your intermediate calculations, but round all answers to two decimal places. Assuming that the markets are in equilibrium, Goodwin's current expected dividend yield is , and Goodwin's capital gains yield is Goodwin has been very successful, but it hasn't paid a dividend yet. It circulates a report to its key investors containing the following statement: Investors prefer the deferred tax liability that capital gains offer over dividends. Is this statement a possible explanation for why the firm hasn't paid a dividend yet? No Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started