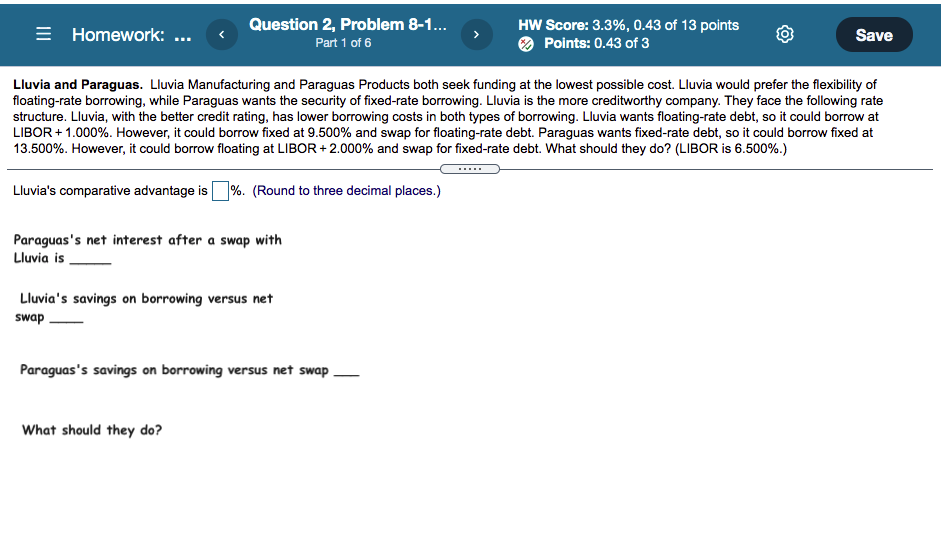

= Homework: ... Question 2, Problem 8-1... Part 1 of 6 HW Score: 3.3%, 0.43 of 13 points Points: 0.43 of 3 Save Lluvia and Paraguas. Lluvia Manufacturing and Paraguas Products both seek funding at the lowest possible cost. Lluvia would prefer the flexibility of floating-rate borrowing, while Paraguas wants the security of fixed-rate borrowing. Lluvia is the more creditworthy company. They face the following rate structure. Lluvia, with the better credit rating, has lower borrowing costs in both types of borrowing. Lluvia wants floating-rate debt, so it could borrow at LIBOR +1.000%. However, it could borrow fixed at 9.500% and swap for floating-rate debt. Paraguas wants fixed-rate debt, so it could borrow fixed at 13.500%. However, it could borrow floating at LIBOR +2.000% and swap for fixed-rate debt. What should they do? (LIBOR is 6.500%.) Lluvia's comparative advantage is %. (Round to three decimal places.) Paraguas's net interest after a swap with Lluvia is Lluvia's savings on borrowing versus net swap Paraguas's savings on borrowing versus net swap What should they do? = Homework: ... Question 2, Problem 8-1... Part 1 of 6 HW Score: 3.3%, 0.43 of 13 points Points: 0.43 of 3 Save Lluvia and Paraguas. Lluvia Manufacturing and Paraguas Products both seek funding at the lowest possible cost. Lluvia would prefer the flexibility of floating-rate borrowing, while Paraguas wants the security of fixed-rate borrowing. Lluvia is the more creditworthy company. They face the following rate structure. Lluvia, with the better credit rating, has lower borrowing costs in both types of borrowing. Lluvia wants floating-rate debt, so it could borrow at LIBOR +1.000%. However, it could borrow fixed at 9.500% and swap for floating-rate debt. Paraguas wants fixed-rate debt, so it could borrow fixed at 13.500%. However, it could borrow floating at LIBOR +2.000% and swap for fixed-rate debt. What should they do? (LIBOR is 6.500%.) Lluvia's comparative advantage is %. (Round to three decimal places.) Paraguas's net interest after a swap with Lluvia is Lluvia's savings on borrowing versus net swap Paraguas's savings on borrowing versus net swap What should they do