Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for drop downs in millions 1) 17051.28/25576.92/ -51153.85/98370.77 2) 13391.92/ 7672.92/14066.92/19182.92 3) 19.84/ 20.84/28.42/11.37 --- ---- increase/decrease The corporate valuation model, the price-to-earnings (P/E) multiple

for drop downs

in millions

1) 17051.28/25576.92/ -51153.85/98370.77

2) 13391.92/ 7672.92/14066.92/19182.92

3) 19.84/ 20.84/28.42/11.37

---

----

increase/decrease

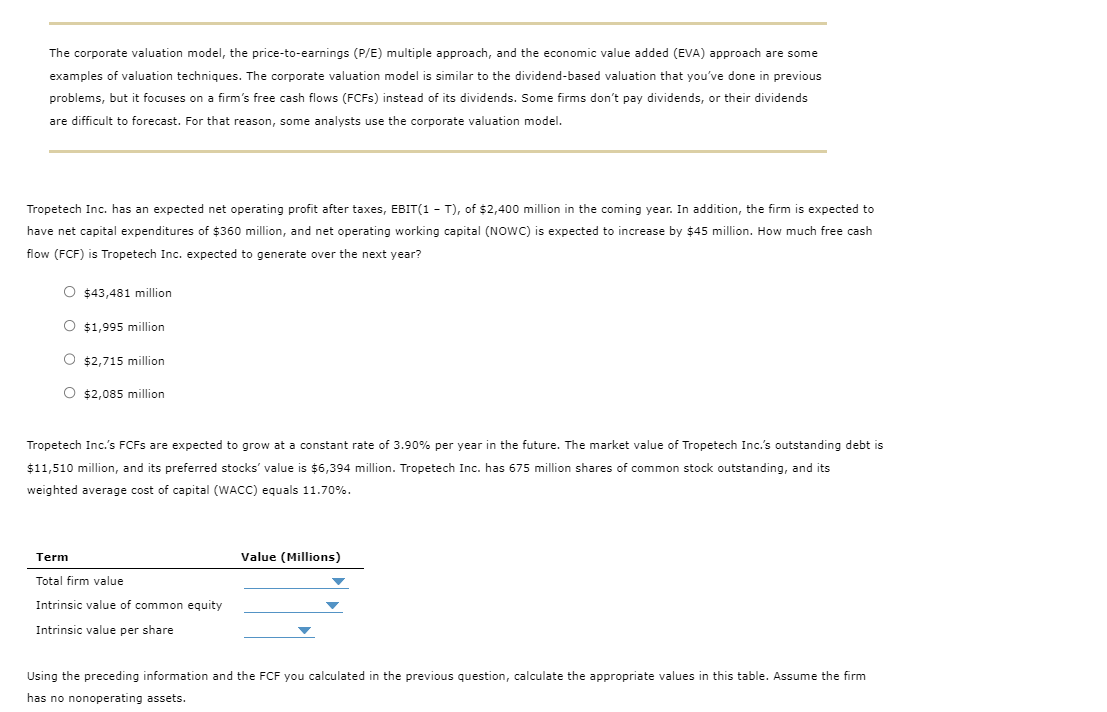

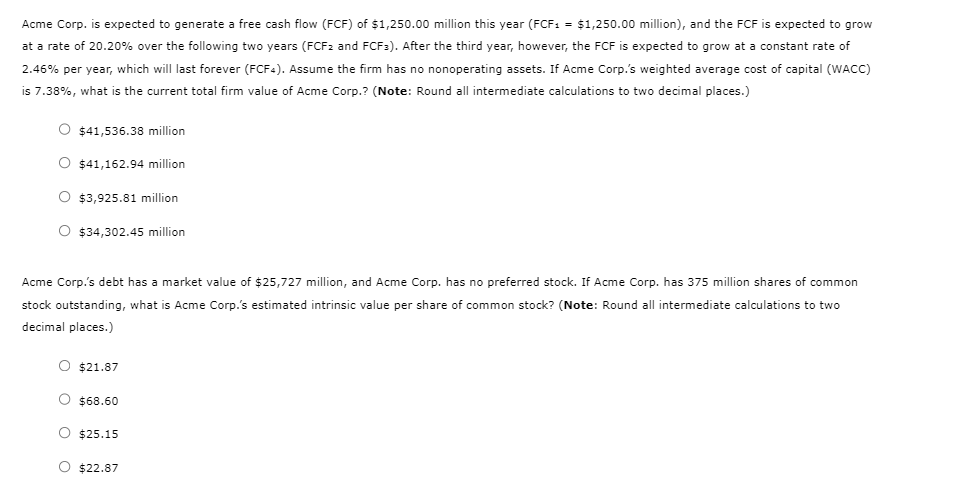

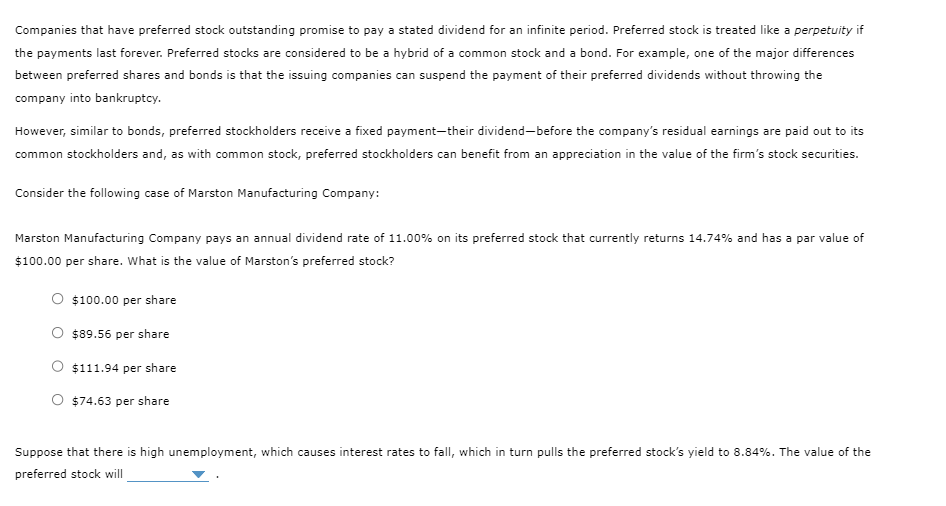

The corporate valuation model, the price-to-earnings (P/E) multiple approach, and the economic value added (EVA) approach are some problems, but it focuses on a firm's free cash flows (FCFs) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast. For that reason, some analysts use the corporate valuation model. Tropetech Inc. has an expected net operating profit after taxes, EBIT(1 - T), of $2,400 million in the coming year. In addition, the firm is expected to have net capital expenditures of $360 million, and net operating working capital (NOWC) is expected to increase by $45 million. How much free cash flow (FCF) is Tropetech Inc. expected to generate over the next year? $43,481 million $1,995 million $2,715 million $2,085 million $11,510 million, and its preferred stocks' value is $6,394 million. Tropetech Inc. has 675 million shares of common stock outstanding, and weighted average cost of capital (WACC) equals 11.70%. Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values in this table. Assume the firm has no nonoperating assets. Acme Corp. is expected to generate a free cash flow (FCF) of $1,250.00 million this year (FCF 1=$1,250.00 million), and the FCF is expected to grow at a rate of 20.20% over the following two years (FCFz and FCF3 ). After the third year, however, the FCF is expected to grow at a constant rate 2.46% per year, which will last forever (FCF4). Assume the firm has no nonoperating assets. If Acme Corp.'s weighted average cost of capital (WACC) is 7.38%, what is the current total firm value of Acme Corp.? (Note: Round all intermediate calculations to two decimal places.) $41,536.38 million $41,162.94 million $3,925.81 milion $34,302.45 million Acme Corp.'s debt has a market value of $25,727 million, and Acme Corp. has no preferred stock. If Acme Corp. has 375 million shares of common stock outstanding, what is Acme Corp.'s estimated intrinsic value per share of common stock? (Note: Round all intermediate calculations to two decimal places.) $21.87 $68.60 $25.15 $22.87 Companies that have preferred stock outstanding promise to pay a stated dividend for an infinite period. Preferred stock is treated like a perpetuity if the payments last forever. Preferred stocks are considered to be a hybrid of a common stock and a bond. For example, one of the major differences between preferred shares and bonds is that the issuing companies can suspend the payment of their preferred dividends without throwing the company into bankruptcy. However, similar to bonds, preferred stockholders receive a fixed payment-their dividend-before the company's residual earnings are paid out to its common stockholders and, as with common stock, preferred stockholders can benefit from an appreciation in the value of the firm's stock securities. Consider the following case of Marston Manufacturing Company: Marston Manufacturing Company pays an annual dividend rate of 11.00% on its preferred stock that currently returns 14.74% and has a par $100.00 per share. What is the value of Marston's preferred stock? $100.00 per share $89.56 per share $111.94 per share $74.63 per share Suppose that there is high unemployment, which causes interest rates to fall, which in turn pulls the preferred stock's yield to 8.84%. The value of the preferred stock willStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started