for drop downs

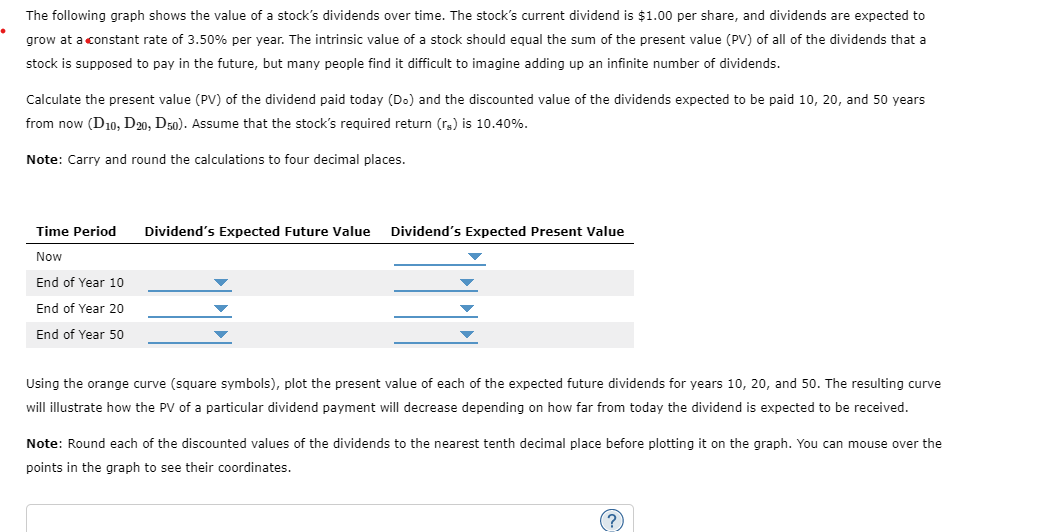

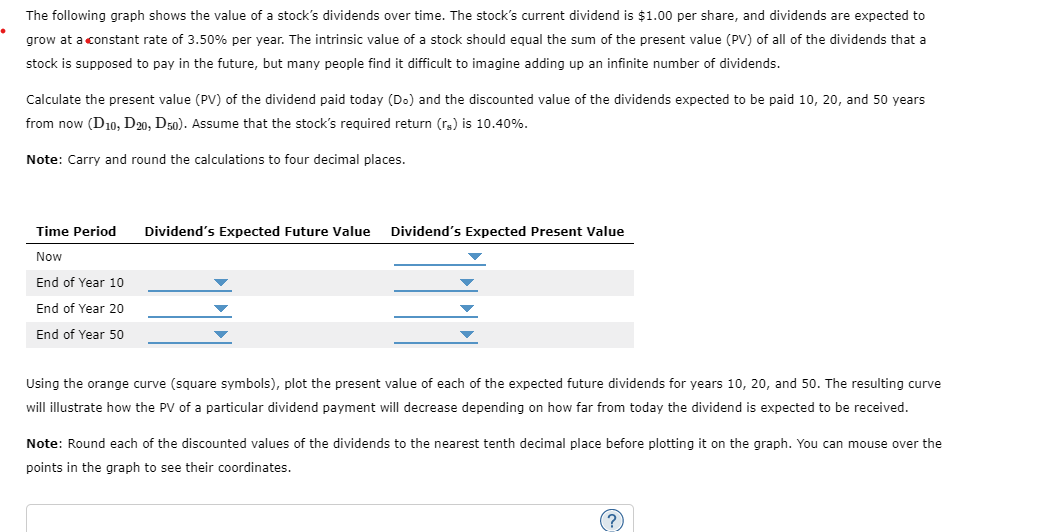

now .0000/.1000/1.0000/10.0000

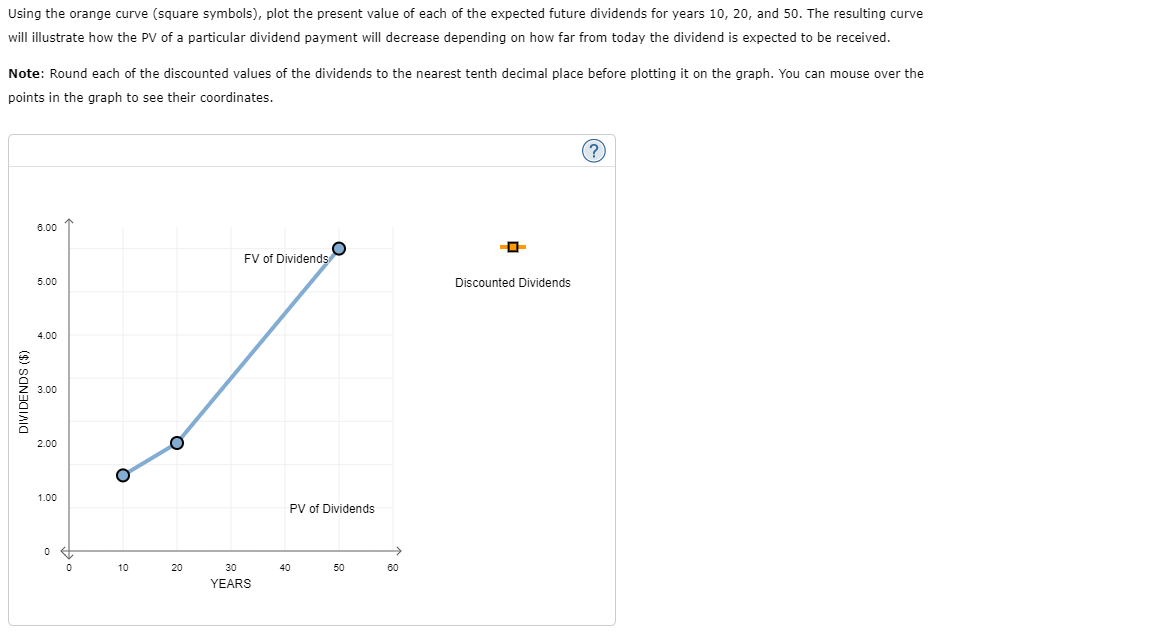

end of year 10 1) .3629/1.4106/1.1087/1.2723 2) .8240/.5549/.5294/.5245/.6365

end of year 20 1) 1.9898/2.2061/1.6753/ 1.7947 2) .2751/.3338/.3798.2266

end of year 50 1) 6.6331/5.5849/5.0373/5.3961 2) .0423/.0397/.0482/.0287

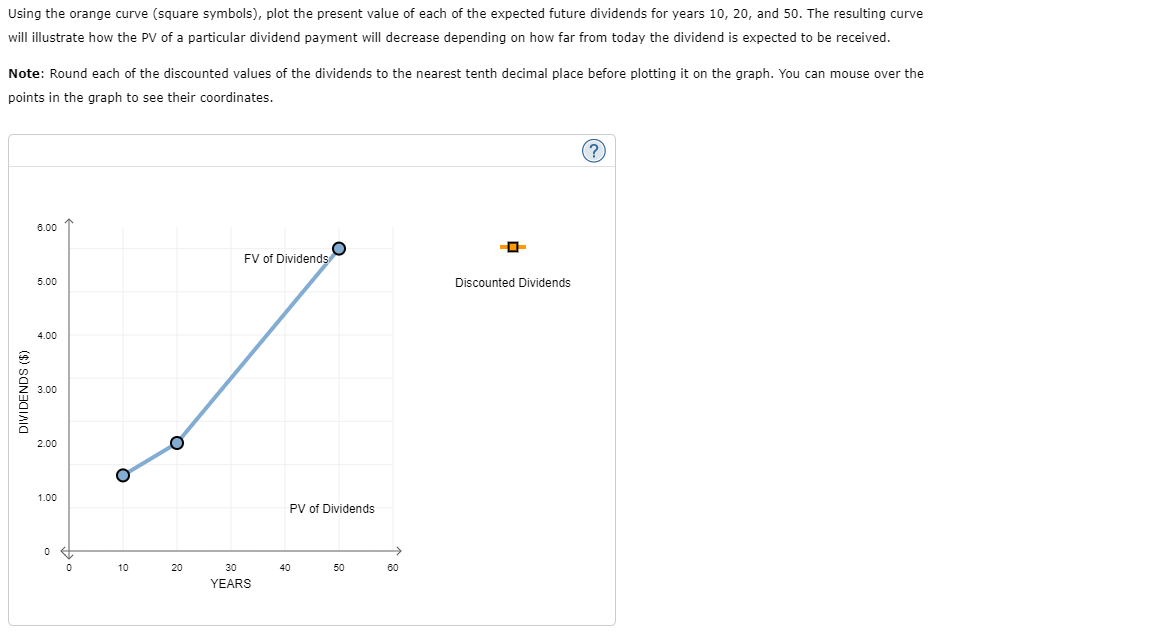

please show me how to do the graph

----

----

\

\

options for drop downs

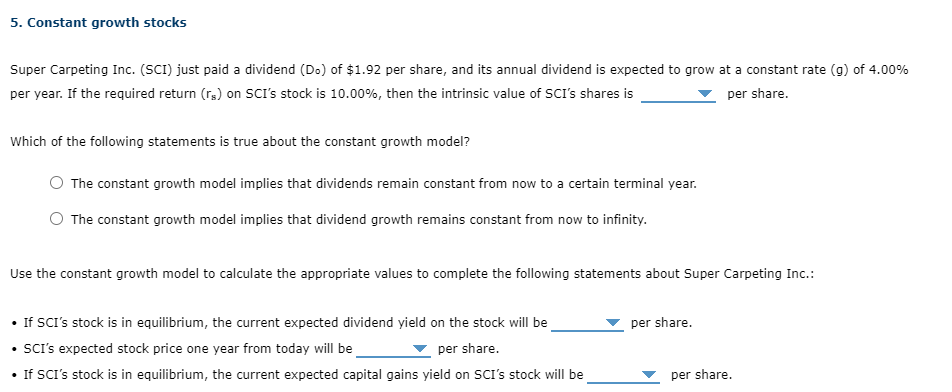

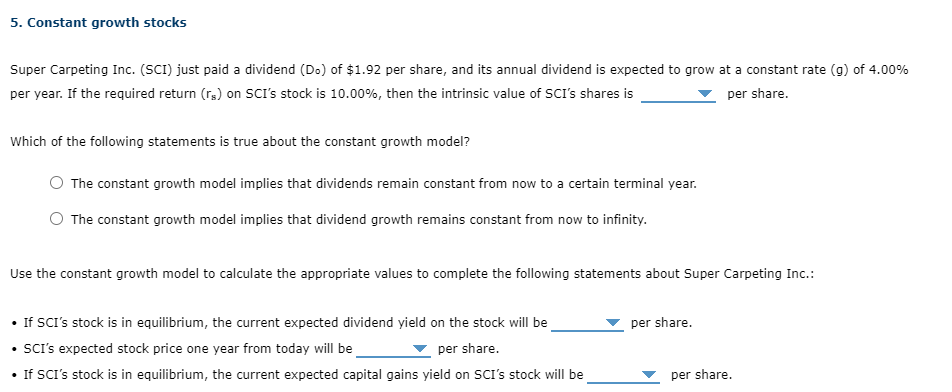

1. 33.28/ 35.2/34.61/36.61

2. 6.24/6.00/5.77/4.16

3. 33.28/34.61/32.00/20.77

4. 4.80/4.00/.24/9.20

----

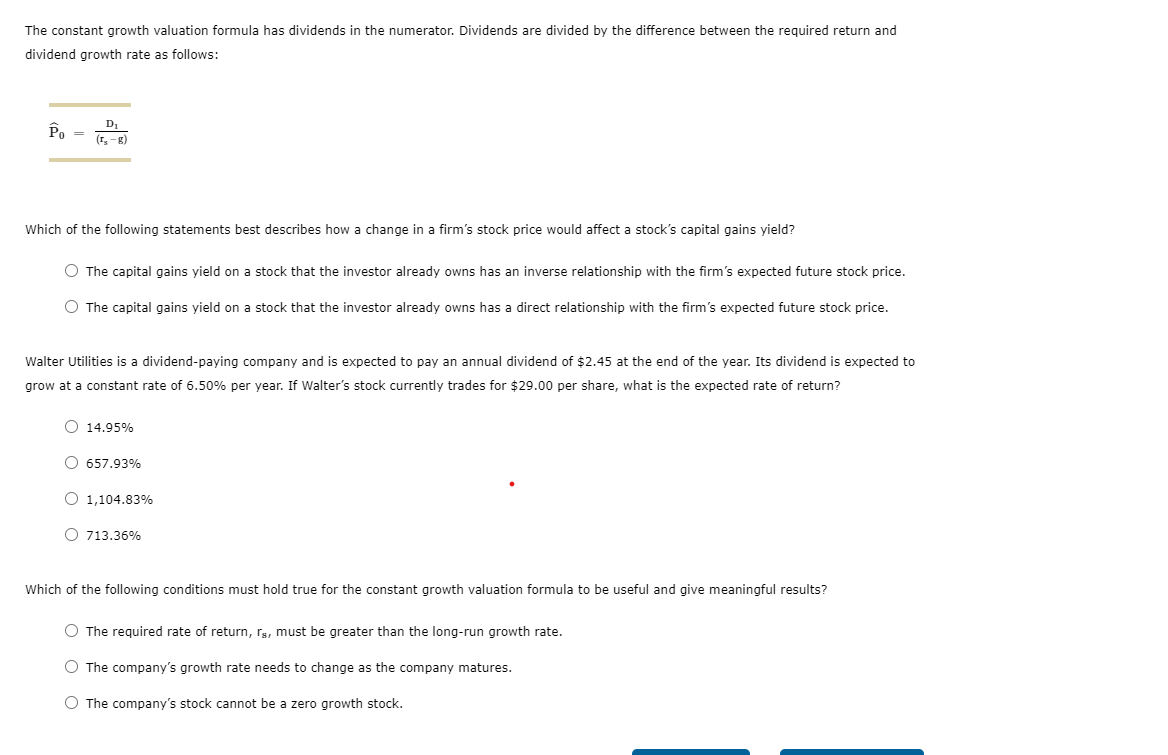

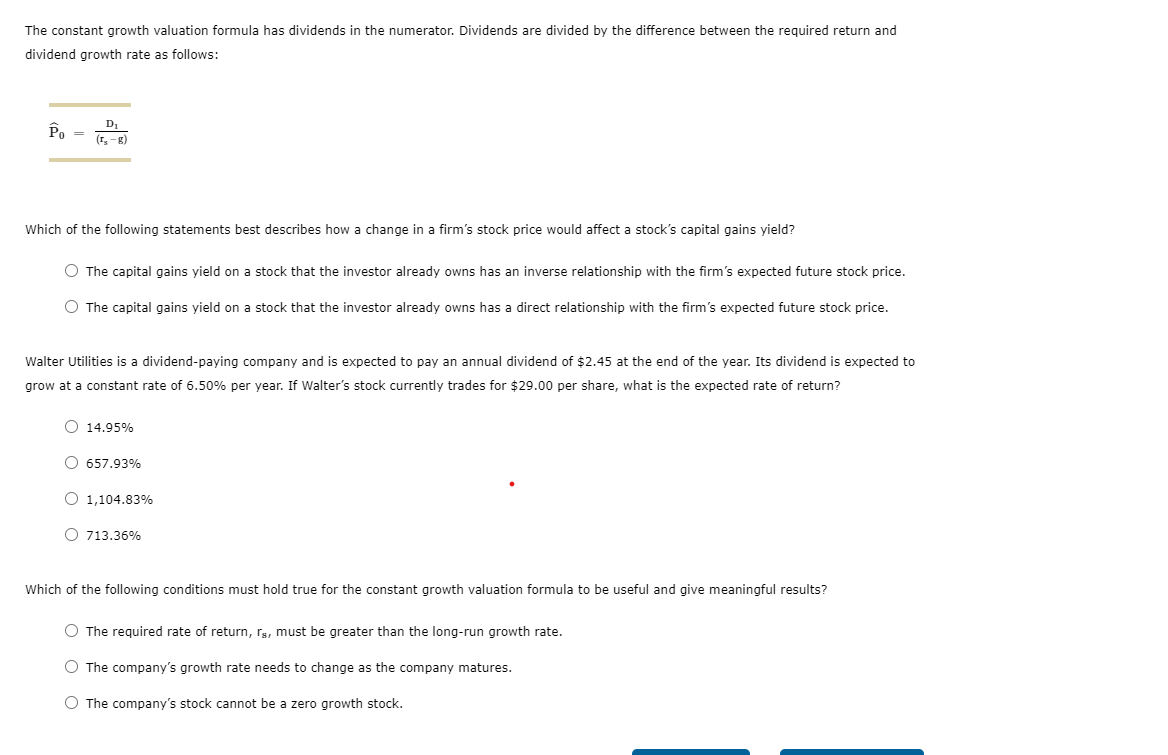

The following graph shows the value of a stock's dividends over time. The stock's current dividend is $1.00 per share, and dividends are expected to stock is supposed to pay in the future, but many people find it difficult to imagine adding up an infinite number of dividends. Calculate the present value (PV) of the dividend paid today (Do) and the discounted value of the dividends expected to be 10 , 20 , and 50 years from now (D10,D20,D50). Assume that the stock's required return (rs) is 10.40%. Note: Carry and round the calculations to four decimal places. Using the orange curve (square symbols), plot the present value of each of the expected future dividends for years 10 , 20 , and 50 . The resulting will illustrate how the PV of a particular dividend payment will decrease depending on how far from today the dividend is expected to be reived. Note: Round each of the discounted values of the dividends to the nearest tenth decimal place before plotting it on the graph. You can mouse the points in the graph to see their coordinates. Using the orange curve (square symbols), plot the present value of each of the expected future dividends for years 10,20 , and 50 . The resulting curve will illustrate how the PV of a particular dividend payment will decrease depending on how far from today the dividend is expected to be received. Note: Round each of the discounted values of the dividends to the nearest tenth decimal place before plotting it on the graph. You can mouse points in the graph to see their coordinates. Super Carpeting Inc. (SCI) just paid a dividend (Do) of $1.92 per share, and its annual dividend is expected to grow at a constant rate ( 9 ) of 4.00% per year. If the required return (rs) on SCI's stock is 10.00%, then the intrinsic value of SCI's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model implies that dividends remain constant from now to a certain terminal year. The constant growth model implies that dividend growth remains constant from now to infinity. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: - If SCI's stock is in equilibrium, the current expected dividend yield on the stock will be per share. - SCI's expected stock price one year from today will be per share. - If SCI's stock is in equilibrium, the current expected capital gains yield on SCI's stock will be The constant growth valuation formula has dividends in the numerator. Dividends are divided by the difference between the required return and dividend growth rate as follows: P0=(rsg)D1 Which of the following statements best describes how a change in a firm's stock price would affect a stock's capital gains yield? The capital gains yield on a stock that the investor already owns has an inverse relationship with the firm's expected future stock price. The capital gains yield on a stock that the investor already owns has a direct relationship with the firm's expected future stock price. Walter Utilities is a dividend-paying company and is expected to pay an annual dividend of $2.45 at the end of the grow at a constant rate of 6.50% per year. If Walter's stock currently trades for $29.00 per share, what is the expected rate of return? 14.95%657.93%1,104.83%713.36% Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? The required rate of return, rs, must be greater than the long-run growth rate. The company's growth rate needs to change as the company matures. The company's stock cannot be a zero growth stock

----

---- \

\