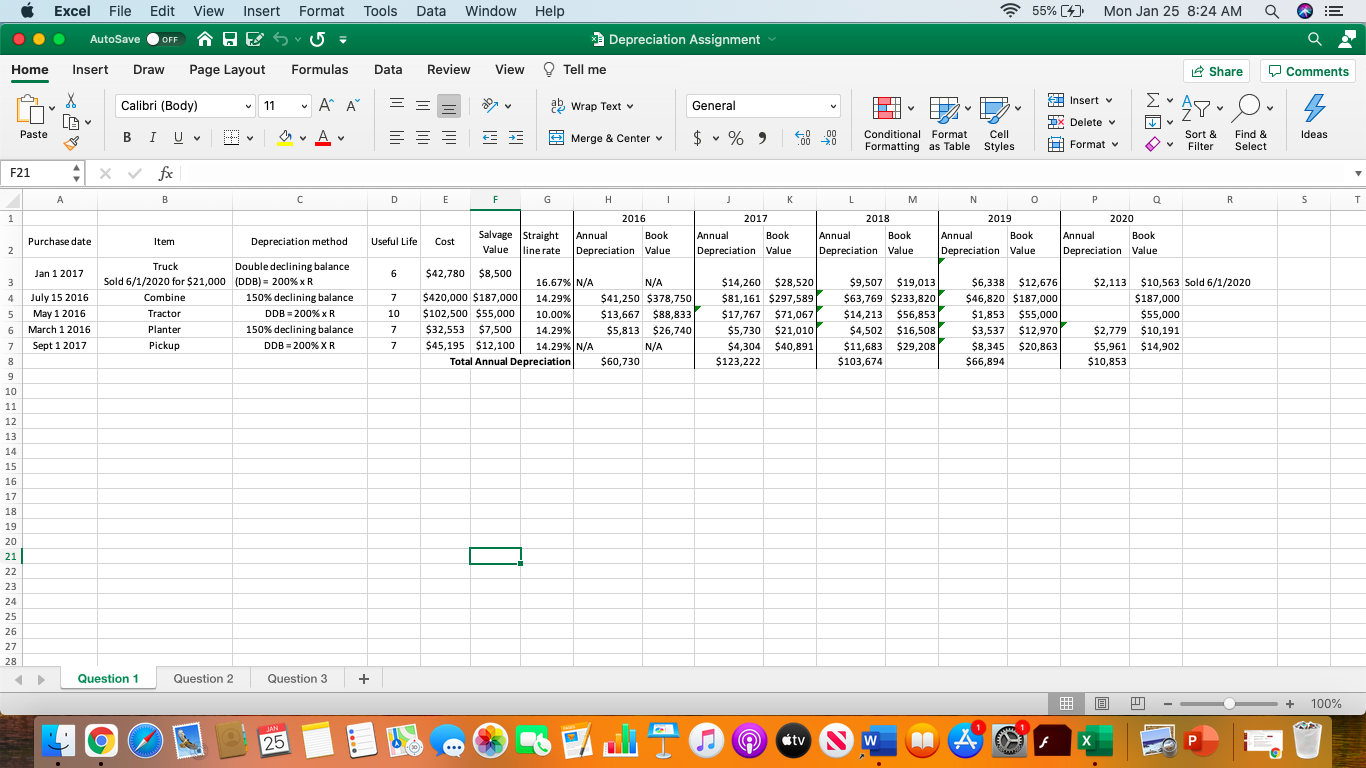

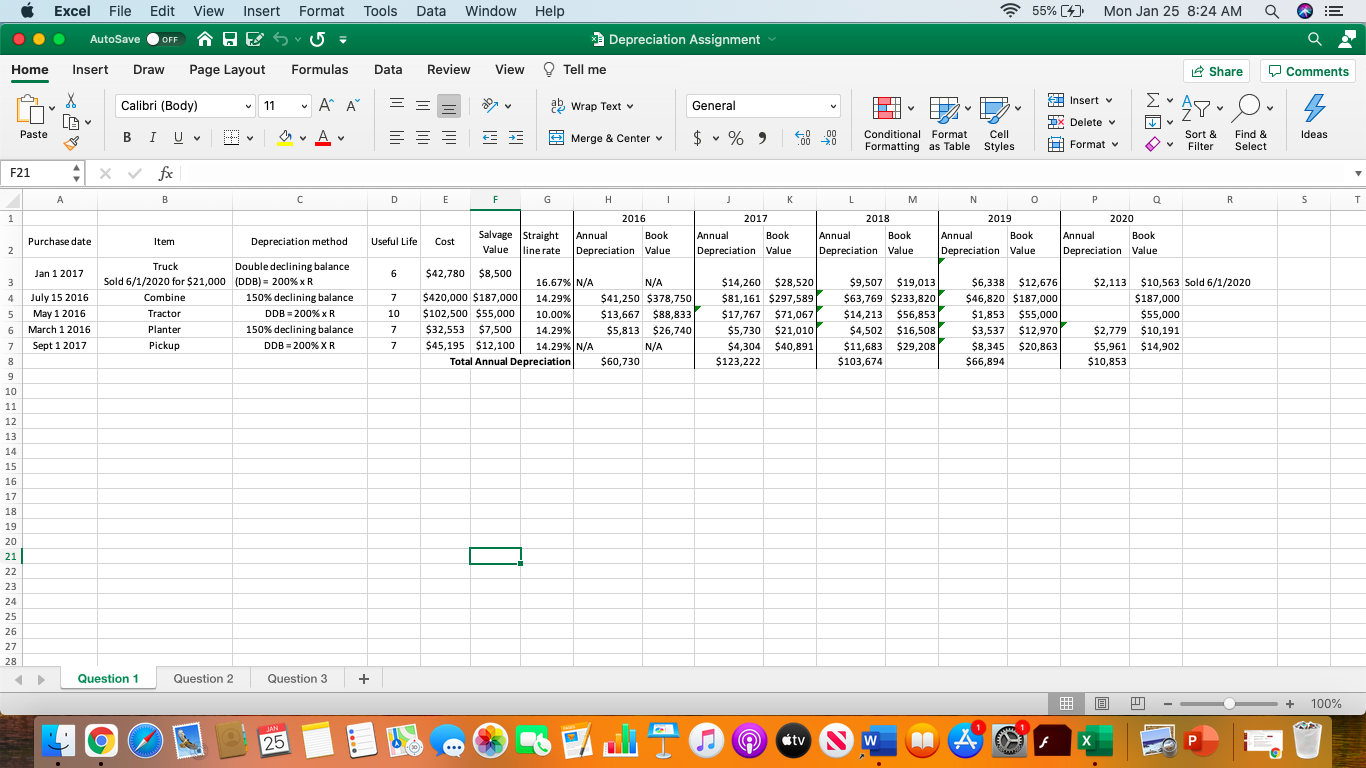

For each asset calculate the annual tax depreciation and adjusted tax basis for each of the first 5 years of depreciation using the appropriate MACR class.

For each asset calculate the annual tax depreciation and adjusted tax basis for each of the first 5 years of depreciation using the appropriate MACR class.

Tools Data Window Help 55% [4] Mon Jan 25 8:24 AM E Excel File Edit View Insert Format OOO AutoSave OFF HESU- Depreciation Assignment Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) X LE 11 - Insert General ab Wrap Text DA WE 48- s NI V DX Delete v Paste BIU v Merge & Center $ % ) .00 0 Ideas Conditional Format Formatting as Table Cell Styles Format Sort & Filter Find & Select F21 4 x fx v A B D E F G H 1 K L L M N O P 0 R S T 1 2017 2019 2016 Annual Book Depreciation Value Depreciation method Purchase date 2018 Annual Book Depreciation Value Item Salvage Straight Value line rate 2020 Annual Book Depreciation Value Useful Life Annual Book Depreciation Value Cost Annual Book Depreciation Value 2 Jan 1 2017 6 3 4 5 Truck Double declining balance Sold 6/1/2020 for $21,000 (DDB) = 200% XR Combine 150% declining balance Tractor DDB = 200% XR Planter 150% declining balance Pickup DDB = 200% XR July 15 2016 May 1 2016 March 1 2016 Sept 1 2017 7 10 $42,780 $8,500 16.67% N/A $420,000 $187,000 14.29% $102,500 $55,000 10.00% $32,553 $7,500 14.29% $45,195 $12,100 14.29% N/A Total Annual Depreciation N/A $41,250 $378,750 $13,667 $88,833 $5,813 $26,740 N/A $60,730 $14,260 $28,520 $81,161 $297,589 $17,767 $71,067 $5,730 $21,010 $4,304 $40,891 $123,222 $9,507 $19,013 $63,769 $233,820 $14,213 $56,853 $4,502 $16,508 $11,683 $29,208 $103,674 $6,338 $12,676 $46,820 $187,000 $1,853 $55,000 $3,537 $12,970 $8,345 $20.863 $66,894 $2,113 $10,563 Sold 6/1/2020 $187,000 $55,000 $2,779 $10,191 $5,961 $14,902 $10,853 7 7 7 6 7 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Question 1 Question 2 Question 3 + HI B + 100% JAN 25 tv SW P Tools Data Window Help 55% [4] Mon Jan 25 8:24 AM E Excel File Edit View Insert Format OOO AutoSave OFF HESU- Depreciation Assignment Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments Calibri (Body) X LE 11 - Insert General ab Wrap Text DA WE 48- s NI V DX Delete v Paste BIU v Merge & Center $ % ) .00 0 Ideas Conditional Format Formatting as Table Cell Styles Format Sort & Filter Find & Select F21 4 x fx v A B D E F G H 1 K L L M N O P 0 R S T 1 2017 2019 2016 Annual Book Depreciation Value Depreciation method Purchase date 2018 Annual Book Depreciation Value Item Salvage Straight Value line rate 2020 Annual Book Depreciation Value Useful Life Annual Book Depreciation Value Cost Annual Book Depreciation Value 2 Jan 1 2017 6 3 4 5 Truck Double declining balance Sold 6/1/2020 for $21,000 (DDB) = 200% XR Combine 150% declining balance Tractor DDB = 200% XR Planter 150% declining balance Pickup DDB = 200% XR July 15 2016 May 1 2016 March 1 2016 Sept 1 2017 7 10 $42,780 $8,500 16.67% N/A $420,000 $187,000 14.29% $102,500 $55,000 10.00% $32,553 $7,500 14.29% $45,195 $12,100 14.29% N/A Total Annual Depreciation N/A $41,250 $378,750 $13,667 $88,833 $5,813 $26,740 N/A $60,730 $14,260 $28,520 $81,161 $297,589 $17,767 $71,067 $5,730 $21,010 $4,304 $40,891 $123,222 $9,507 $19,013 $63,769 $233,820 $14,213 $56,853 $4,502 $16,508 $11,683 $29,208 $103,674 $6,338 $12,676 $46,820 $187,000 $1,853 $55,000 $3,537 $12,970 $8,345 $20.863 $66,894 $2,113 $10,563 Sold 6/1/2020 $187,000 $55,000 $2,779 $10,191 $5,961 $14,902 $10,853 7 7 7 6 7 1 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Question 1 Question 2 Question 3 + HI B + 100% JAN 25 tv SW P

For each asset calculate the annual tax depreciation and adjusted tax basis for each of the first 5 years of depreciation using the appropriate MACR class.

For each asset calculate the annual tax depreciation and adjusted tax basis for each of the first 5 years of depreciation using the appropriate MACR class.