Answered step by step

Verified Expert Solution

Question

1 Approved Answer

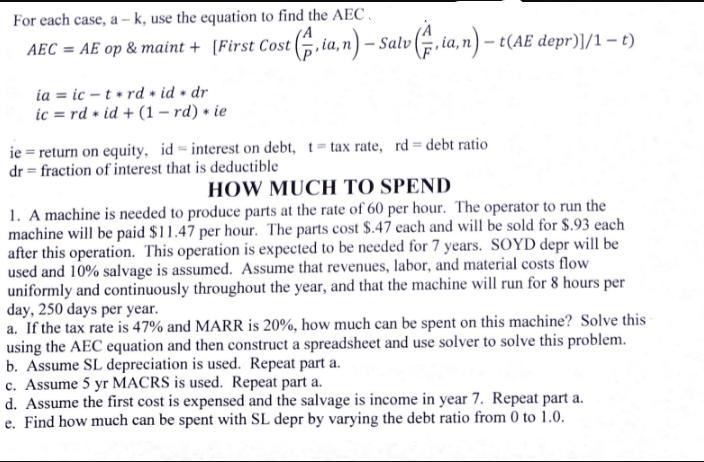

For each case, a-k, use the equation to find the AEC AEC AE op & maint+ [First Cost ia - ic - trd id

For each case, a-k, use the equation to find the AEC AEC AE op & maint+ [First Cost ia - ic - trd id dr ic = rd id + (1-rd) * ie stia, n)-s Salv v (4,ila, n) t(AE depr}]/1 t) ie= return on equity, id= interest on debt, t-tax rate, rd = debt ratio dr = fraction of interest that is deductible HOW MUCH TO SPEND 1. A machine is needed to produce parts at the rate of 60 per hour. The operator to run the machine will be paid $11.47 per hour. The parts cost $.47 each and will be sold for $.93 each after this operation. This operation is expected to be needed for 7 years. SOYD depr will be used and 10% salvage is assumed. Assume that revenues, labor, and material costs flow uniformly and continuously throughout the year, and that the machine will run for 8 hours per day, 250 days per year. a. If the tax rate is 47% and MARR is 20%, how much can be spent on this machine? Solve this using the AEC equation and then construct a spreadsheet and use solver to solve this problem. b. Assume SL depreciation is used. Repeat part a. c. Assume 5 yr MACRS is used. Repeat part a. d. Assume the first cost is expensed and the salvage is income in year 7. Repeat part a. e. Find how much can be spent with SL depr by varying the debt ratio from 0 to 1.0.

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

For each case ak use the equation to find the AEC AEC AE op maint First Cost ian Salv ian A ian t tA...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started