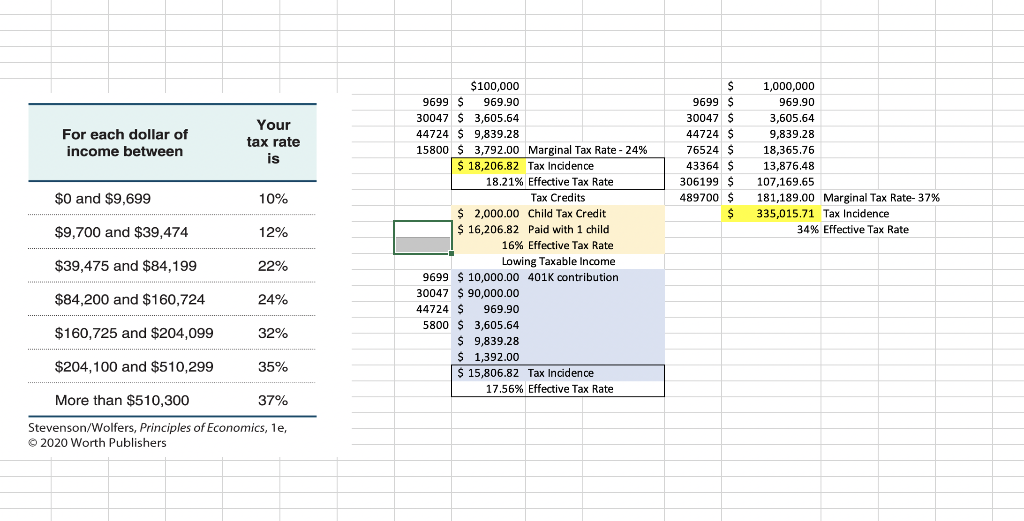

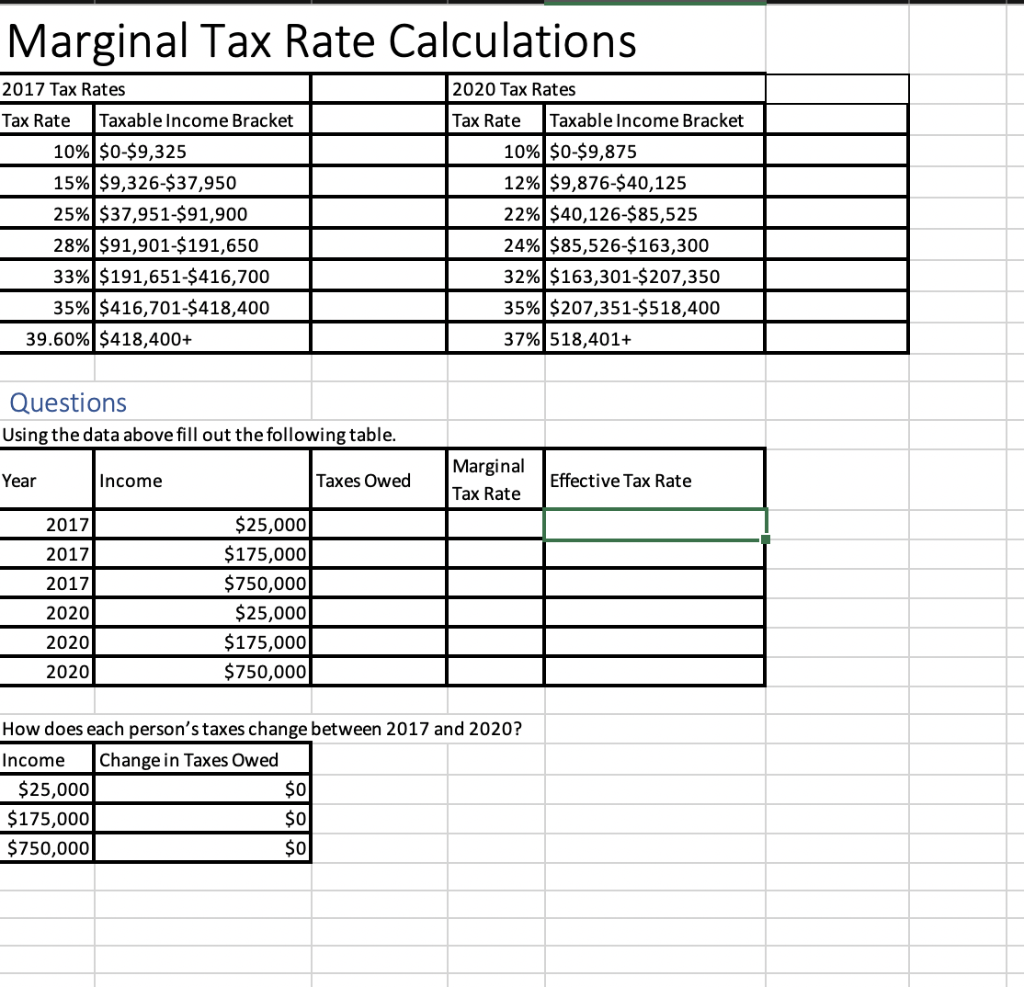

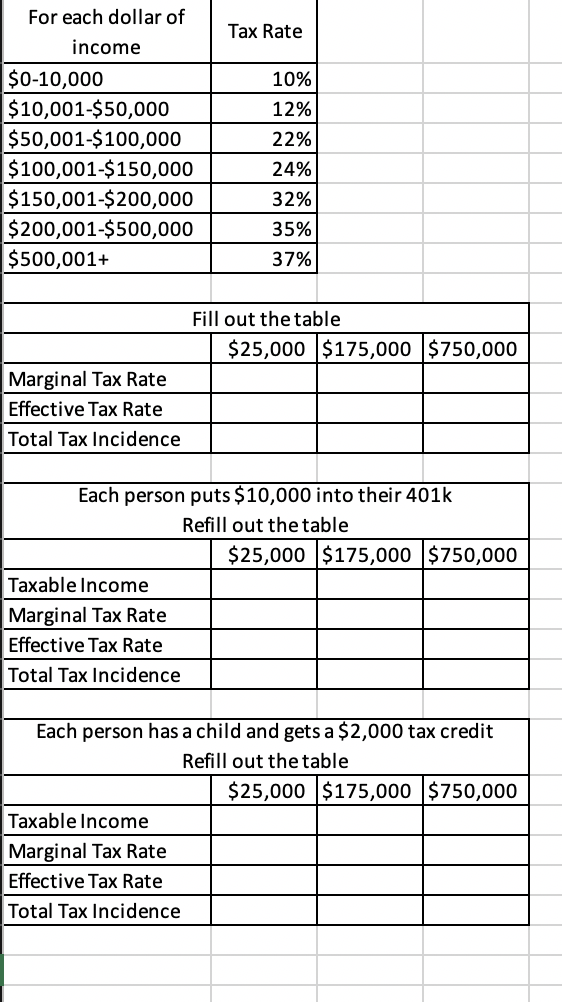

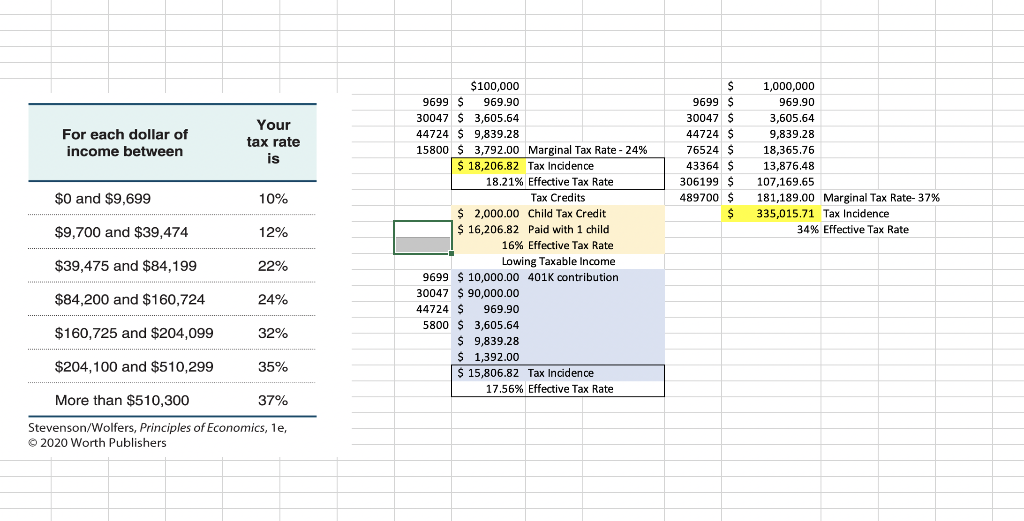

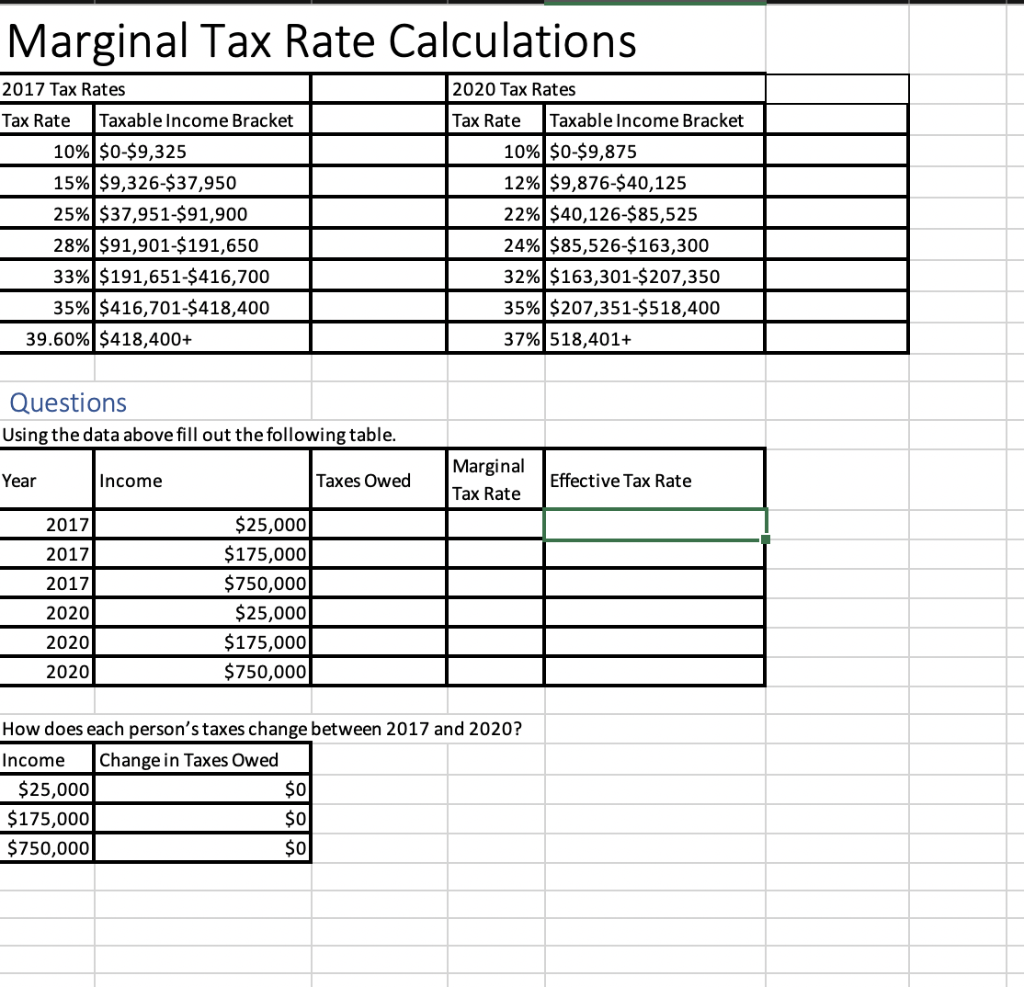

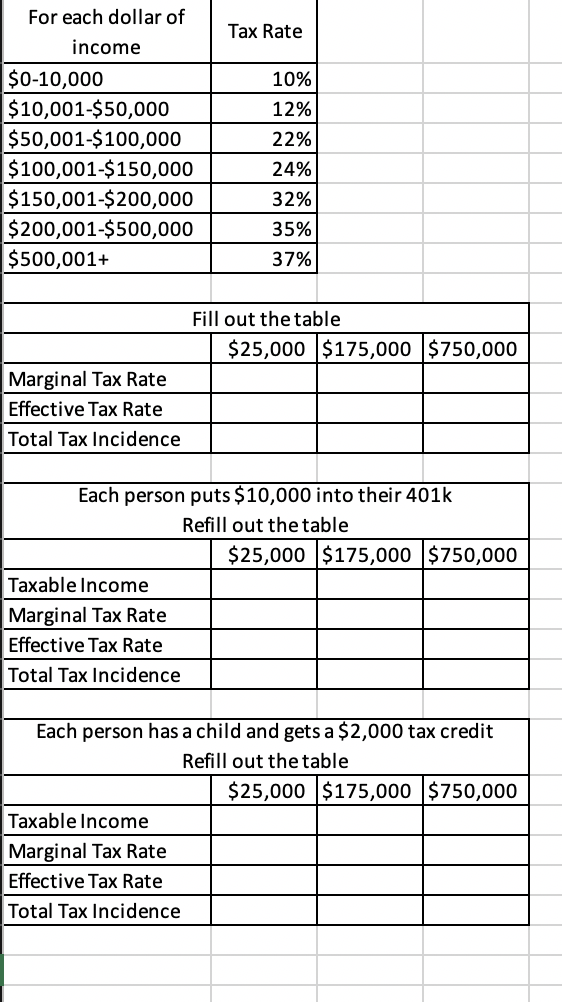

For each dollar of income between Your tax rate is $ 9699 $ 30047 $ 44724 $ 76524 $ 43364 $ 306199 $ 489700 $ $ 1,000,000 969.90 3,605.64 WWW.07 9,839.28 09:20 18,365.76 13,876.48 107,169.65 181,189.00 Marginal Tax Rate-37% 335,015.71 Tax Incidence 34% Effective Tax Rate $0 and $9,699 10% $9,700 and $39,474 12% $100,000 9699 S 969.90 30047 $ 3,605.64 44724 $ 9,839.28 15800 S 3,792.00 Marginal Tax Rate - 24% $ 18,206.82 Tax Incidence 18.21% Effective Tax Rate Tax Credits $ 2,000.00 Child Tax Credit $ 16,206.82 Paid with 1 child 16% Effective Tax Rate Lowing Taxable income 9699 $ 10,000.00 401K contribution 30047 $ 90,000.00 44724 $ 969.90 5800 $3,605,64 $ 9,839.28 $ 1,392.00 $ 15,806.82 Tax Incidence 17.56% Effective Tax Rate % $39,475 and $84,199 22% $84,200 and $160,724 24% $160,725 and $204,099 32% $204,100 and $510,299 35% More than $510,300 37% Stevenson/Wolfers, Principles of Economics, 1e, 2020 Worth Publishers Marginal Tax Rate Calculations 2017 Tax Rates Tax Rate Taxable income Bracket 10% $0-$9,325 15% $9,326-$37,950 25% $37,951-$91,900 28% $91,901-$191,650 33% $191,651-$416,700 35% $416,701-$418,400 39.60% $418,400+ 2020 Tax Rates Tax Rate Taxable income Bracket 10% $0-$9,875 12% $9,876-$40,125 22% $40,126-$85,525 24% $85,526-$163,300 32% $163,301-$207,350 35% $207,351-$518,400 37% 518,401+ Questions Using the data above fill out the following table. Year Income Taxes Owed Marginal Tax Rate Effective Tax Rate 2017 2017 2017 $25,000 $175,000 $750,000 $25,000 $175,000 $750,000 2020 2020 2020 How does each person's taxes change between 2017 and 2020? Income Change in Taxes Owed $25,000 $0 $175,000 $0 $750,000 $0 For each dollar of income Tax Rate $0-10,000 $10,001-$50,000 $50,001-$100,000 $100,001-$150,000 $150,001-$200,000 $200,001-$500,000 $500,001+ 10% 12% 22% 24% 32% 35% 37% Fill out the table $25,000 $175,000 $750,000 Marginal Tax Rate Effective Tax Rate Total Tax Incidence Each person puts $10,000 into their 401k Refill out the table $25,000 $175,000 $750,000 Taxable income Marginal Tax Rate Effective Tax Rate Total Tax Incidence Each person has a child and gets a $2,000 tax credit Refill out the table $25,000 $175,000 $750,000 Taxable income Marginal Tax Rate Effective Tax Rate Total Tax Incidence For each dollar of income between Your tax rate is $ 9699 $ 30047 $ 44724 $ 76524 $ 43364 $ 306199 $ 489700 $ $ 1,000,000 969.90 3,605.64 WWW.07 9,839.28 09:20 18,365.76 13,876.48 107,169.65 181,189.00 Marginal Tax Rate-37% 335,015.71 Tax Incidence 34% Effective Tax Rate $0 and $9,699 10% $9,700 and $39,474 12% $100,000 9699 S 969.90 30047 $ 3,605.64 44724 $ 9,839.28 15800 S 3,792.00 Marginal Tax Rate - 24% $ 18,206.82 Tax Incidence 18.21% Effective Tax Rate Tax Credits $ 2,000.00 Child Tax Credit $ 16,206.82 Paid with 1 child 16% Effective Tax Rate Lowing Taxable income 9699 $ 10,000.00 401K contribution 30047 $ 90,000.00 44724 $ 969.90 5800 $3,605,64 $ 9,839.28 $ 1,392.00 $ 15,806.82 Tax Incidence 17.56% Effective Tax Rate % $39,475 and $84,199 22% $84,200 and $160,724 24% $160,725 and $204,099 32% $204,100 and $510,299 35% More than $510,300 37% Stevenson/Wolfers, Principles of Economics, 1e, 2020 Worth Publishers Marginal Tax Rate Calculations 2017 Tax Rates Tax Rate Taxable income Bracket 10% $0-$9,325 15% $9,326-$37,950 25% $37,951-$91,900 28% $91,901-$191,650 33% $191,651-$416,700 35% $416,701-$418,400 39.60% $418,400+ 2020 Tax Rates Tax Rate Taxable income Bracket 10% $0-$9,875 12% $9,876-$40,125 22% $40,126-$85,525 24% $85,526-$163,300 32% $163,301-$207,350 35% $207,351-$518,400 37% 518,401+ Questions Using the data above fill out the following table. Year Income Taxes Owed Marginal Tax Rate Effective Tax Rate 2017 2017 2017 $25,000 $175,000 $750,000 $25,000 $175,000 $750,000 2020 2020 2020 How does each person's taxes change between 2017 and 2020? Income Change in Taxes Owed $25,000 $0 $175,000 $0 $750,000 $0 For each dollar of income Tax Rate $0-10,000 $10,001-$50,000 $50,001-$100,000 $100,001-$150,000 $150,001-$200,000 $200,001-$500,000 $500,001+ 10% 12% 22% 24% 32% 35% 37% Fill out the table $25,000 $175,000 $750,000 Marginal Tax Rate Effective Tax Rate Total Tax Incidence Each person puts $10,000 into their 401k Refill out the table $25,000 $175,000 $750,000 Taxable income Marginal Tax Rate Effective Tax Rate Total Tax Incidence Each person has a child and gets a $2,000 tax credit Refill out the table $25,000 $175,000 $750,000 Taxable income Marginal Tax Rate Effective Tax Rate Total Tax Incidence