Answered step by step

Verified Expert Solution

Question

1 Approved Answer

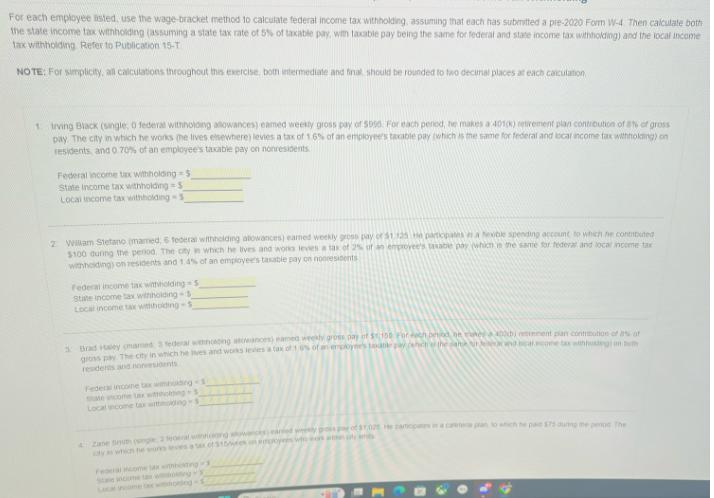

For each employee asted, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4 Then

For each employee asted, use the wage-bracket method to calculate federal income tax withholding, assuming that each has submitted a pre-2020 Form W-4 Then calculate both the state income tax withholding (assuming a state tax rate of 5% of taxable pay, with taxable pay being the same for federal and state income tax withholding) and the local income tax withholding Refer to Publication 15-T NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final should be rounded to two decimal places at each calculation 1 Irving Black (single, o federal withholding allowances) eamed weekly gross pay of 5055. For each period, he makes a 401(k) retirement plan contribution of % of gross pay. The city in which he works the lives elsewhere) levies a tax of 1.6% of an employee's taxable pay (which is the same for federal and local income tax withholding) on residents, and 0.70% of an employee's taxable pay on nonresidents Federal income tax withholding-5 State Income tax withholding-S Local income tax withholding-5 2 Wilam Stefano (mamed, 6 federal withholding allowances) earned weekly gross pay of $1 125 He participates a hexible spending account to which he contributed $100 during the period. The city in which he lives and wona levies a tax of 2% of an employee's taxable pay (which in the same for federal and local income tax withholding) on residents and 1.4% of an employee's taxable pay on nonresidents Federal income tax withholding-5 State income tax withholding-s Local income tax withholding-s Brad Hey mamed 3 federal wooing atowances) named weekly gross pay of $1150 Force on ker bi timent plan contution of % of gross pay. The city in which he lives and works levers a tax of 10% of one's loathe pay, which of the candle tax withing on th residents and noresidents Federal income tax wmbing ate come ar witholding+ Local income tax wings 4 Zane St (segle 2 Malang wowances) earned weenly pois por of 102 He articp in a can pran to achhe pae $75 during me pepe The ayas which he sees a sex of $15eyes who a Federal Home Sax withhisting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started