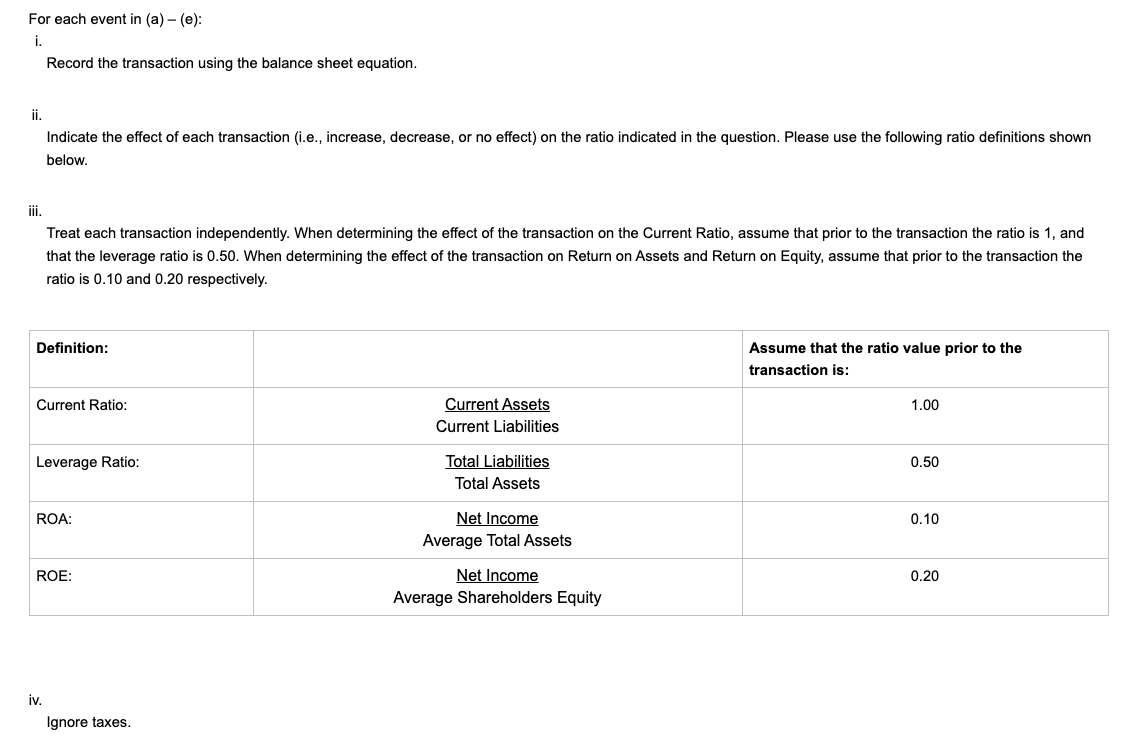

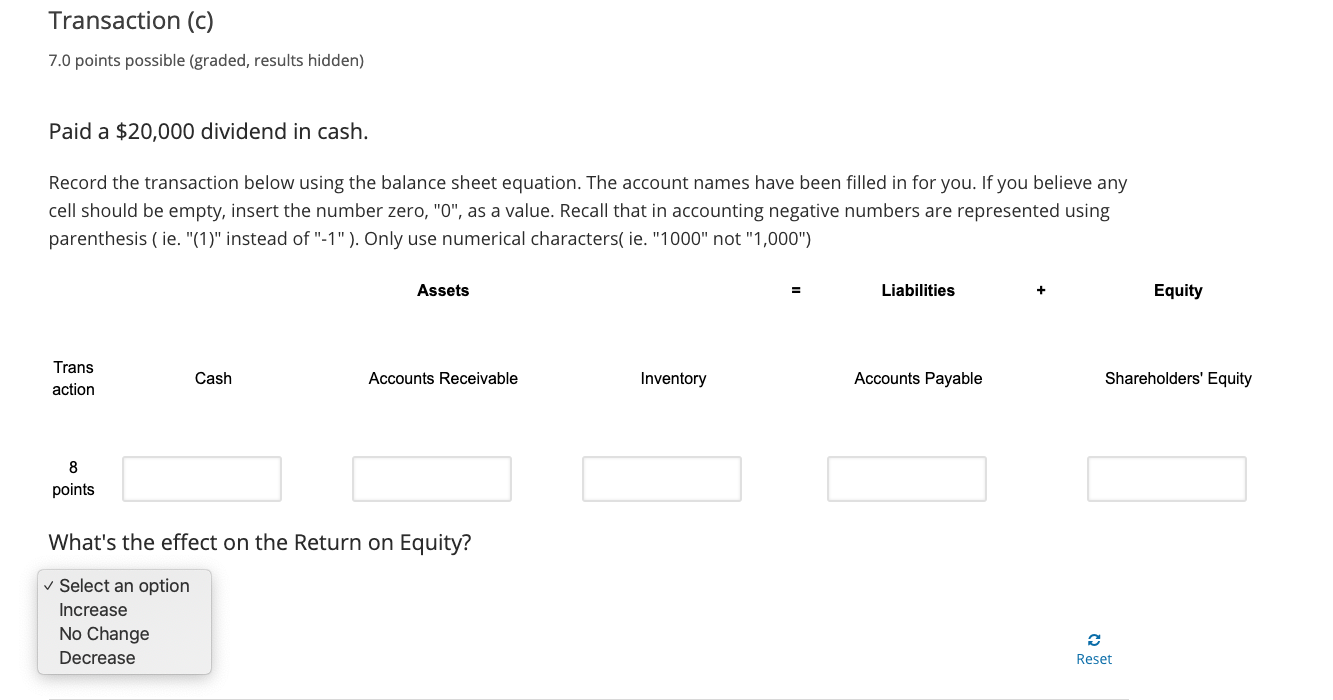

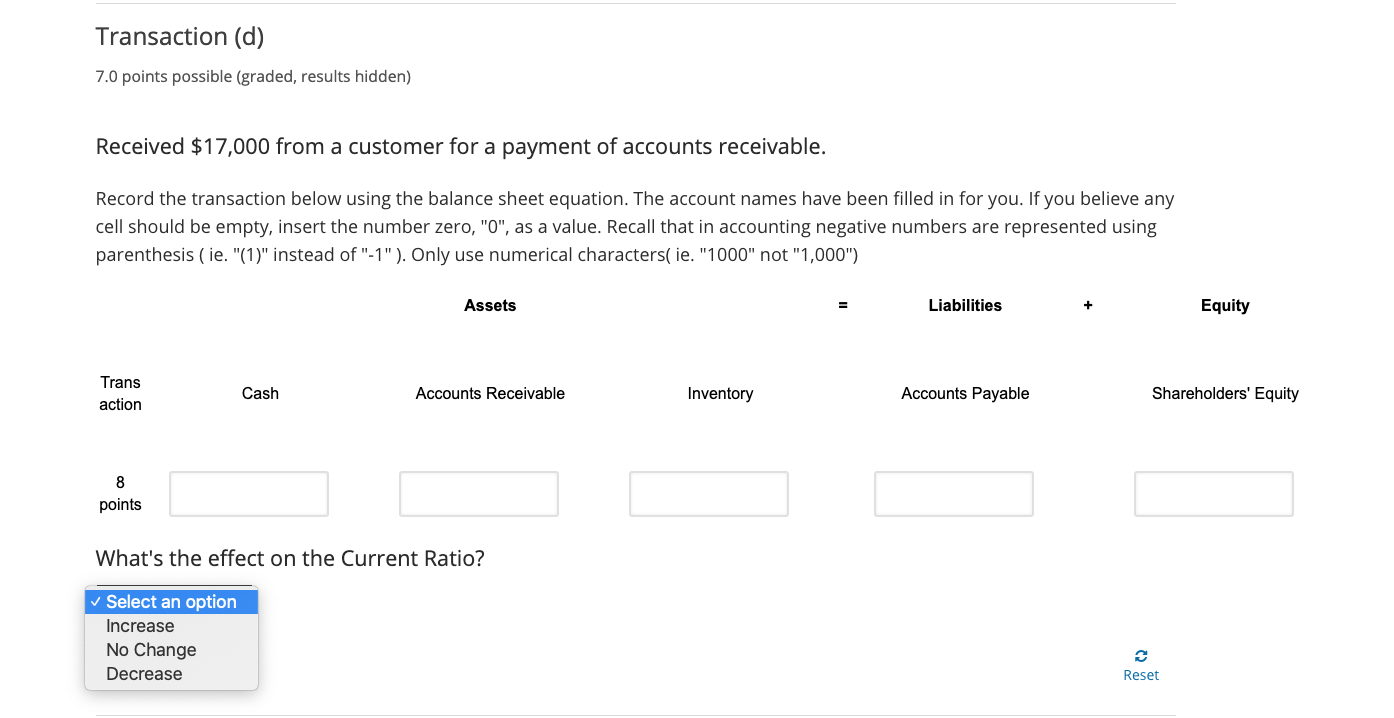

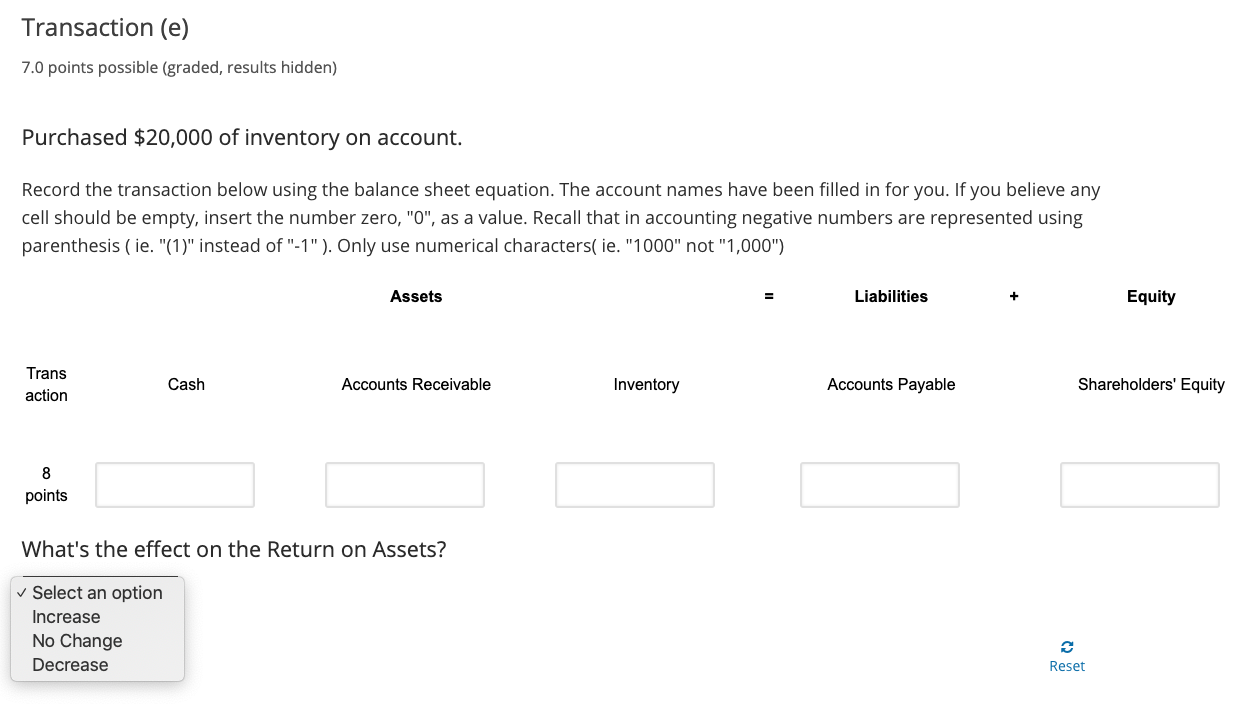

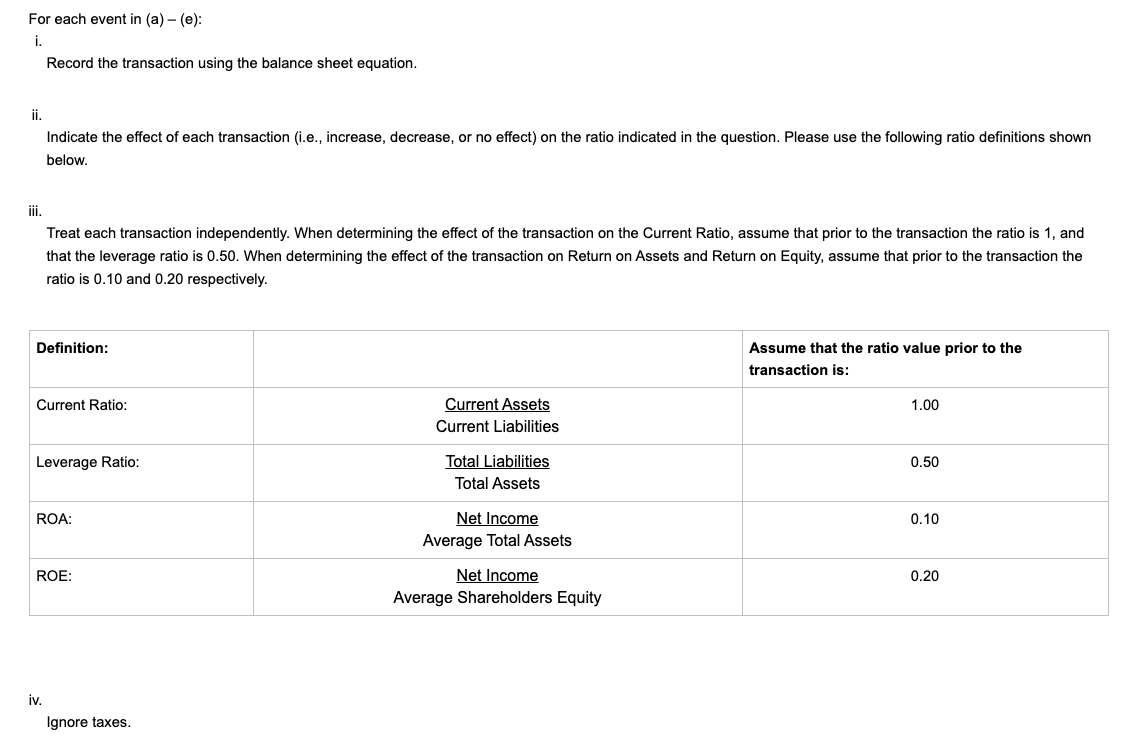

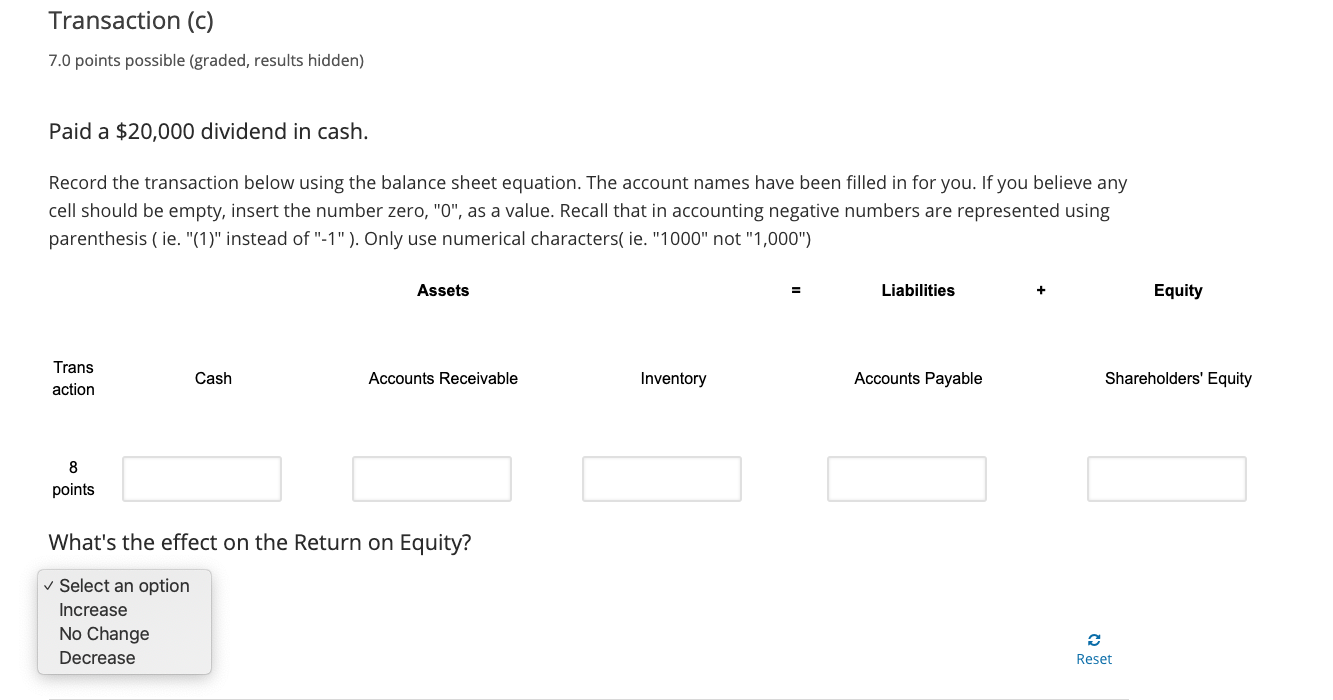

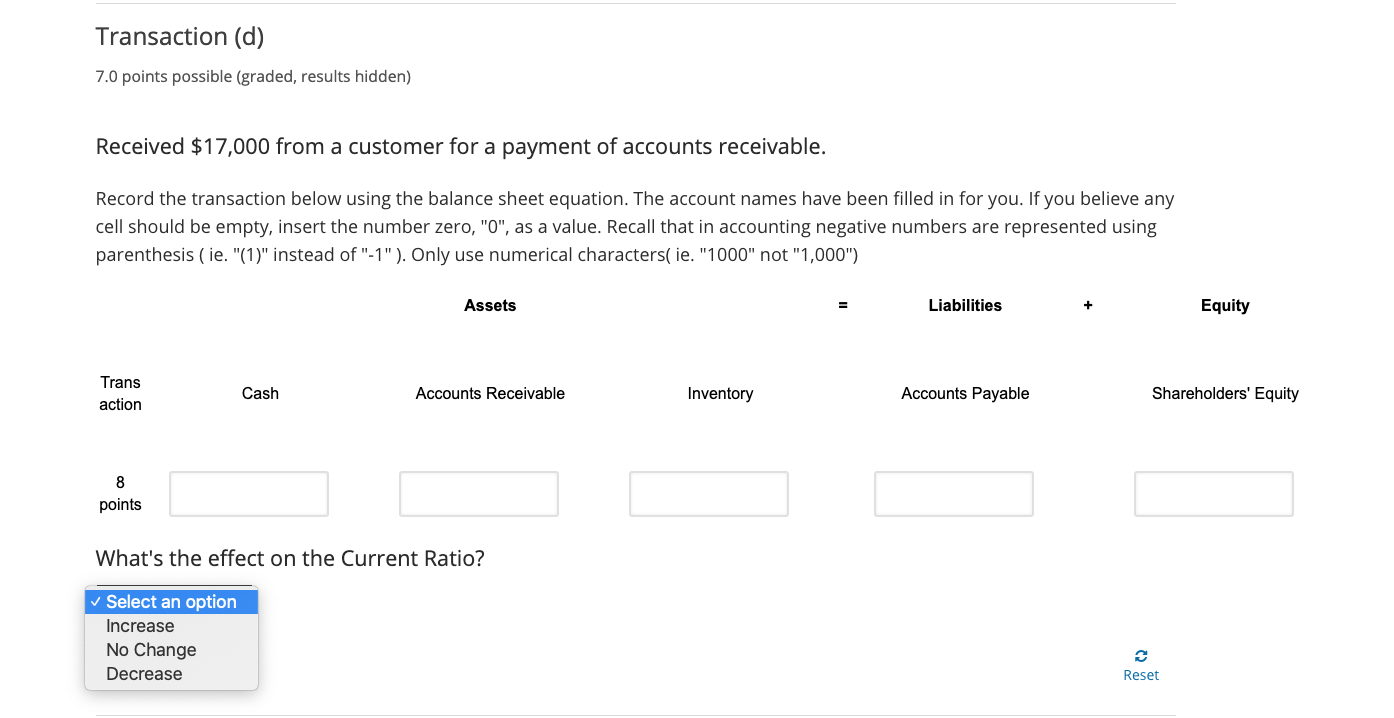

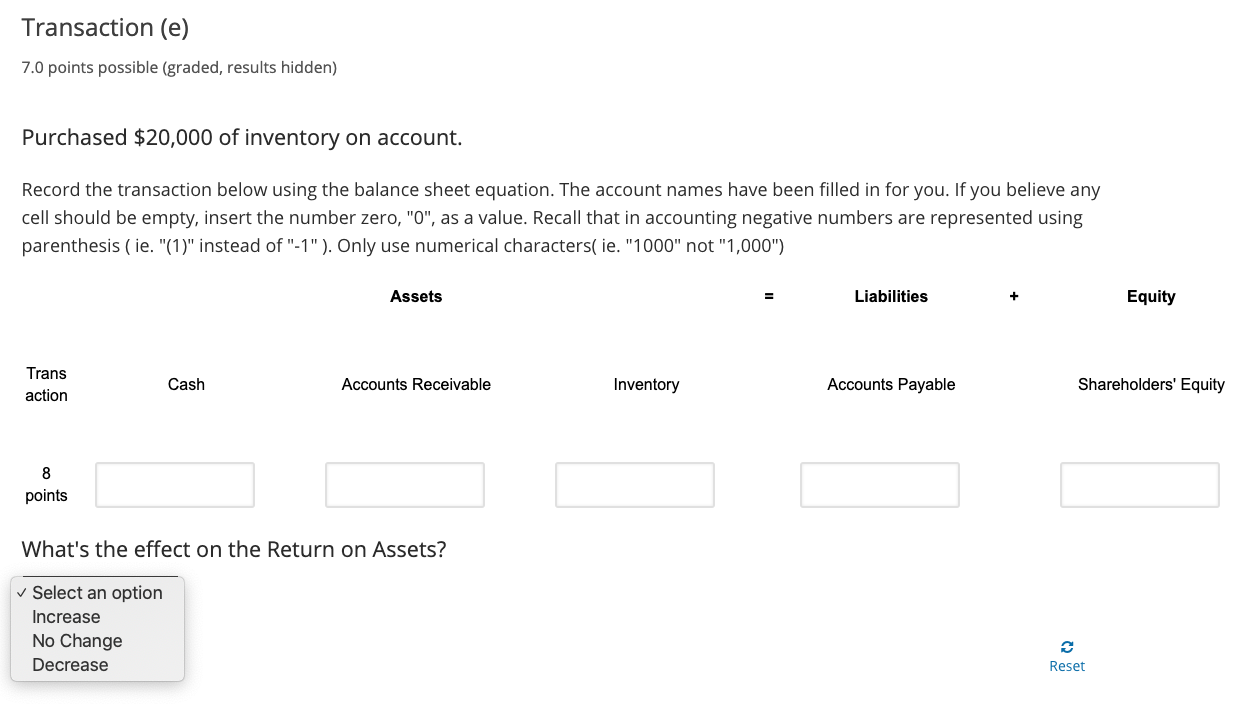

For each event in (a)-(e): i. Record the transaction using the balance sheet equation. ii. Indicate the effect of each transaction (i.e., increase, decrease, or no effect) on the ratio indicated in the question. Please use the following ratio definitions shown below iii. Treat each transaction independently. When determining the effect of the transaction on the Current Ratio, assume that prior to the transaction the ratio is 1, and that the leverage ratio is 0.50. When determining the effect of the transaction on Return on Assets and Return on Equity, assume that prior to the transaction the ratio is 0.10 and 0.20 respectively. Definition: Assume that the ratio value prior to the transaction is: Current Ratio: 1.00 Current Assets Current Liabilities everage Ratio: 0.50 Total Liabilities Total Assets ROA: 0.10 Net Income Average Total Assets ROE: 0.20 Net Income Average Shareholders Equity iv. Ignore taxes. Transaction (C) 7.0 points possible (graded, results hidden) Paid a $20,000 dividend in cash. Record the transaction below using the balance sheet equation. The account names have been filled in for you. If you believe any cell should be empty, insert the number zero, "0", as a value. Recall that in accounting negative numbers are represented using parenthesis (ie. "(1)" instead of "-1"). Only use numerical characters( ie. "1000" not "1,000") Assets Liabilities Equity Trans action Cash Accounts Receivable Inventory Accounts Payable Shareholders' Equity 8 points What's the effect on the Return on Equity? Select an option Increase No Change Decrease Reset Transaction (d) 7.0 points possible (graded, results hidden) Received $17,000 from a customer for a payment of accounts receivable. Record the transaction below using the balance sheet equation. The account names have been filled in for you. If you believe any cell should be empty, insert the number zero, "O", as a value. Recall that in accounting negative numbers are represented using parenthesis (ie. "(1)" instead of "-1"). Only use numerical characters( ie. "1000" not "1,000") Assets Liabilities Equity Trans action Cash Accounts Receivable Inventory Accounts Payable Shareholders' Equity 8 points What's the effect on the Current Ratio? Select an option Increase No Change Decrease Reset Transaction (e) 7.0 points possible (graded, results hidden) Purchased $20,000 of inventory on account. Record the transaction below using the balance sheet equation. The account names have been filled in for you. If you believe any cell should be empty, insert the number zero, "O", as a value. Recall that in accounting negative numbers are represented using parenthesis (ie. "(1)" instead of "-1"). Only use numerical characters( ie. "1000" not "1,000") Assets Liabilities Equity Trans action Cash Accounts Receivable Inventory Accounts Payable Shareholders' Equity 8 points What's the effect on the Return on Assets? Select an option Increase No Change Decrease a Reset