Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for each of the above separate cases analyze each adjusting entry by showing its effects on the accounting equation. specifically identify the accounts and amounts

for each of the above separate cases analyze each adjusting entry by showing its effects on the accounting equation. specifically identify the accounts and amounts including (+) increase or (-) decrease for transcation A through F

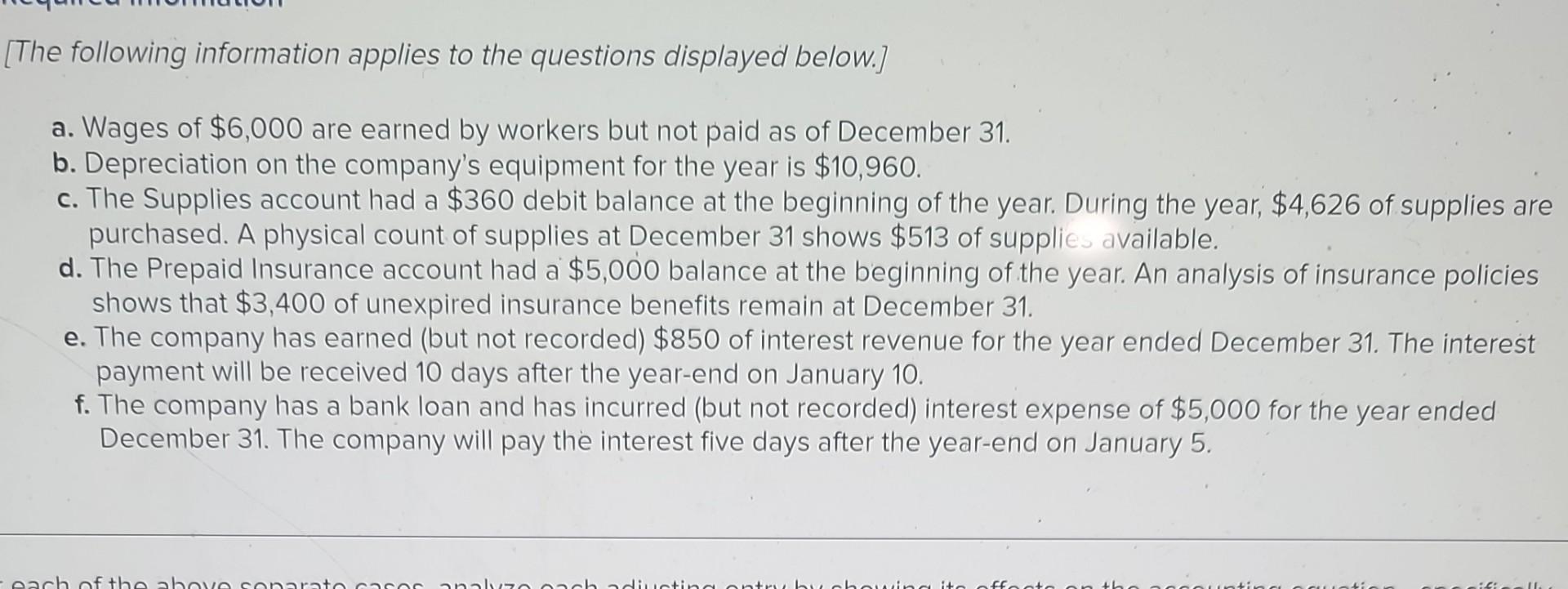

[The following information applies to the questions displayed below.] a. Wages of $6,000 are earned by workers but not paid as of December 31 . b. Depreciation on the company's equipment for the year is $10,960. c. The Supplies account had a $360 debit balance at the beginning of the year. During the year, $4,626 of supplies are purchased. A physical count of supplies at December 31 shows $513 of supplies available. d. The Prepaid Insurance account had a $5,000 balance at the beginning of the year. An analysis of insurance policies shows that $3,400 of unexpired insurance benefits remain at December 31 . e. The company has earned (but not recorded) $850 of interest revenue for the year ended December 31 . The interest payment will be received 10 days after the year-end on January 10. f. The company has a bank loan and has incurred (but not recorded) interest expense of $5,000 for the year ended December 31. The company will pay the interest five days after the year-end on January 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started