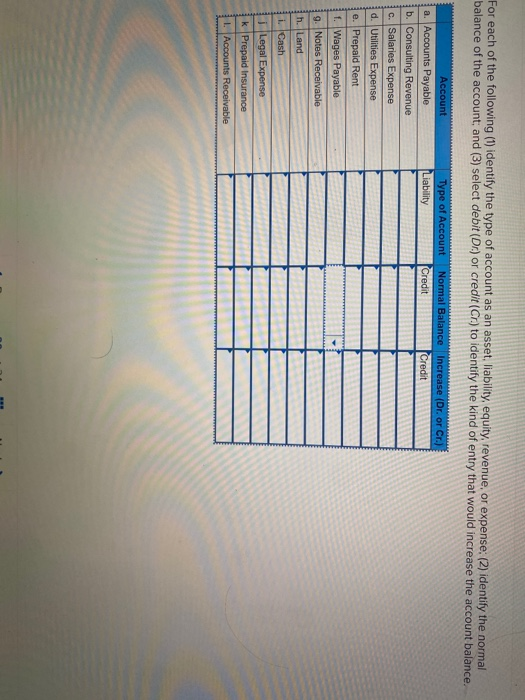

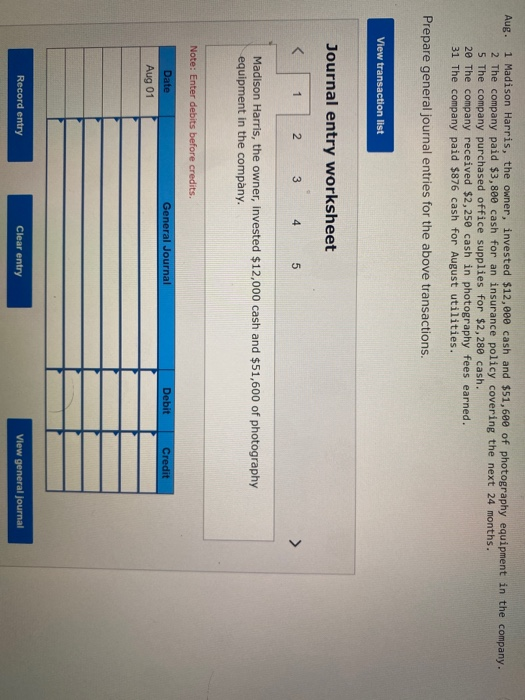

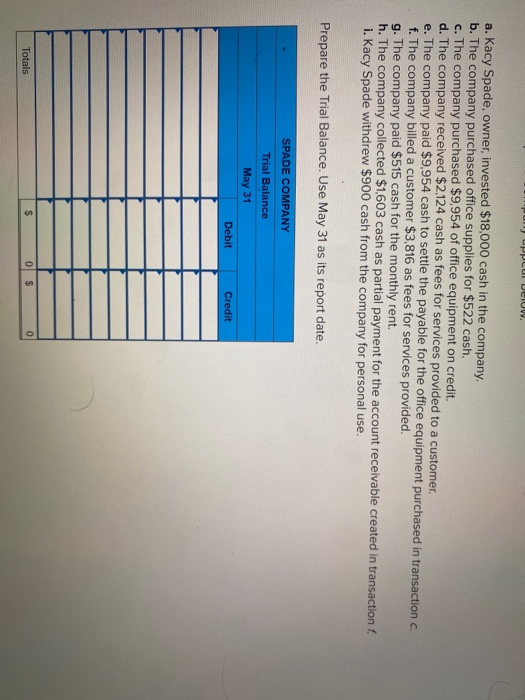

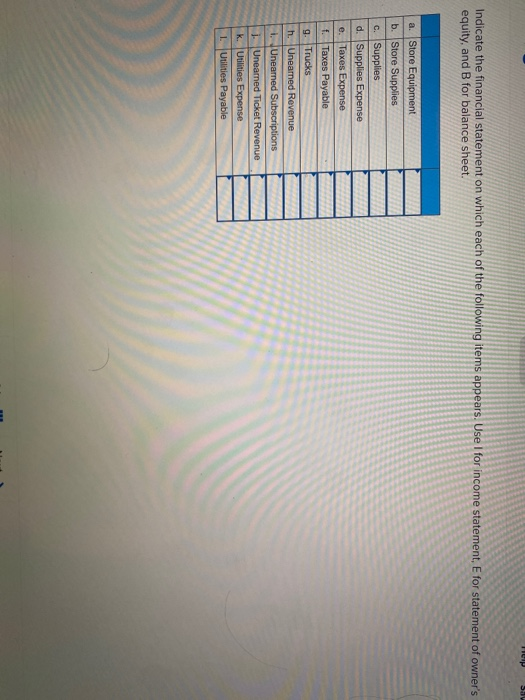

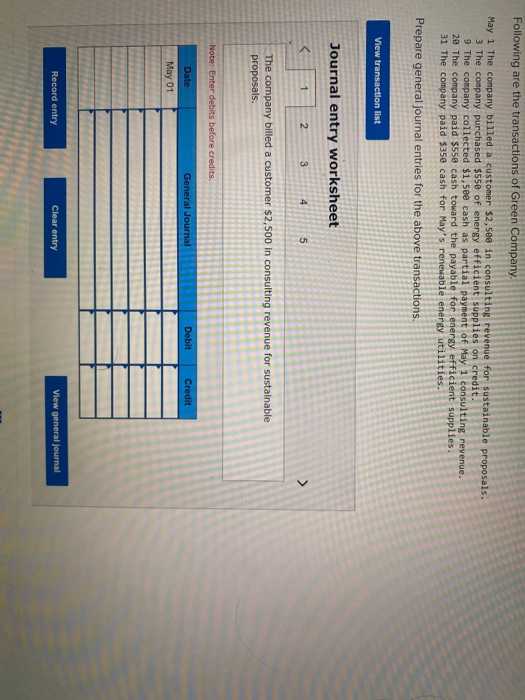

For each of the following (1) identify the type of account as an asset, liability, equity, revenue, or expense: (2) identify the normal balance of the account; and (3) select debit (Dr.) or credit (Cr.) to identify the kind of entry that would increase the account balance. Type of Account Liability Normal Balance increase (Dr. or Cr.) Credit Credit Account a. Accounts Payable b. Consulting Revenue c. Salaries Expense d. Utilities Expense e. Prepaid Rent f. Wages Payable 9. Notes Receivable h. Land i. Cash Legal Expense k Prepaid Insurance 1. Accounts Receivable Aug. 1 Madison Harris, the owner, invested $12,000 cash and $51,600 of photography equipment in the company. 2 The company paid $3,800 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,280 cash. 20 The company received $2,250 cash in photography fees earned. 31 The company paid $876 cash for August utilities. Prepare general journal entries for the above transactions. View transaction list Journal entry worksheet Madison Harris, the owner, invested $12,000 cash and $51,600 of photography equipment in the company. Note: Enter debits before credits. General Journal Debit Credit Date Aug 01 Record entry Clear entry View general journal "UPPLUi DelUW. a. Kacy Spade, owner, invested $18,000 cash in the company. b. The company purchased office supplies for $522 cash. c. The company purchased $9,954 of office equipment on credit. d. The company received $2,124 cash as fees for services provided to a customer. e. The company paid $9,954 cash to settle the payable for the office equipment purchased in transaction c. f. The company billed a customer $3,816 as fees for services provided. g. The company paid $515 cash for the monthly rent. h. The company collected $1,603 cash as partial payment for the account receivable created in transaction f. i. Kacy Spade withdrew $900 cash from the company for personal use. Prepare the Trial Balance. Use May 31 as its report date. SPADE COMPANY Trial Balance May 31 Debit Credit Totals $ 0 $ 0 FILIP Indicate the financial statement on which each of the following items appears. Use I for income statement, E for statement of owner's equity, and B for balance sheet. a. Store Equipment b. Store Supplies c. Supplies d. Supplies Expense e. Taxes Expense f. Taxes Payable 9. Trucks h. Unearned Revenue i. Unearned Subscriptions 1. Unearned Ticket Revenue k. Utilities Expense 1 Utilities Payable Following are the transactions of Green Company May 1 The company billed a customer $2,500 in consulting revenue for sustainable proposals. 3 The company purchased $550 of energy efficient supplies on credit. 9 The company collected $1,5ee cash as partial payment of May 1 consulting revenue. 20 The company paid $550 cash toward the payable for energy efficient supplies 31 The company paid $350 cash for May's renewable energy utilities. Prepare general journal entries for the above transactions. View transaction list Journal entry worksheet The company billed a customer $2,500 in consulting revenue for sustainable proposals. Note: Enter debits before credits Date General Journal Debit Credit May 01 Record entry Clear entry View general journal