Answered step by step

Verified Expert Solution

Question

1 Approved Answer

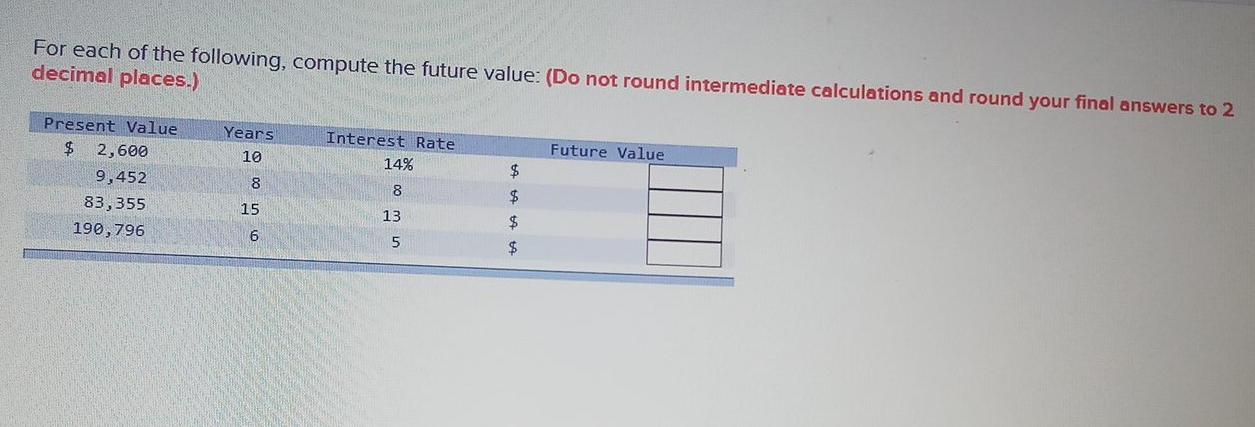

For each of the following, compute the future value: (Do not round intermediate calculations and round your final answers to 2 decimal places.) Years Interest

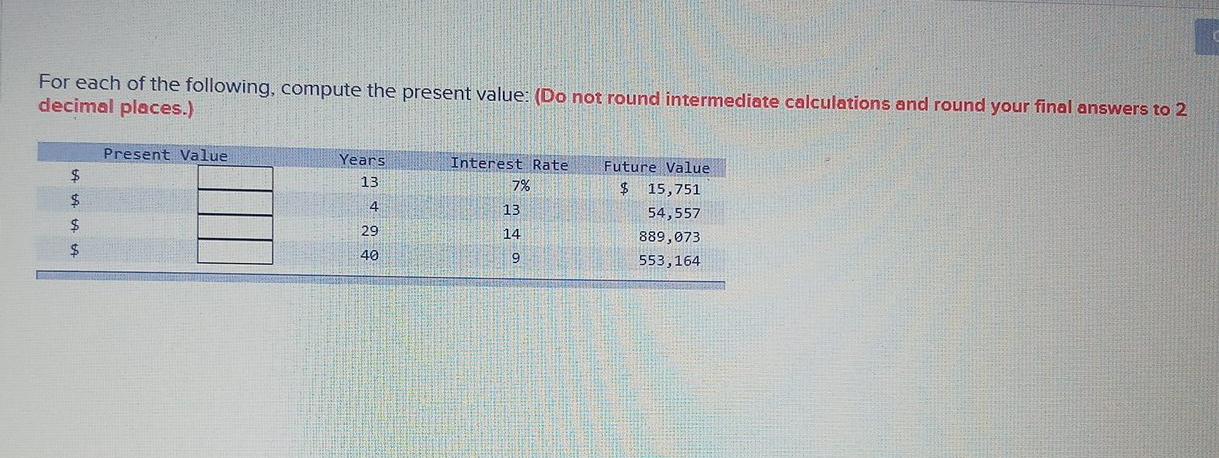

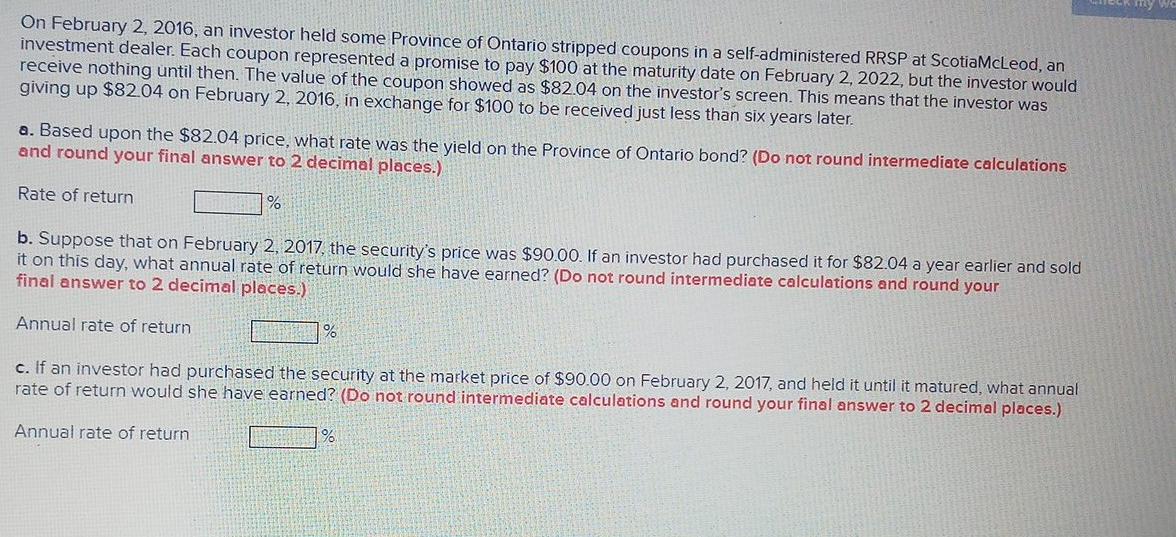

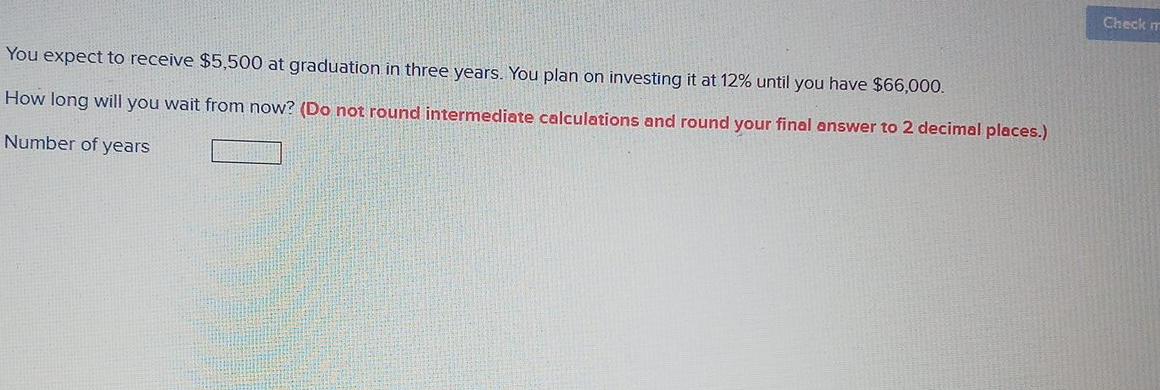

For each of the following, compute the future value: (Do not round intermediate calculations and round your final answers to 2 decimal places.) Years Interest Rate 14% Future Value 10 Present Value $ 2,600 9,452 83,355 190,796 $ 8 8 $ 15 13 $ 6 5 $ For each of the following, compute the present value: (Do not round intermediate calculations and round your final answers to 2 decimal places.) Present Value Years 13 Interest Rate 7% 4 $ $ $ $ 13 Future Value $ 15,751 54,557 889,073 553, 164 29 14 40 9 On February 2, 2016, an investor held some Province of Ontario stripped coupons in a self-administered RRSP at ScotiaMcLeod, an investment dealer. Each coupon represented a promise to pay $100 at the maturity date on February 2, 2022, but the investor would receive nothing until then. The value of the coupon showed as $82.04 on the investor's screen. This means that the investor was giving up $8204 on February 2, 2016, in exchange for $100 to be received just less than six years later. a. Based upon the $82.04 price, what rate was the yield on the Province of Ontario bond? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Rate of return % b. Suppose that on February 2, 2017, the security's price was $90.00. If an investor had purchased it for $82.04 a year earlier and sold it on this day, what annual rate of return would she have earned? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Annual rate of return 1% c. If an investor had purchased the security at the market price of $90.00 on February 2, 2017, and held it until it matured, what annual rate of return would she have earned? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Annual rate of return % Check IT You expect to receive $5,500 at graduation in three years. You plan on investing it at 12% until you have $66,000. How long will you wait from now? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Number of years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started