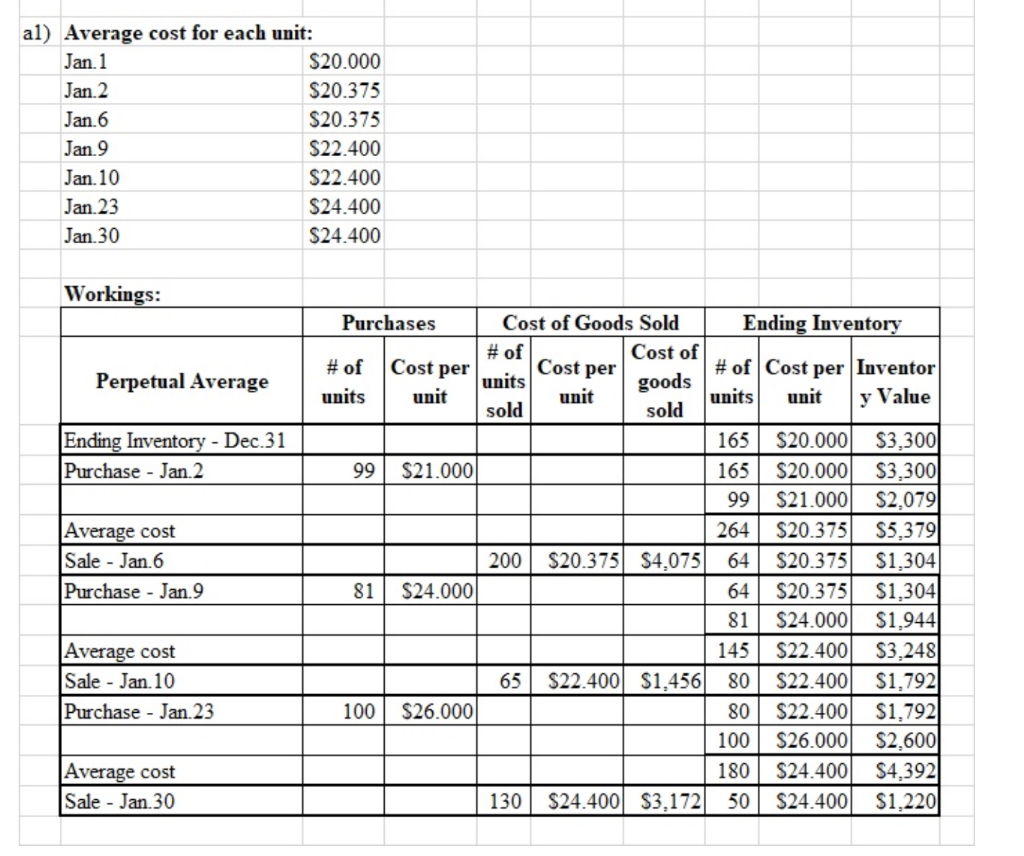

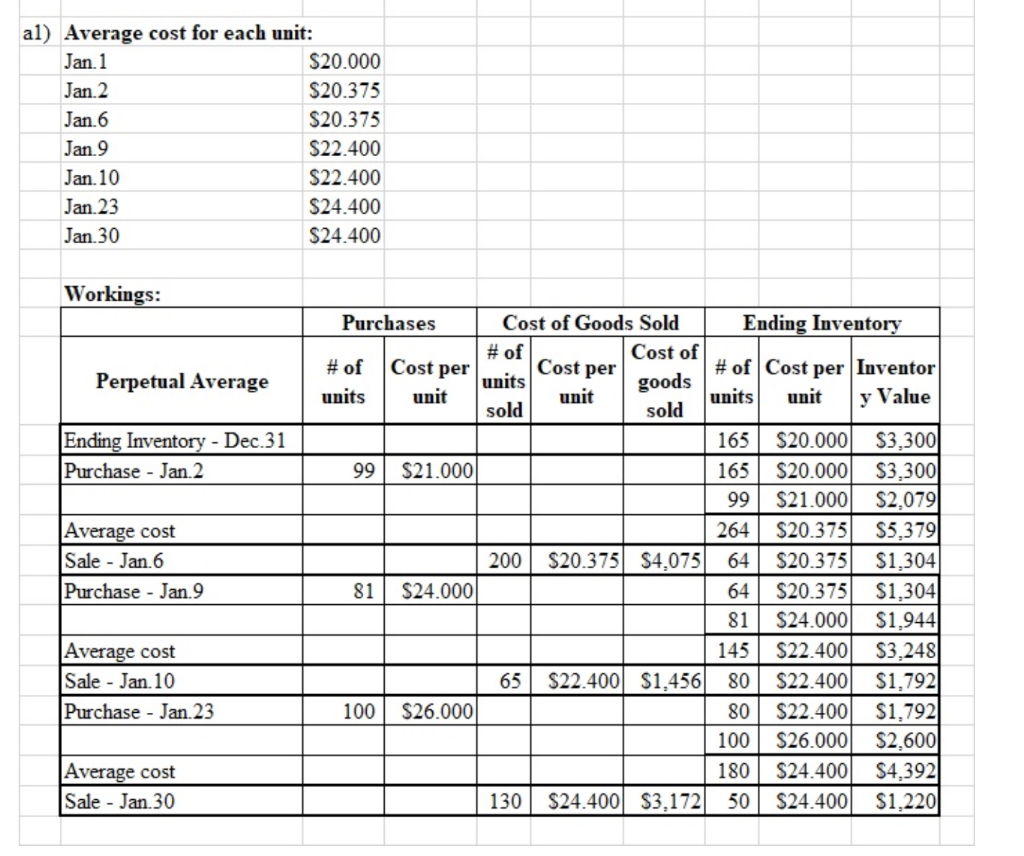

For each of the following cost flow assumptions, calculate (i) cost of goods sold, (ii) ending inventory, and (iii) gross profit. (Round answers to O decimal places, e.g. 125.) (1) LIFO. (2) FIFO. (3) Moving-average. LIFO FIFO Moving-average Cost of goods sold $ " Ending inventory $ " Gross profit A A $ al) Average cost for each unit: Jan. 1 $20.000 Jan.2 $20.375 Jan. 6 $20.375 Jan. 9 $22.400 Jan. 10 $22.400 Jan. 23 $24.400 Jan 30 $24.400 Workings: Purchases Cost per Cost of Goods Sold Ending Inventory # of Cost of Cost per # of Cost per Inventor units goods units unit y Value # of units Perpetual Average unit sold unit sold Ending Inventory - Dec.31 Purchase - Jan.2 99 $21.000 Average cost Sale - Jan. 6 Purchase - Jan. 9 200 81 $24.000 165 165 99 264 $20.375 $4,075 64 64 81 145 $22.400 $1,456 80 80 100 | 180 $24.400 $3,17250 $20.000 $20.000 $21.000 $20.375 $20.375 $20.375 $24.000 $22.400 $22.400 $22.400 $26.000 $24.400 $24.400 $3,300 $3,300 $2,079 $5,379 $1,304 $1,304 $1,944 $3,248 $1,792 $1,792 $2,600 $4,392 $1,220 Average cost Sale - Jan. 10 Purchase - Jan. 23 65 100 $26.000 Average cost Sale - Jan 30 | 130 For each of the following cost flow assumptions, calculate (i) cost of goods sold, (ii) ending inventory, and (iii) gross profit. (Round answers to O decimal places, e.g. 125.) (1) LIFO. (2) FIFO. (3) Moving-average. LIFO FIFO Moving-average Cost of goods sold $ " Ending inventory $ " Gross profit A A $ al) Average cost for each unit: Jan. 1 $20.000 Jan.2 $20.375 Jan. 6 $20.375 Jan. 9 $22.400 Jan. 10 $22.400 Jan. 23 $24.400 Jan 30 $24.400 Workings: Purchases Cost per Cost of Goods Sold Ending Inventory # of Cost of Cost per # of Cost per Inventor units goods units unit y Value # of units Perpetual Average unit sold unit sold Ending Inventory - Dec.31 Purchase - Jan.2 99 $21.000 Average cost Sale - Jan. 6 Purchase - Jan. 9 200 81 $24.000 165 165 99 264 $20.375 $4,075 64 64 81 145 $22.400 $1,456 80 80 100 | 180 $24.400 $3,17250 $20.000 $20.000 $21.000 $20.375 $20.375 $20.375 $24.000 $22.400 $22.400 $22.400 $26.000 $24.400 $24.400 $3,300 $3,300 $2,079 $5,379 $1,304 $1,304 $1,944 $3,248 $1,792 $1,792 $2,600 $4,392 $1,220 Average cost Sale - Jan. 10 Purchase - Jan. 23 65 100 $26.000 Average cost Sale - Jan 30 | 130