Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following four statements, indicate whether the given statement is true, false, or uncertain. You will need to provide an explanation for

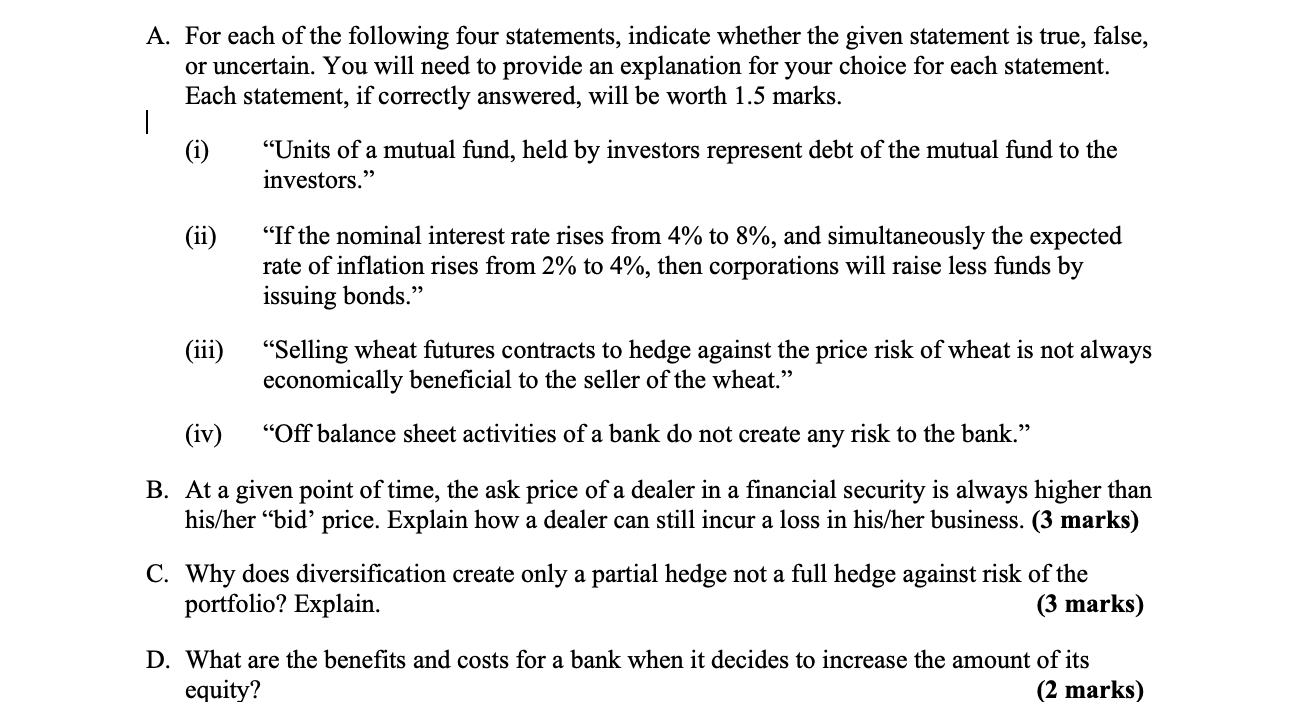

- For each of the following four statements, indicate whether the given statement is true, false, or uncertain. You will need to provide an explanation for your choice for each statement. Each statement, if correctly answered, will be worth 1.5 marks.

- Units of a mutual fund, held by investors represent debt of the mutual fund to the investors.

- If the nominal interest rate rises from 4% to 8%, and simultaneously the expected rate of inflation rises from 2% to 4%, then corporations will raise less funds by issuing bonds.

- Selling wheat futures contracts to hedge against the price risk of wheat is not always economically beneficial to the seller of the wheat.

- Off balance sheet activities of a bank do not create any risk to the bank. B. At a given point of time, the ask price of a dealer in a financial security is always higher than his/her bid price. Explain how a dealer can still incur a loss in his/her business. (3 marks C. Why does diversification create only a partial hedge not a full hedge against risk of the portfolio? Explain. (3 marks D. What are the benefits and costs for a bank when it decides to increase the amount of its equity? (2 marks)

PLEASE answer in an ELABORATED FORM AND please show FORMULAS too. Appreciate it THANK YOU SO MUCH !

A. For each of the following four statements, indicate whether the given statement is true, false, or uncertain. You will need to provide an explanation for your choice for each statement. Each statement, if correctly answered, will be worth 1.5 marks. (i) Units of a mutual fund, held by investors represent debt of the mutual fund to the investors. (ii) If the nominal interest rate rises from 4% to 8%, and simultaneously the expected rate of inflation rises from 2% to 4%, then corporations will raise less funds by issuing bonds. (iii) Selling wheat futures contracts to hedge against the price risk of wheat is not always economically beneficial to the seller of the wheat. (iv) Off balance sheet activities of a bank do not create any risk to the bank." B. At a given point of time, the ask price of a dealer in a financial security is always higher than his/her bid' price. Explain how a dealer can still incur a loss in his/her business. (3 marks) C. Why does diversification create only a partial hedge not a full hedge against risk of the portfolio? Explain. (3 marks) D. What are the benefits and costs for a bank when it decides to increase the amount of its equity? (2 marks) A. For each of the following four statements, indicate whether the given statement is true, false, or uncertain. You will need to provide an explanation for your choice for each statement. Each statement, if correctly answered, will be worth 1.5 marks. (i) Units of a mutual fund, held by investors represent debt of the mutual fund to the investors. (ii) If the nominal interest rate rises from 4% to 8%, and simultaneously the expected rate of inflation rises from 2% to 4%, then corporations will raise less funds by issuing bonds. (iii) Selling wheat futures contracts to hedge against the price risk of wheat is not always economically beneficial to the seller of the wheat. (iv) Off balance sheet activities of a bank do not create any risk to the bank." B. At a given point of time, the ask price of a dealer in a financial security is always higher than his/her bid' price. Explain how a dealer can still incur a loss in his/her business. (3 marks) C. Why does diversification create only a partial hedge not a full hedge against risk of the portfolio? Explain. (3 marks) D. What are the benefits and costs for a bank when it decides to increase the amount of its equity? (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started