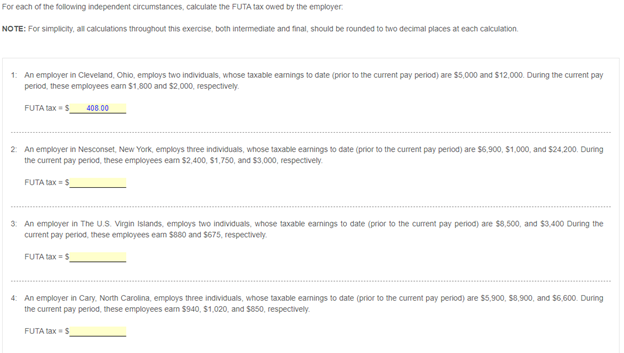

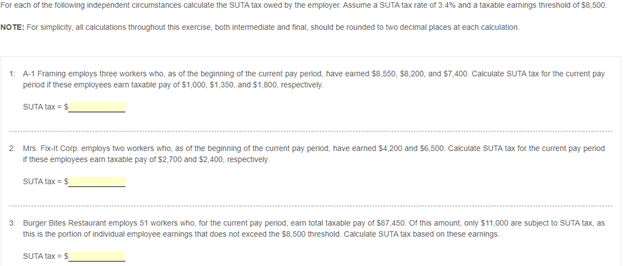

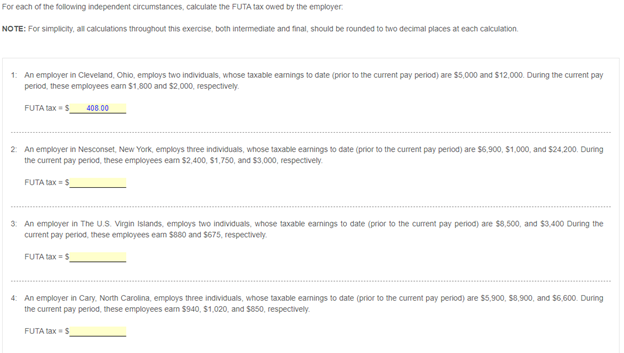

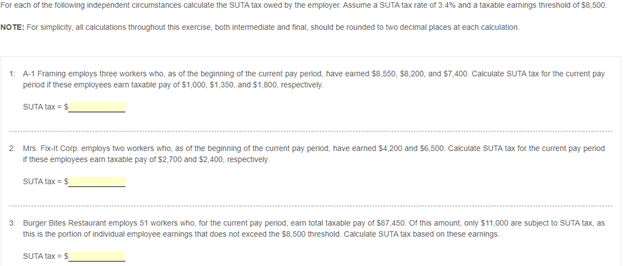

For each of the following independent circumstances, calculate the FUTA tax owed by the employer NOTE: For simplicity, al calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each cakulation 1 An employer in Cleveland, Ohio, employs two individuals whose taxable earnings to date (prior to the current pay period) are $5,000 and $12,000. During the current pay period, these employees earn $1,800 and $2,000, respectively FUTA tax = 5 408.00 2. An employer in Nesconset, New York, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,900, $1.000 and $24 200. During the current pay period, these employees eam $2,400, 51,750, and $3,000, respectively FUTAX 3. An employer In The U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $8,500, and $3,400 During the current pay period, these employees eam 5880 and 5675, respectively FUTA tax = 5 4 An employer in Cary, North Carolina, employs three individuals whose taxable earnings to date (prior to the current pay period) are 55,900, 58,900, and $6,600. During the current pay period, these employees eam $940, 51,020 and $850, respectively FUTA taxs For each of the following independent circumstances calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a tacable eamings threshold of $8,500 NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: A-1 Framing employs three workers who, as of the beginning of the current pay period, have earned $8,550, S8,200, and 87,400. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $1,000, 51,350, and $1,800, respectively SUTA tax 5 2: Mrs. Folt Corp. employs two workers who, as of the beginning of the current pay period, have eamed 54 200 and $6,500. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $2.700 and $2,400, respectively, SUTA ax = $ 3: Burger Bites Restaurant employs 51 workers who, for the current pay period, eam total tacable pay of $87,450. Of this amount only $11,000 are subject to SUTA tax, as this is the portion of individual employee earnings that does not exceed the $8,500 threshold. Calculate SUTA tax based on these earnings SUTA tax For each of the following independent circumstances, calculate the FUTA tax owed by the employer NOTE: For simplicity, al calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each cakulation 1 An employer in Cleveland, Ohio, employs two individuals whose taxable earnings to date (prior to the current pay period) are $5,000 and $12,000. During the current pay period, these employees earn $1,800 and $2,000, respectively FUTA tax = 5 408.00 2. An employer in Nesconset, New York, employs three individuals, whose taxable earnings to date (prior to the current pay period) are $6,900, $1.000 and $24 200. During the current pay period, these employees eam $2,400, 51,750, and $3,000, respectively FUTAX 3. An employer In The U.S. Virgin Islands, employs two individuals, whose taxable earnings to date (prior to the current pay period) are $8,500, and $3,400 During the current pay period, these employees eam 5880 and 5675, respectively FUTA tax = 5 4 An employer in Cary, North Carolina, employs three individuals whose taxable earnings to date (prior to the current pay period) are 55,900, 58,900, and $6,600. During the current pay period, these employees eam $940, 51,020 and $850, respectively FUTA taxs For each of the following independent circumstances calculate the SUTA tax owed by the employer. Assume a SUTA tax rate of 3.4% and a tacable eamings threshold of $8,500 NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation 1: A-1 Framing employs three workers who, as of the beginning of the current pay period, have earned $8,550, S8,200, and 87,400. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $1,000, 51,350, and $1,800, respectively SUTA tax 5 2: Mrs. Folt Corp. employs two workers who, as of the beginning of the current pay period, have eamed 54 200 and $6,500. Calculate SUTA tax for the current pay period if these employees eam taxable pay of $2.700 and $2,400, respectively, SUTA ax = $ 3: Burger Bites Restaurant employs 51 workers who, for the current pay period, eam total tacable pay of $87,450. Of this amount only $11,000 are subject to SUTA tax, as this is the portion of individual employee earnings that does not exceed the $8,500 threshold. Calculate SUTA tax based on these earnings SUTA tax