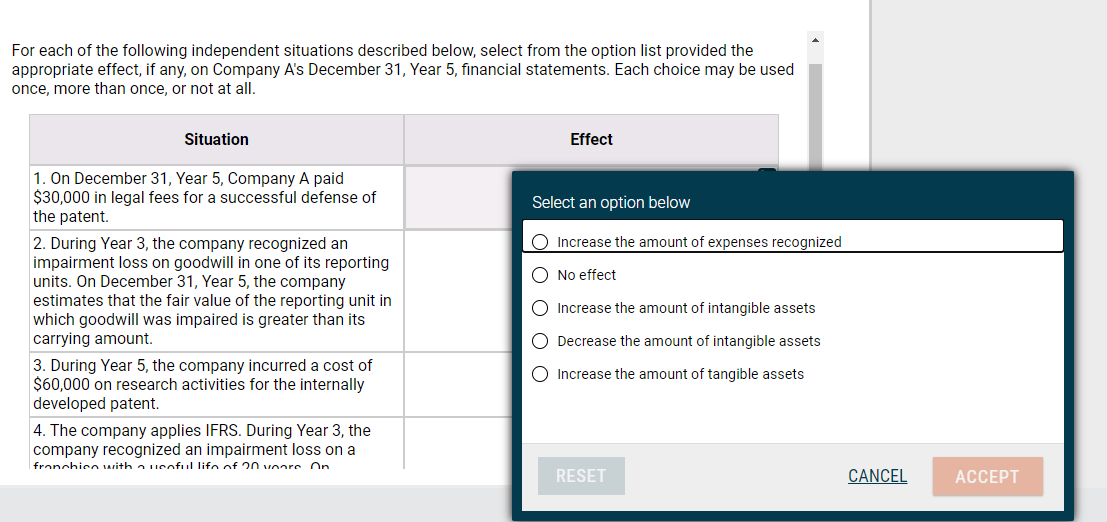

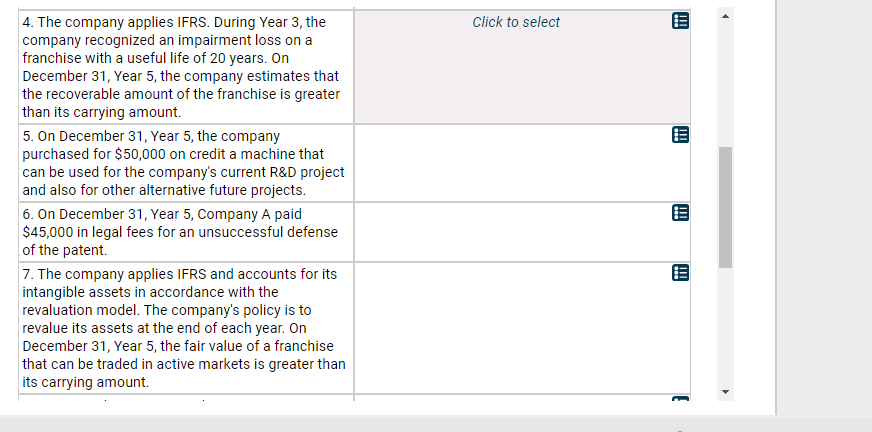

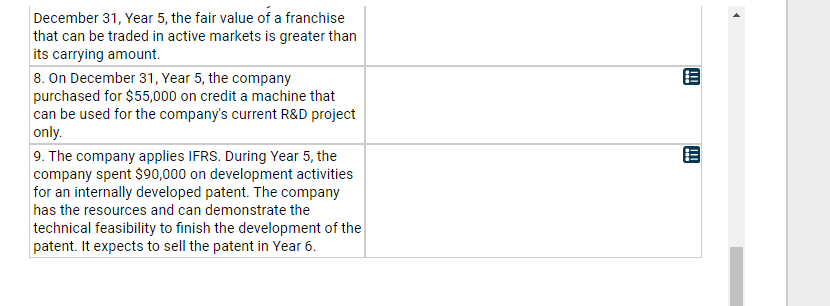

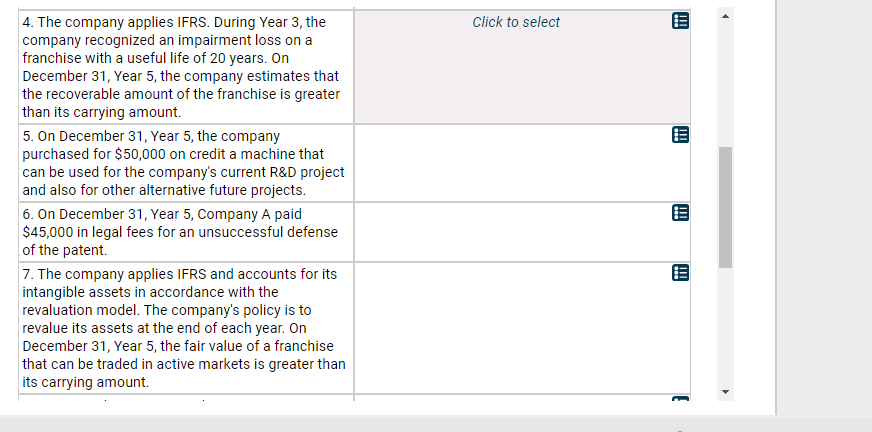

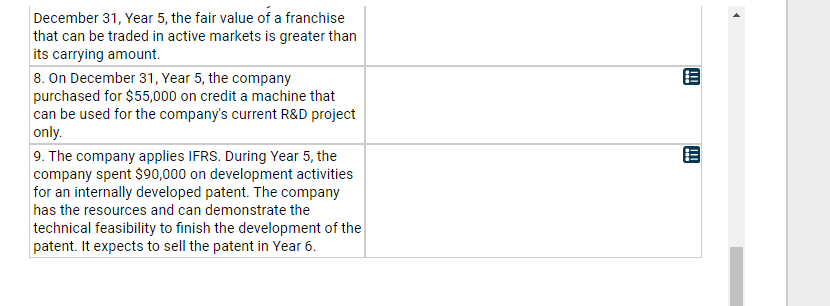

For each of the following independent situations described below, select from the option list provided the appropriate effect, if any, on Company A's December 31, Year 5, financial statements. Each choice may be used once, more than once, or not at all. Situation Effect Select an option below Increase the amount of expenses recognized O No effect O Increase the amount of intangible assets 1. On December 31, Year 5, Company A paid $30,000 in legal fees for a successful defense of the patent 2. During Year 3, the company recognized an impairment loss on goodwill in one of its reporting units. On December 31, Year 5, the company estimates that the fair value of the reporting unit in which goodwill was impaired is greater than its carrying amount. 3. During Year 5, the company incurred a cost of $60,000 on research activities for the internally developed patent. 4. The company applies IFRS. During Year 3, the company recognized an impairment loss on a franchien with a licnful life of an vnare nn O Decrease the amount of intangible assets Increase the amount of tangible assets RESET CANCEL ACCEPT Click to select 110 ..! 4. The company applies IFRS. During Year 3, the company recognized an impairment loss on a franchise with a useful life of 20 years. On December 31, Year 5, the company estimates that the recoverable amount of the franchise is greater than its carrying amount 5. On December 31, Year 5, the company purchased for $50,000 on credit a machine that can be used for the company's current R&D project and also for other alternative future projects. 6. On December 31, Year 5, Company A paid $45,000 in legal fees for an unsuccessful defense of the patent 7. The company applies IFRS and accounts for its intangible assets in accordance with the revaluation model. The company's policy is to revalue its assets at the end of each year. On December 31, Year 5, the fair value of a franchise that can be traded in active markets is greater than its carrying amount ...! ] December 31, Year 5, the fair value of a franchise that can be traded in active markets is greater than its carrying amount 8. On December 31, Year 5, the company purchased for $55,000 on credit a machine that can be used for the company's current R&D project only. 9. The company applies IFRS. During Year 5, the company spent $90,000 on development activities for an internally developed patent. The company has the resources and can demonstrate the technical feasibility to finish the development of the patent. It expects to sell the patent in Year 6