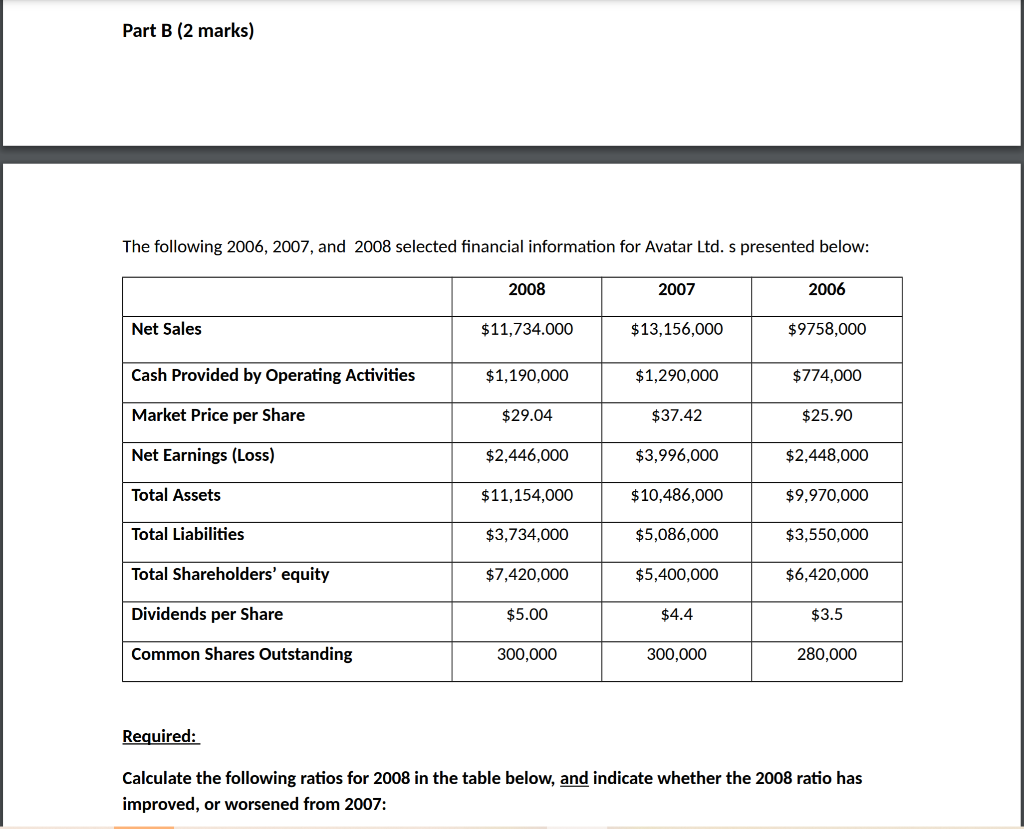

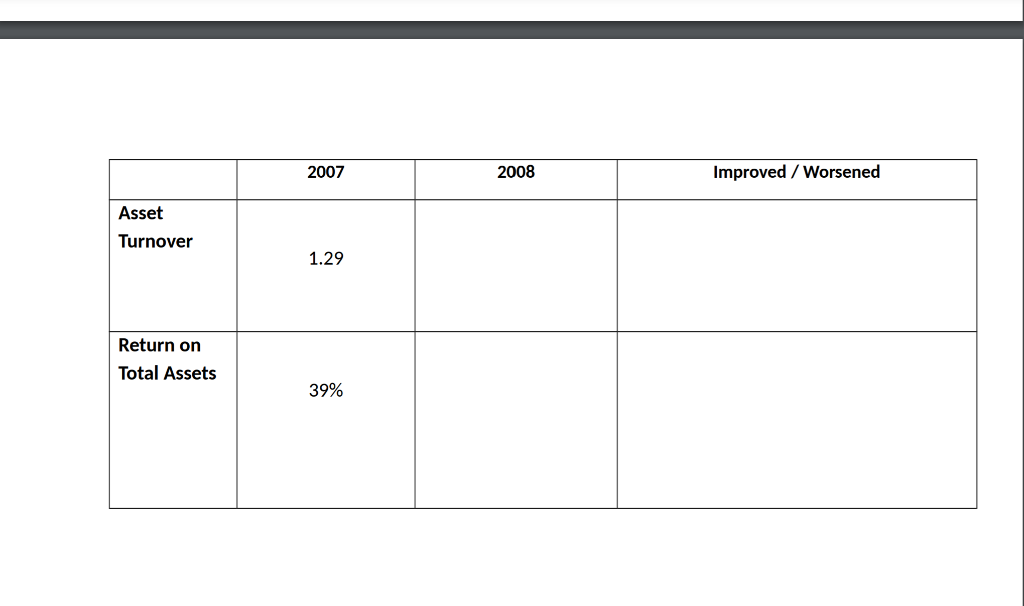

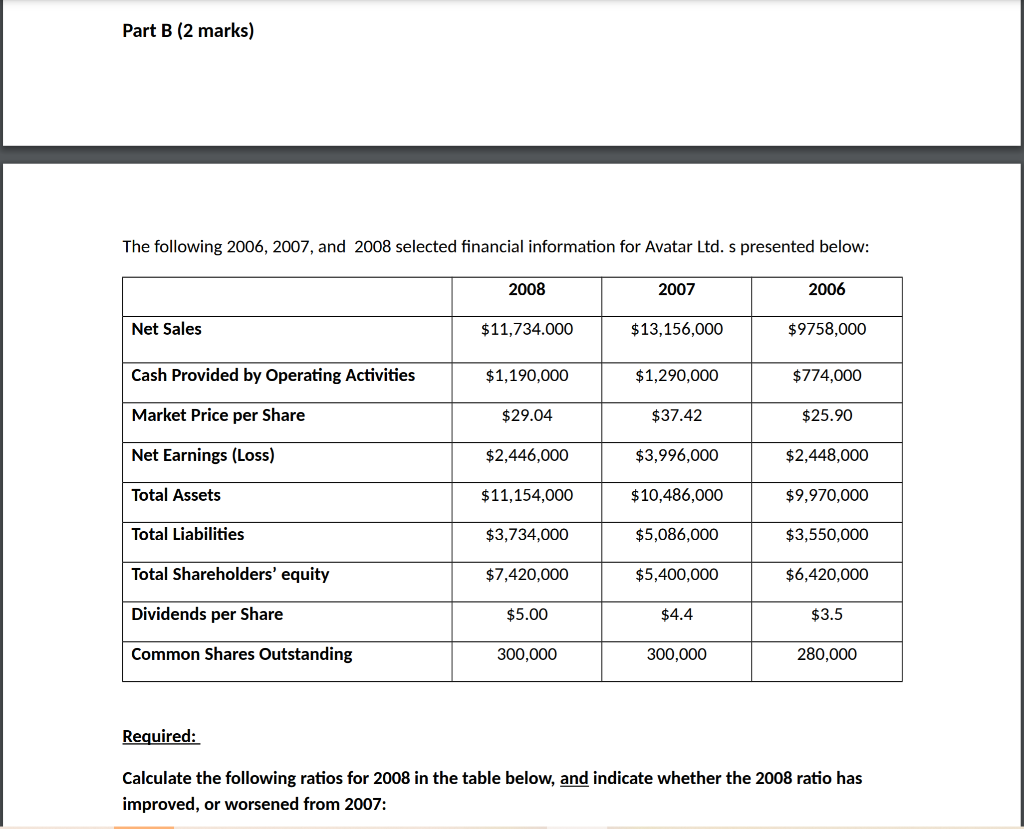

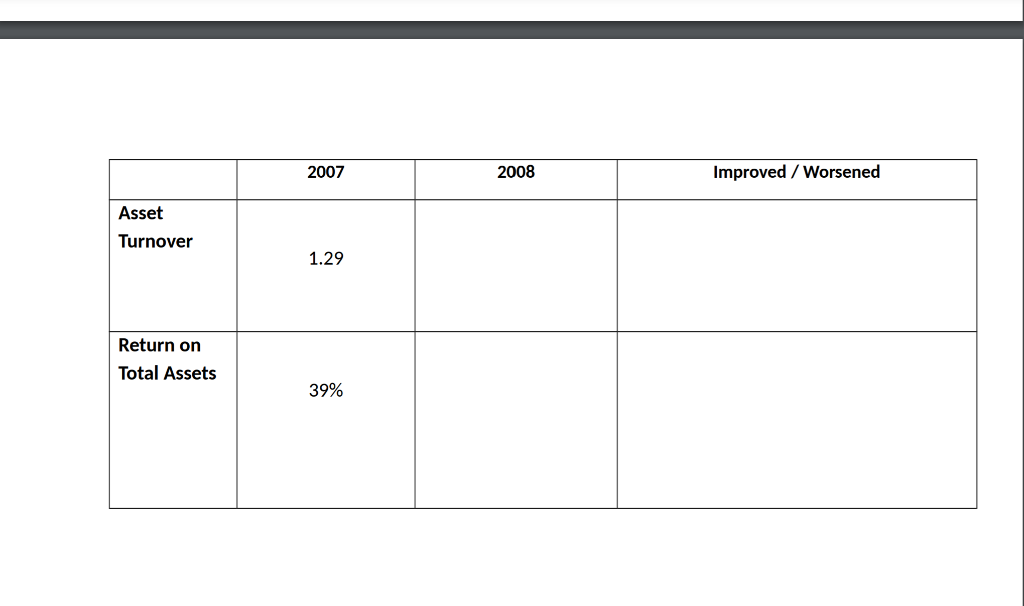

For each of the following independent situations listed below, identify whether the internal controls are strong or weak and provide a concise explanation to your answer. Write your answers in the table provided on the next page: Situation 1: Cascade Construction Ltd., operating in Calgary, has a policy requiring all construction supervisors to fill out a purchase requisition to order any equipment needed for their construction jobs. The purchase requisition is to be sent directly to the Head Office for approval. Head Office is responsible to purchase the requested equipment from the appropriate vendor and instruct the vendor to ship the equipment directly to the construction site. Situation 2: All cash received by mail at Niagara Wineries Ltd is sent directly to the accountant, who has been working at Niagara for over 25 years. The accountant prepares a journal entry debiting Cash and crediting Accounts Receivable and then deposits the cash in the bank. Situation 3 At a recent management meeting, project supervisors at Amazon Construction Ltd. expressed serious concerns about delays in receiving equipment from the vendors. In many instances, this has resulted in construction projects being completed 60 days later than scheduled. As such, Amazon Construction Ltd. now has a policy allowing project supervisors to directly purchase equipment needed for their jobs. The supervisors are required to submit the paid invoices to Amazon's head office for reimbursement. Part B (2 marks) The following 2006, 2007, and 2008 selected financial information for Avatar Ltd. s presented below: 2008 2007 2006 Net Sales $11,734.000 $13,156,000 $9758,000 Cash Provided by Operating Activities $1,190,000 $1,290,000 $774,000 Market Price per Share $29.04 $37.42 $25.90 Net Earnings (Loss) $2,446,000 $3,996,000 $2,448,000 Total Assets $11,154,000 $10,486,000 $9,970,000 Total Liabilities $3,734,000 $5,086,000 $3,550,000 Total Shareholders' equity $7,420,000 $5,400,000 $6,420,000 Dividends per Share $5.00 $4.4 $3.5 Common Shares Outstanding 300,000 300,000 280,000 Required: Calculate the following ratios for 2008 in the table below, and indicate whether the 2008 ratio has improved, or worsened from 2007: 2007 2008 Improved / Worsened Asset Turnover 1.29 Return on Total Assets 39%