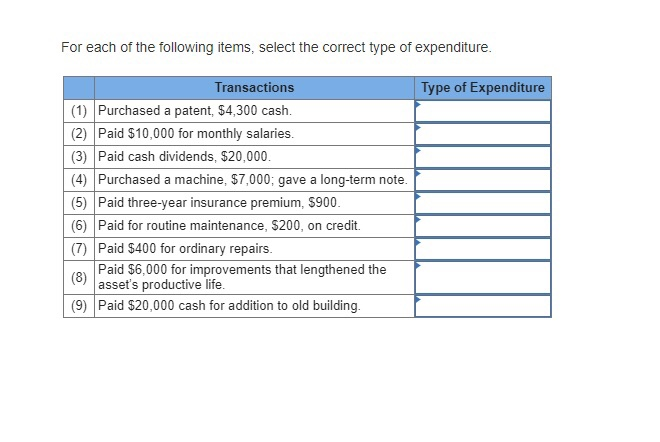

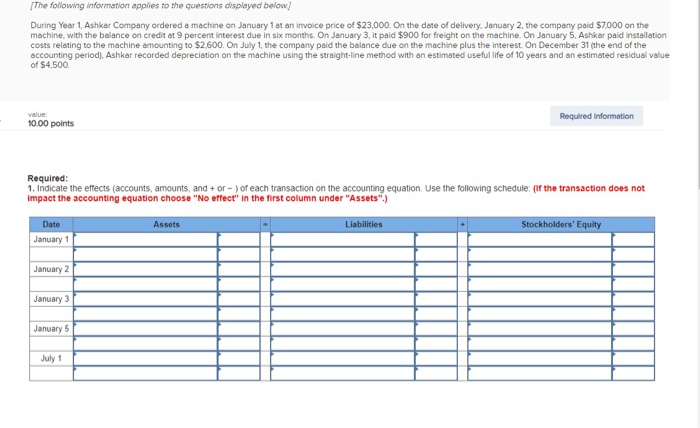

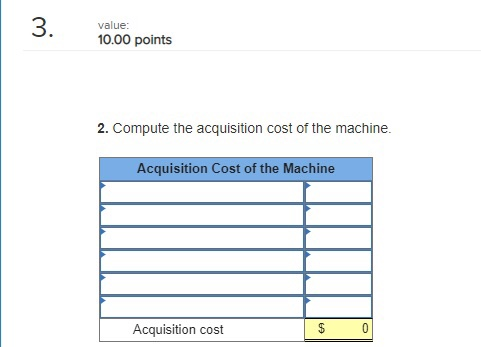

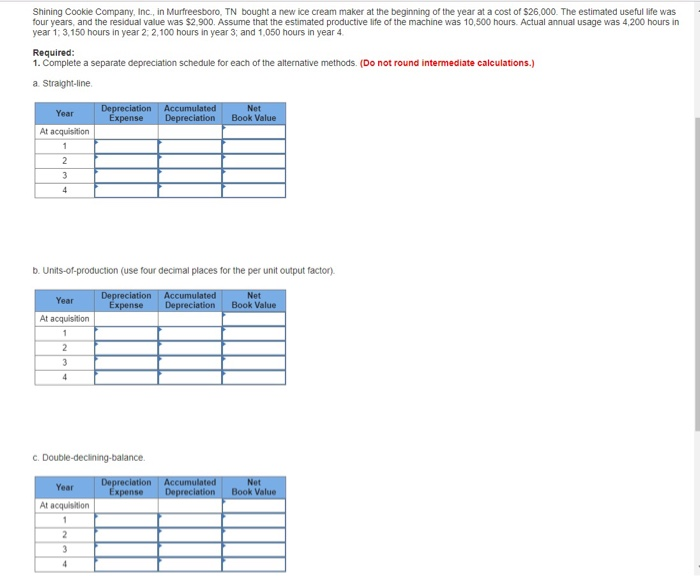

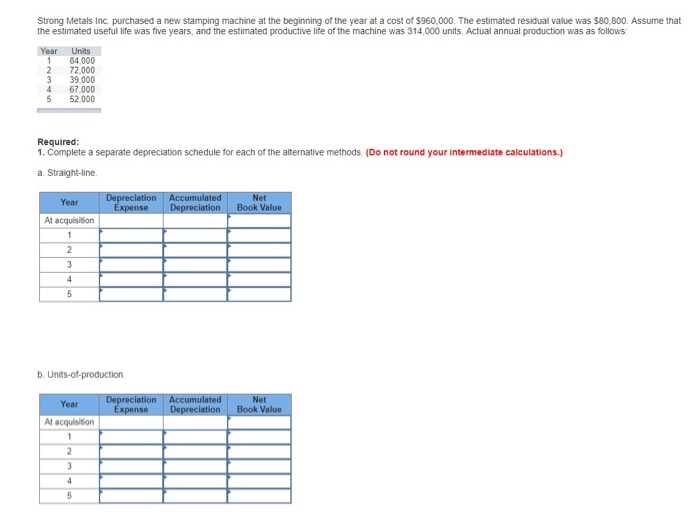

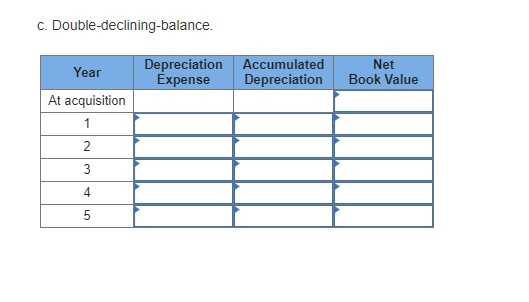

For each of the following items, select the correct type of expenditure. Transactions Type of Expenditure (1) Purchased a patent, $4,300 cash (2) Paid $10,000 for monthly salaries. (3) Paid cash dividends, $20,000 (4) Purchased a machine, $7,000; gave a long-term note. (5) Paid three-year insurance premium, $900 (6) Paid for routine maintenance, $200, on credit. (7) Paid $400 for ordinary repairs. Paid $6,000 for improvements that lengthened the (8) asset's productive life. (9) Paid $20,000 cash for addition to old building. The following information applies to the questions displayed below During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $23,000. On the dete of delivery, January 2, the company paid $7000 on the machine, with the balance on credit at 9 percent interest due in six months. On January 3, it paid $900 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,600. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $4,500 value: Required information 10.00 points Required: 1. Indicate the effects (accounts, amounts, and + or -)of each transaction on the accounting equation. Use the following schedule: (If the transaction does not impact the accounting equation choose "No effect" in the first column under "Assets".) Date Assets Liabilities Stockholders' Equity January 1 January 2 January 3 January 5 July 1 3 value: 10.00 points 2. Compute the acquisition cost of the machine. Acquisition Cost of the Machine Acquisition cost Shining Cookie Company, Inc., in Murfreesboro, TN bought a new ice cream maker at the beginning of the year at a cost of $26,000. The estimated useful life was four years, and the residual value was $2,900. Assume that the estimated productive life of the machine was 10,500 hours. Actual annual usage was 4,200 hours in year 1; 3,150 hours in year 2, 2,100 hours in year 3, and 1,050 hours in year 4 Required: 1. Complete a separate depreciation schedule for each of the alternative methods. (Do not round intermediate calculations.) a Straight-line Accumulated Depreciation Depreciation xpense Net Book Value Year At acquisition 1 2 3 4 b. Units-of-production (use four decimal places for the per unit output factor). Depreciation xpense Accumulated Net Book Value Year Depreciation At acquisition 2 3 4 c. Double-declining-balance. Depreciation Accumulated xpense Net Book Value Year Depreciation At acquisition 1 2 3 Strong Metals Inc. purchased a new stamping machine at the beginning of the year at a cost of $960,000. The estimated residual value was $80,800. Assume that the estimated useful life was five years, and the estimated productive life of the machine was 314,000 units. Actual annual production was as follows: Year 1 2 Units 84.000 72,000 39.000 67.000 52,000 4 5 Required: 1. Complete a separate depreciation schedule for each of the alternative methods. (Do not round your intermediate calculations.) a. Straight-line. Accumulated Depreciation Depreciation xpense Net Book Value Year At acquisition 2 3 4 b. Units-of-production. Depreciation Expense Accumulated Net Book Value Year Depreciation At acquisition 1 2 3 4 c. Double-declining-balance. Depreciation Accumulated Expense Net Year Book Value Depreciation At acquisition 2 3 5