Question

For each of the following, select its usual cost classification in an absorption costing system. Miscellaneous factory supplies ( oils , ?lubricants, etc. ) Shipping

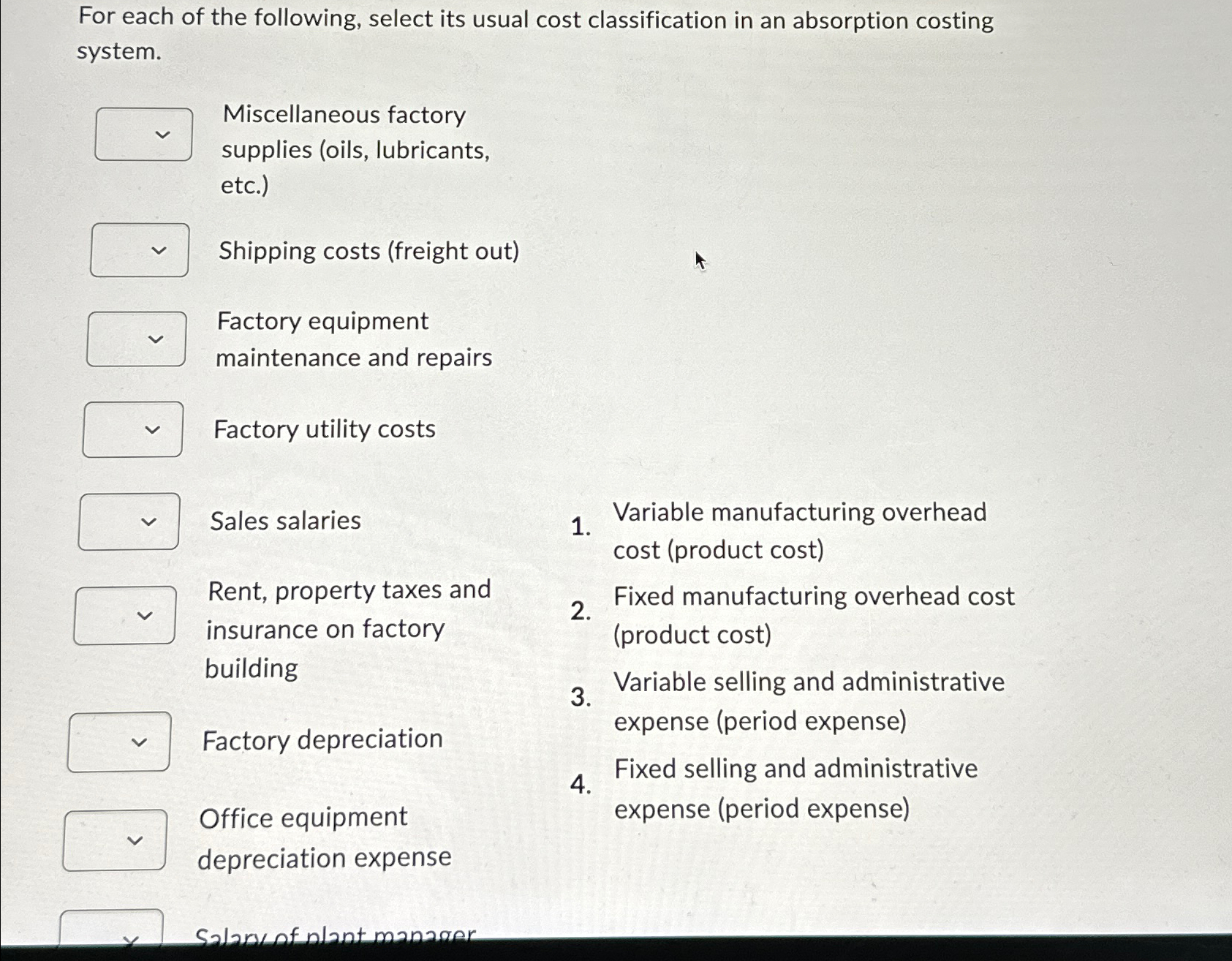

For each of the following, select its usual cost classification in an absorption costing system.

Miscellaneous factory supplies oils ?lubricants, etc. Shipping costs freight out Factory equipment maintenance and repairs Factory utility costs Sales salaries Variable manufacturing overhead cost product cost Rent, property taxes and Fixed manufacturing overhead cost insurance on factory product cost ?building Variable selling and administrative Factory depreciation expense period expense Office equipment Fixed selling and administrative expense period expense ?depreciation expense

For each of the following, select its usual cost classification in an absorption costing system. Miscellaneous factory supplies (oils, lubricants, etc.) Shipping costs (freight out) Factory equipment maintenance and repairs Factory utility costs Sales salaries 1. Variable manufacturing overhead cost (product cost) Rent, property taxes and 2. insurance on factory Fixed manufacturing overhead cost (product cost) building 3. Variable selling and administrative Factory depreciation expense (period expense) Fixed selling and administrative 4. Office equipment expense (period expense) depreciation expense Salary of plant manager

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Miscellaneous factory supplies oils lubricants etc These are materials used in the production process but are not directly part of the final product T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started