Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following situations, determine the amount of income (loss) that should be allocated to the S corporation shareholder. Enter the appropriate

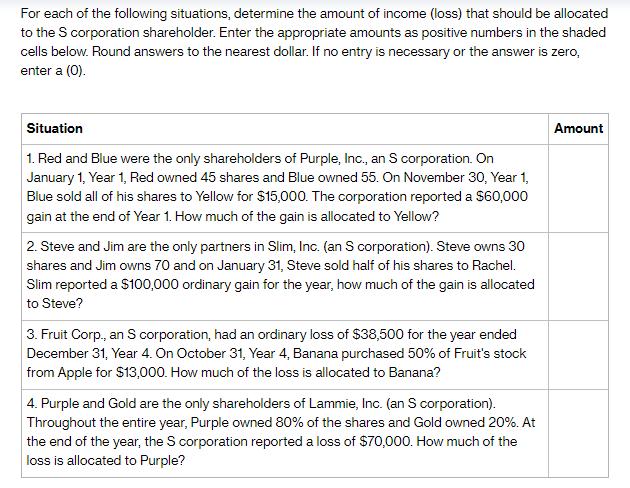

For each of the following situations, determine the amount of income (loss) that should be allocated to the S corporation shareholder. Enter the appropriate amounts as positive numbers in the shaded cells below. Round answers to the nearest dollar. If no entry is necessary or the answer is zero, enter a (0). Situation 1. Red and Blue were the only shareholders of Purple, Inc., an S corporation. On January 1, Year 1, Red owned 45 shares and Blue owned 55. On November 30, Year 1, Blue sold all of his shares to Yellow for $15,000. The corporation reported a $60,000 gain at the end of Year 1. How much of the gain is allocated to Yellow? 2. Steve and Jim are the only partners in Slim, Inc. (an S corporation). Steve owns 30 shares and Jim owns 70 and on January 31, Steve sold half of his shares to Rachel. Slim reported a $100,000 ordinary gain for the year, how much of the gain is allocated to Steve? 3. Fruit Corp., an S corporation, had an ordinary loss of $38,500 for the year ended December 31, Year 4. On October 31, Year 4, Banana purchased 50% of Fruit's stock from Apple for $13,000. How much of the loss is allocated to Banana? 4. Purple and Gold are the only shareholders of Lammie, Inc. (an S corporation). Throughout the entire year, Purple owned 80% of the shares and Gold owned 20%. At the end of the year, the S corporation reported a loss of $70,000. How much of the loss is allocated to Purple? Amount

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Yellow purchased Blues shares after the gain was reported so Yellow wouldnt be allocated any porti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started