Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net

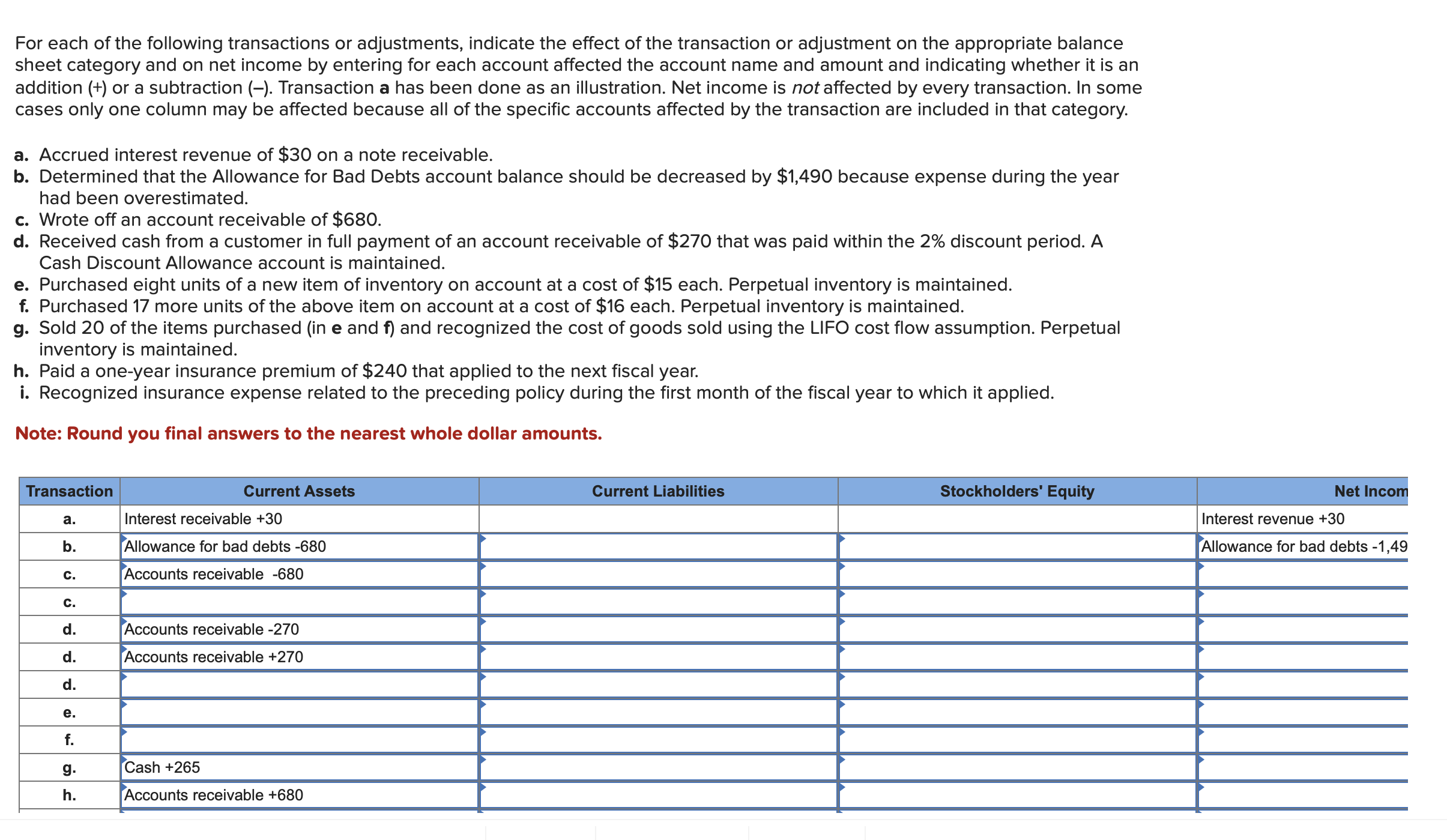

For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category. a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by $1,490 because expense during the year had been overestimated. c. Wrote off an account receivable of $680. d. Received cash from a customer in full payment of an account receivable of $270 that was paid within the 2% discount period. A Cash Discount Allowance account is maintained. e. Purchased eight units of a new item of inventory on account at a cost of $15 each. Perpetual inventory is maintained. f. Purchased 17 more units of the above item on account at a cost of $16 each. Perpetual inventory is maintained. g. Sold 20 of the items purchased (in e and f ) and recognized the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Paid a one-year insurance premium of $240 that applied to the next fiscal year. i. Recognized insurance expense related to the preceding policy during the first month of the fiscal year to which it applied. Note: Round you final answers to the nearest whole dollar amounts. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category. a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by $1,490 because expense during the year had been overestimated. c. Wrote off an account receivable of $680. d. Received cash from a customer in full payment of an account receivable of $270 that was paid within the 2% discount period. A Cash Discount Allowance account is maintained. e. Purchased eight units of a new item of inventory on account at a cost of $15 each. Perpetual inventory is maintained. f. Purchased 17 more units of the above item on account at a cost of $16 each. Perpetual inventory is maintained. g. Sold 20 of the items purchased (in e and f ) and recognized the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Paid a one-year insurance premium of $240 that applied to the next fiscal year. i. Recognized insurance expense related to the preceding policy during the first month of the fiscal year to which it applied. Note: Round you final answers to the nearest whole dollar amounts

For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category. a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by $1,490 because expense during the year had been overestimated. c. Wrote off an account receivable of $680. d. Received cash from a customer in full payment of an account receivable of $270 that was paid within the 2% discount period. A Cash Discount Allowance account is maintained. e. Purchased eight units of a new item of inventory on account at a cost of $15 each. Perpetual inventory is maintained. f. Purchased 17 more units of the above item on account at a cost of $16 each. Perpetual inventory is maintained. g. Sold 20 of the items purchased (in e and f ) and recognized the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Paid a one-year insurance premium of $240 that applied to the next fiscal year. i. Recognized insurance expense related to the preceding policy during the first month of the fiscal year to which it applied. Note: Round you final answers to the nearest whole dollar amounts. For each of the following transactions or adjustments, indicate the effect of the transaction or adjustment on the appropriate balance sheet category and on net income by entering for each account affected the account name and amount and indicating whether it is an addition (+) or a subtraction (-). Transaction a has been done as an illustration. Net income is not affected by every transaction. In some cases only one column may be affected because all of the specific accounts affected by the transaction are included in that category. a. Accrued interest revenue of $30 on a note receivable. b. Determined that the Allowance for Bad Debts account balance should be decreased by $1,490 because expense during the year had been overestimated. c. Wrote off an account receivable of $680. d. Received cash from a customer in full payment of an account receivable of $270 that was paid within the 2% discount period. A Cash Discount Allowance account is maintained. e. Purchased eight units of a new item of inventory on account at a cost of $15 each. Perpetual inventory is maintained. f. Purchased 17 more units of the above item on account at a cost of $16 each. Perpetual inventory is maintained. g. Sold 20 of the items purchased (in e and f ) and recognized the cost of goods sold using the LIFO cost flow assumption. Perpetual inventory is maintained. h. Paid a one-year insurance premium of $240 that applied to the next fiscal year. i. Recognized insurance expense related to the preceding policy during the first month of the fiscal year to which it applied. Note: Round you final answers to the nearest whole dollar amounts Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started