Answered step by step

Verified Expert Solution

Question

1 Approved Answer

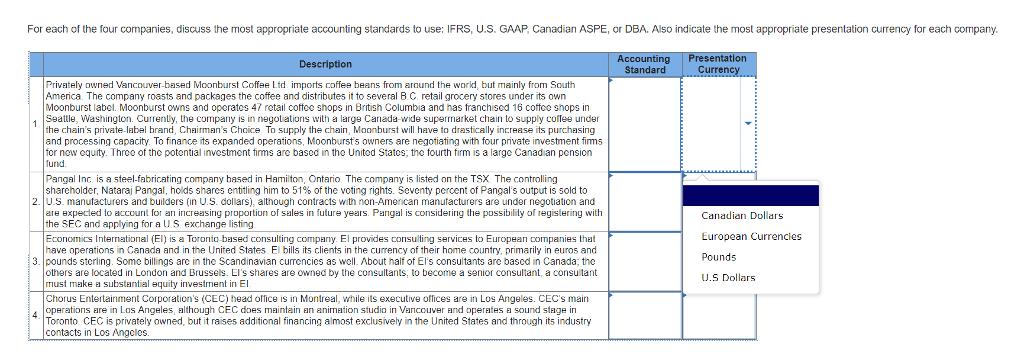

For each of the four companies, discuss the most appropriate accounting standards to use: IFRS, U.S. GAAP, Canadian ASPE, or DBA. Also indicate the

For each of the four companies, discuss the most appropriate accounting standards to use: IFRS, U.S. GAAP, Canadian ASPE, or DBA. Also indicate the most appropriate presentation currency for each company. Accounting Standard Presentation Currency Description 1 Privately owned Vancouver-based Moonburst Coffee Ltd imports coffee beans from around the world, but mainly from South America. The company roasts and packages the coffee and distributes it to several B C retail grocery stores under its own Moonburst label. Moonburst owns and operates 47 retail coffee shops in British Columbia and has franchised 16 coffee shops in Seattle, Washington. Currently, the company is in negotiations with a large Canada-wide supermarket chain to supply coffee under the chain's private-label brand, Chairman's Choice To supply the chain, Moonburst will have to drastically increase its purchasing and processing capacity. To finance its expanded operations, Moonburst's owners are negotiating with four private investment firms for new equity. Three of the potential investment firms are based in the United States, the fourth firm is a large Canadian pension fund Pangal Inc. is a steel-fabricating company based in Hamilton, Ontario. The company is listed on the TSX The controlling shareholder, Nataraj Pangal, holds shares entitling him to 51% of the voting rights. Seventy percent of Pangal's output is sold to 2. U.S. manufacturers and builders (in U.S. dollars), although contracts with non-American manufacturers are under negotiation and are expected to account for an increasing proportion of sales in future years. Pangal is considering the possibility of registering with the SEC and applying for a U.S. exchange listing Economics International (El) is a Toronto-based consulting company. El provides consulting services to European companies that have operations in Canada and in the United States. El bills its clients in the currency of their home country, primarily in euros and 3. pounds sterling. Some billings are in the Scandinavian currencies as well. About half of El's consultants are based in Canada; the others are located in London and Brussels. El's shares are owned by the consultants, to become a senior consultant, a consultant must make a substantial equity investment in El Chorus Entertainment Corporation's (CEC) head office is in Montreal, while its executive offices are in Los Angeles. CEC's main operations are in Los Angeles, although CEC does maintain an animation studio in Vancouver and operates a sound stage in Toronto CEC is privately owned, but it raises additional financing almost exclusively in the United States and through its industry contacts in Los Angeles. Canadian Dollars European Currencies Pounds U.S Dollars

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Company Accounting Standard Presentation Currency Moonburst Coffee Ltd IFRS Canadian Dollars Pangal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started