Answered step by step

Verified Expert Solution

Question

1 Approved Answer

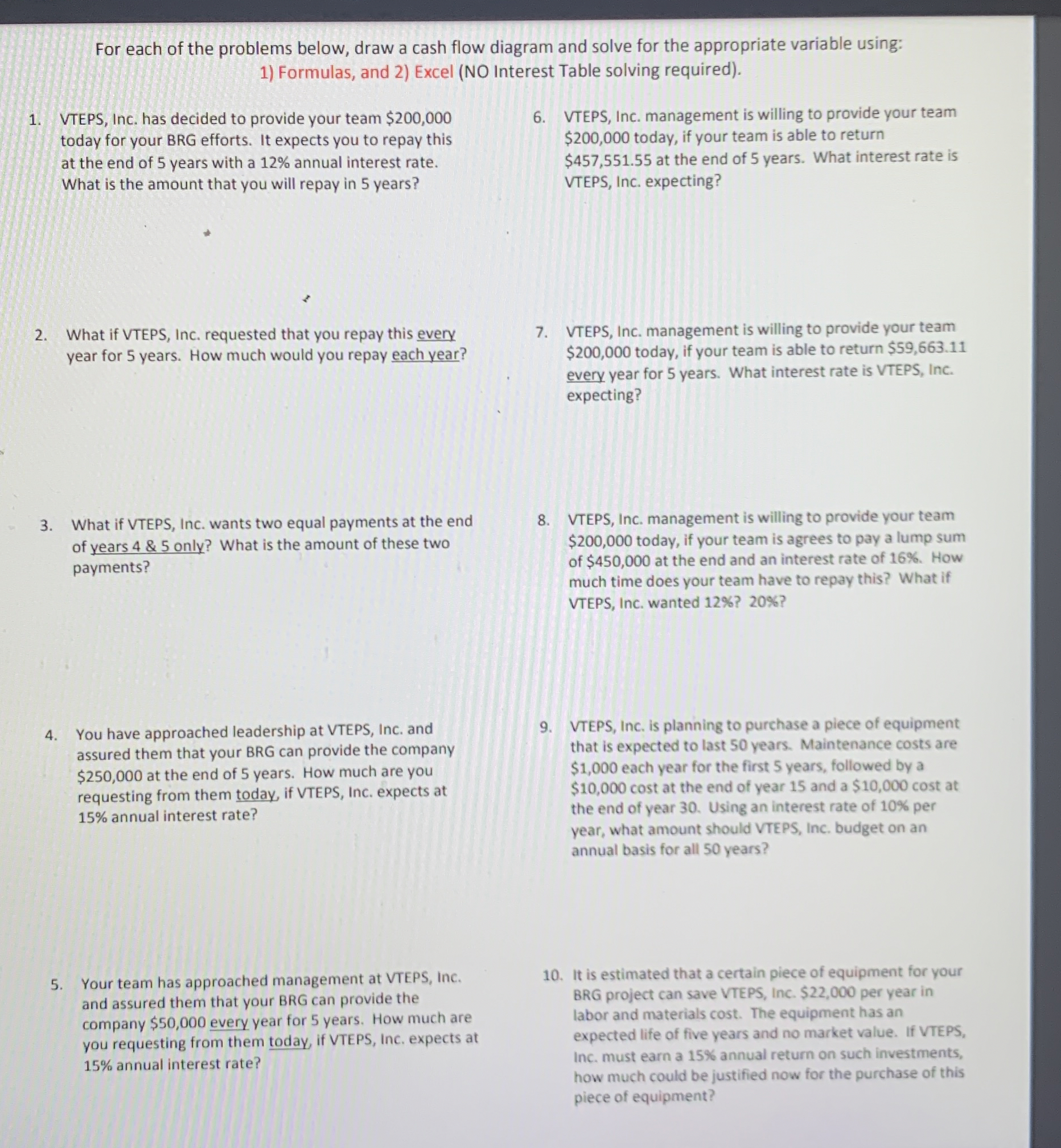

For each of the problems below, draw a cash flow diagram and solve for the appropriate variable using: Formulas, and 2 ) Excel ( NO

For each of the problems below, draw a cash flow diagram and solve for the appropriate variable using:

Formulas, and Excel NO Interest Table solving required

VTEPS, Inc. has decided to provide your team $ today for your BRG efforts. It expects you to repay this at the end of years with a annual interest rate. What is the amount that you will repay in years?

What if VTEPS, Inc. requested that you repay this every year for years. How much would you repay each year?

What if VTEPS, Inc. wants two equal payments at the end of years & only? What is the amount of these two payments?

You have approached leadership at VTEPS, Inc. and assured them that your BRG can provide the company $ at the end of years. How much are you requesting from them today, if VTEPS, Inc. expects at annual interest rate?

Your team has approached management at VTEPS, Inc. and assured them that your BRG can provide the company $ every year for years. How much are you requesting from them today, if VTEPS, Inc. expects at annual interest rate?

VTEPS, Inc. management is willing to provide your team $ today, if your team is able to return $ at the end of years. What interest rate is VTEPS, Inc. expecting?

VTEPS, Inc. management is willing to provide your team $ today, if your team is able to return $ every year for years. What interest rate is VTEPS, Inc. expecting?

VTEPS, Inc. management is willing to provide your team $ today, if your team is agrees to pay a lump sum of $ at the end and an interest rate of How much time does your team have to repay this? What if VTEPS, Inc. wanted

VTEPS, Inc. is planning to purchase a plece of equipment that is expected to last years. Maintenance costs are $ each year for the first $ years, followed by a $ cost at the end of year and a $ cost at the end of year Using an interest rate of per year, what amount should VTEPS, Inc. budget on an annual basis for all years?

It is estimated that a certain piece of equipment for your BRG project can save VTEPS, Inc. $ per year in labor and materials cost. The equipment has an expected life of five years and no market value. If VTEPS, Inc. must earn a annual return on such investments, how much could be justified now for the purchase of this piece of equipment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started