Answered step by step

Verified Expert Solution

Question

1 Approved Answer

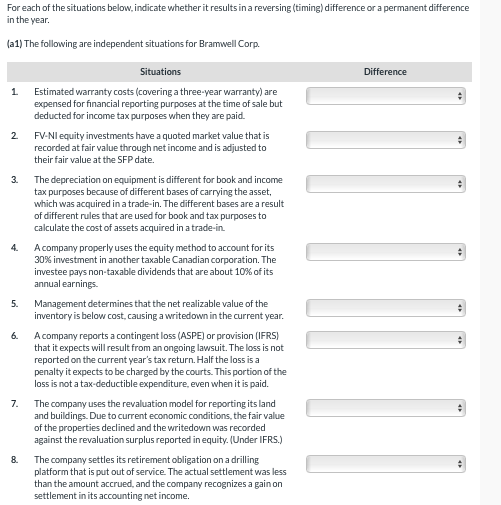

For each of the situations below, indicate whether it results in a reversing (timing) difference or a permanent difference in the year. (a1) The following

For each of the situations below, indicate whether it results in a reversing (timing) difference or a permanent difference in the year. (a1) The following are independent situations for Bramwell Corp. Situations Difference 1 Estimated warranty costs (covering a three-year warranty) are expensed for financial reporting purposes at the time of sale but deducted for income tax purposes when they are paid. 2. FV-NI equity investments have a quoted market value that is recorded at fair value through net income and is adjusted to their fair value at the SFP date. 3. The depreciation on equipment is different for book and income tax purposes because of different bases of carrying the asset, which was acquired in a trade-in. The different bases are a result of different rules that are used for book and tax purposes to calculate the cost of assets acquired in a trade-in. 4. A company properly uses the equity method to account for its 30% investment in another taxable Canadian corporation. The investee pays non-taxable dividends that are about 10% of its annual earnings. 5. Management determines that the net realizable value of the imventory is below cost, causing a writedown in the current year. 6. A company reports a contingent loss (ASPE) or provision (IFRS) that it expects will result from an ongoing lawsuit. The loss is not reported on the current year's tax return. Half the loss is a penalty it expects to be charged by the courts. This portion of the loss is not a tax-deductible expenditure, even when it is paid. 7. The company uses the revaluation model for reporting its land and buildings. Due to current economic conditions, the fair value of the properties declined and the writedown was recorded against the revaluation surplus reported in equity. (Under IFRS.) 8. The company settles its retirement obligation on a drilling platform that is put out of service. The actual settlement was less than the amount accrued, and the company recognizes a gain on settlement in its accounting net income

For each of the situations below, indicate whether it results in a reversing (timing) difference or a permanent difference in the year. (a1) The following are independent situations for Bramwell Corp. Situations Difference 1 Estimated warranty costs (covering a three-year warranty) are expensed for financial reporting purposes at the time of sale but deducted for income tax purposes when they are paid. 2. FV-NI equity investments have a quoted market value that is recorded at fair value through net income and is adjusted to their fair value at the SFP date. 3. The depreciation on equipment is different for book and income tax purposes because of different bases of carrying the asset, which was acquired in a trade-in. The different bases are a result of different rules that are used for book and tax purposes to calculate the cost of assets acquired in a trade-in. 4. A company properly uses the equity method to account for its 30% investment in another taxable Canadian corporation. The investee pays non-taxable dividends that are about 10% of its annual earnings. 5. Management determines that the net realizable value of the imventory is below cost, causing a writedown in the current year. 6. A company reports a contingent loss (ASPE) or provision (IFRS) that it expects will result from an ongoing lawsuit. The loss is not reported on the current year's tax return. Half the loss is a penalty it expects to be charged by the courts. This portion of the loss is not a tax-deductible expenditure, even when it is paid. 7. The company uses the revaluation model for reporting its land and buildings. Due to current economic conditions, the fair value of the properties declined and the writedown was recorded against the revaluation surplus reported in equity. (Under IFRS.) 8. The company settles its retirement obligation on a drilling platform that is put out of service. The actual settlement was less than the amount accrued, and the company recognizes a gain on settlement in its accounting net income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started