Question

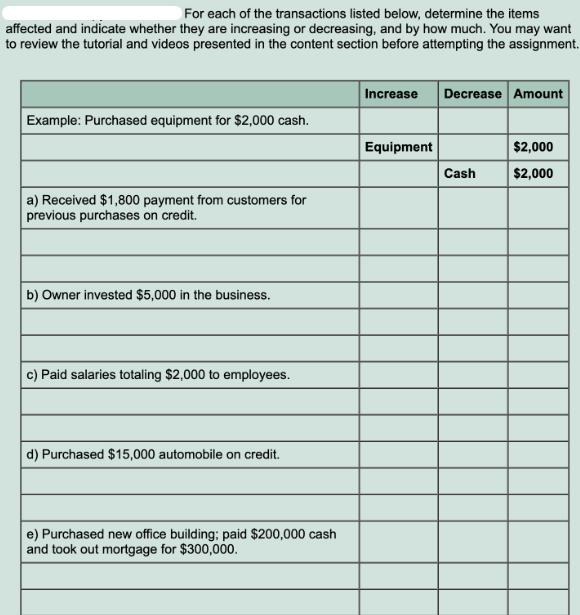

For each of the transactions listed below, determine the items affected and indicate whether they are increasing or decreasing, and by how much. You

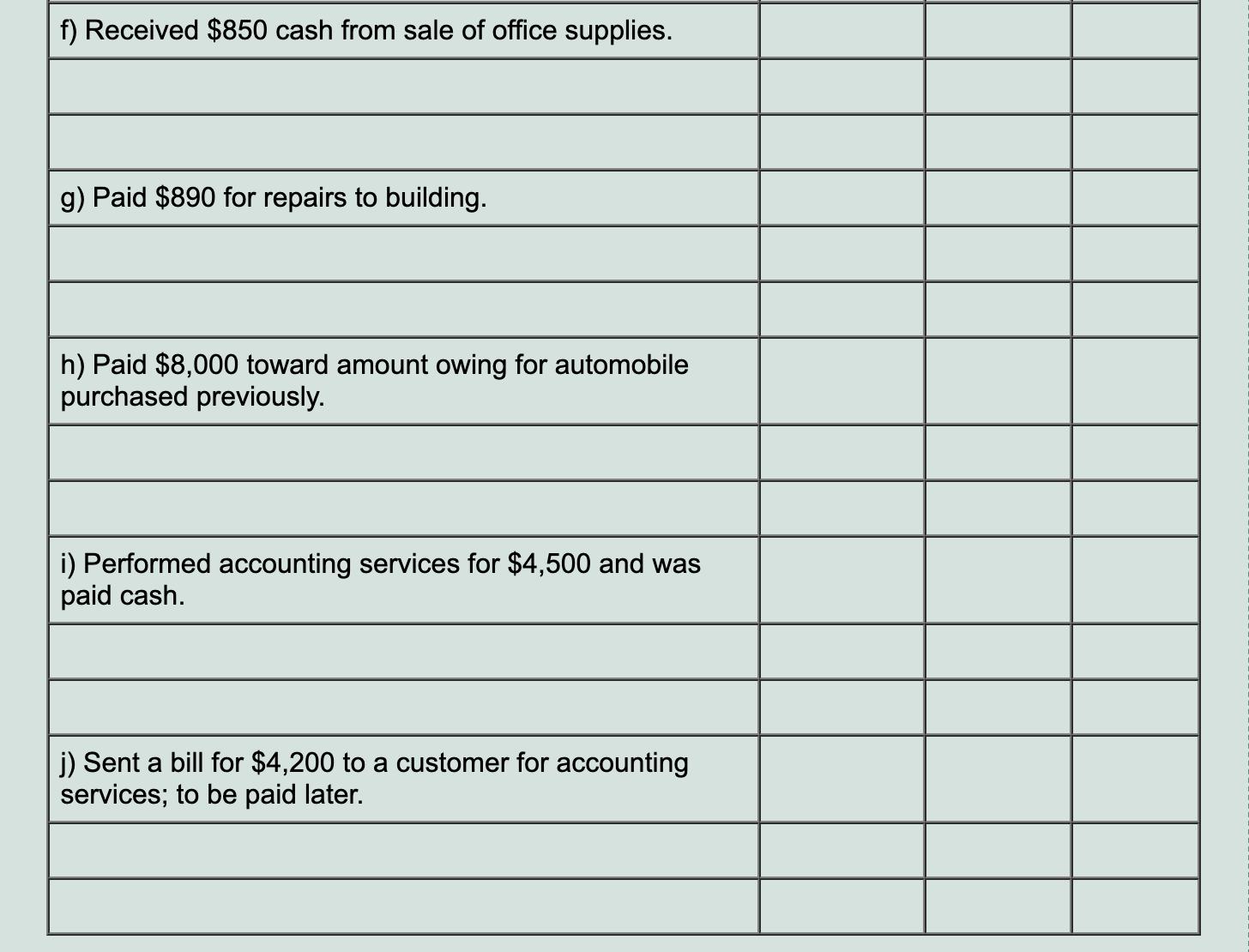

For each of the transactions listed below, determine the items affected and indicate whether they are increasing or decreasing, and by how much. You may want to review the tutorial and videos presented in the content section before attempting the assignment. Example: Purchased equipment for $2,000 cash. a) Received $1,800 payment from customers for previous purchases on credit. b) Owner invested $5,000 in the business. c) Paid salaries totaling $2,000 to employees. d) Purchased $15,000 automobile on credit. e) Purchased new office building; paid $200,000 cash and took out mortgage for $300,000. Increase Decrease Amount Equipment Cash $2,000 $2,000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a b c d e f g Increase Cash Cash Capital Equity Salaries Expense Office bui...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App