Answered step by step

Verified Expert Solution

Question

1 Approved Answer

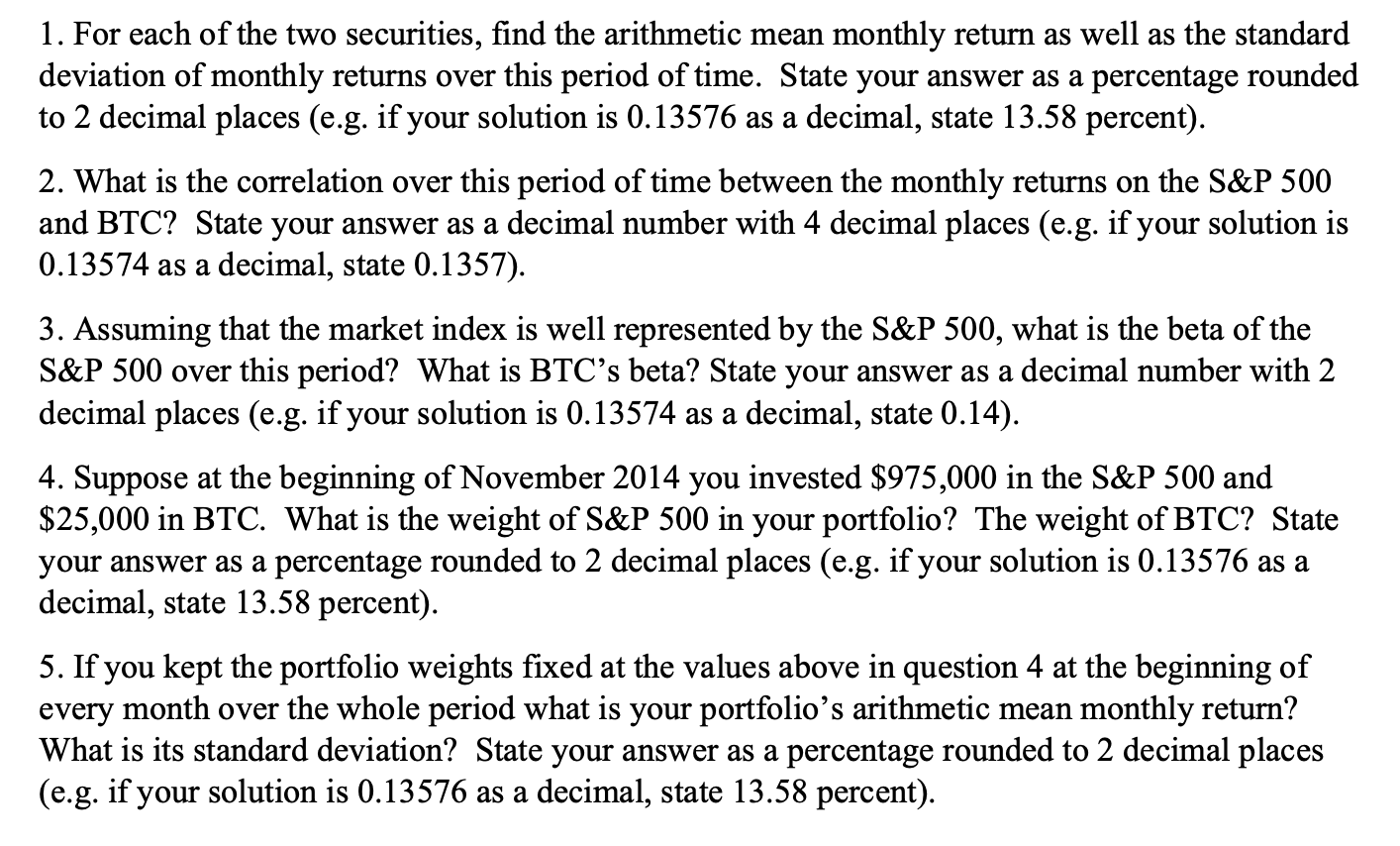

For each of the two securities , find the arithmetic mean monthly return as well as the standard deviation of monthly returns over this period

For each of the two securities find the arithmetic mean monthly return as well as the standard

deviation of monthly returns over this period of time. State your answer as a percentage rounded

to decimal places eg if your solution is as a decimal, state percent

What is the correlation over this period of time between the monthly returns on the S&P

and BTC State your answer as a decimal number with decimal places eg if your solution is

as a decimal, state

Assuming that the market index is well represented by the S&P what is the beta of the

S&P over this period? What is BTCs beta? State your answer as a decimal number with

decimal places eg if your solution is as a decimal, state

Suppose at the beginning of November you invested $ in the S&P and

$ in BTC What is the weight of S&P in your portfolio? The weight of BTC State

your answer as a percentage rounded to decimal places eg if your solution is as a

decimal, state percent

If you kept the portfolio weights fixed at the values above in question at the beginning of

every month over the whole period what is your portfolio's arithmetic mean monthly return?

What is its standard deviation? State your answer as a percentage rounded to decimal places

eg if your solution is as a decimal, state percent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started