Answered step by step

Verified Expert Solution

Question

1 Approved Answer

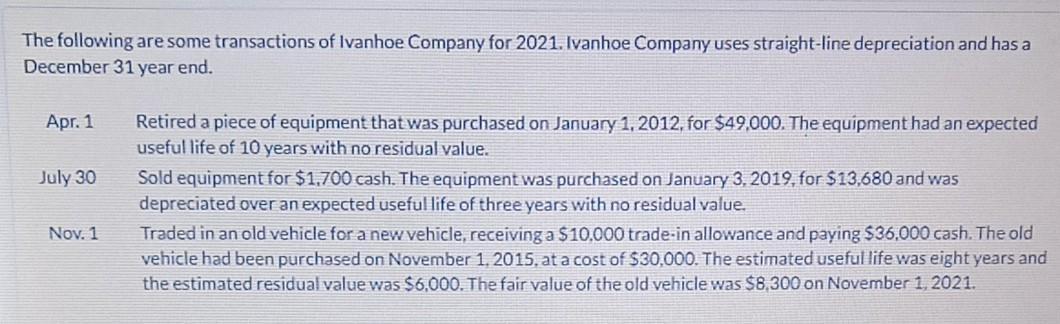

The following are some transactions of Ivanhoe Company for 2021. Ivanhoe Company uses straight-line depreciation and has a December 31 year end. Apr. 1

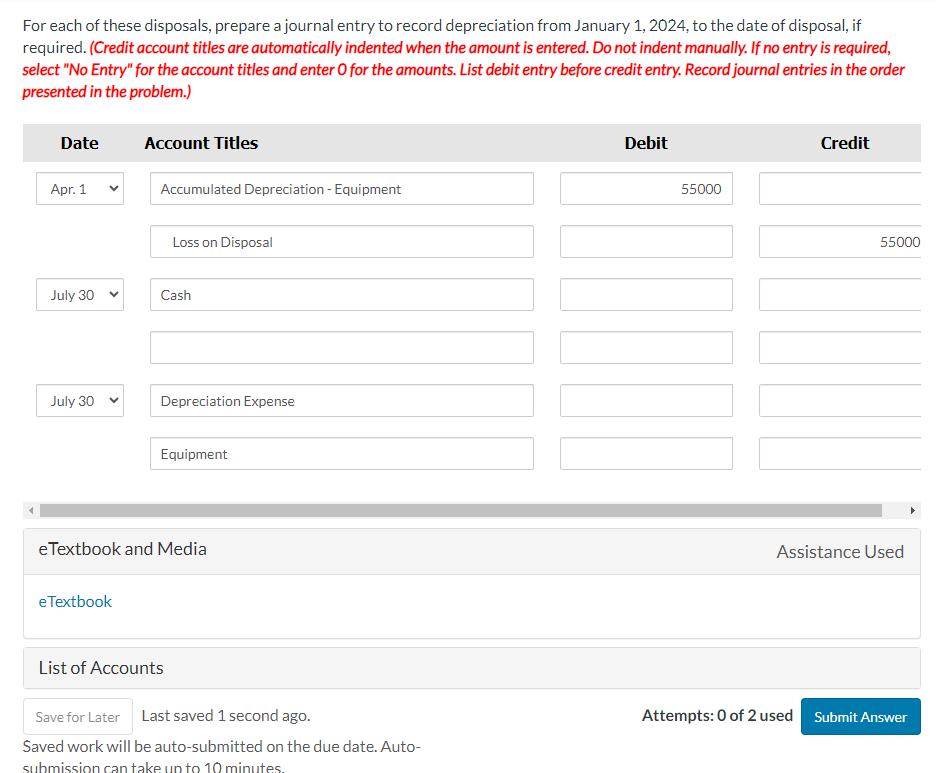

The following are some transactions of Ivanhoe Company for 2021. Ivanhoe Company uses straight-line depreciation and has a December 31 year end. Apr. 1 July 30 Nov. 1 Retired a piece of equipment that was purchased on January 1, 2012, for $49,000. The equipment had an expected useful life of 10 years with no residual value. Sold equipment for $1,700 cash. The equipment was purchased on January 3, 2019, for $13,680 and was depreciated over an expected useful life of three years with no residual value. Traded in an old vehicle for a new vehicle, receiving a $10,000 trade-in allowance and paying $36,000 cash. The old vehicle had been purchased on November 1, 2015, at a cost of $30,000. The estimated useful life was eight years and the estimated residual value was $6,000. The fair value of the old vehicle was $8,300 on November 1, 2021. For each of these disposals, prepare a journal entry to record depreciation from January 1, 2024, to the date of disposal, if required. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry. Record journal entries in the order presented in the problem.) Date Apr. 1 July 30 July 30 Account Titles e Textbook Accumulated Depreciation - Equipment Loss on Disposal Cash Depreciation Expense Equipment eTextbook and Media List of Accounts Save for Later Last saved 1 second ago. Saved work will be auto-submitted on the due date. Auto- submission can take up to 10 minutes. Debit 55000 Credit 55000 Assistance Used Attempts: 0 of 2 used Submit Answer

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Retired Equipment on April 1 2024 Debit Accumulated Depreciation Equipment 5500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started