For each question, please show the necessary derivation (if applicable) and highlight the answer.

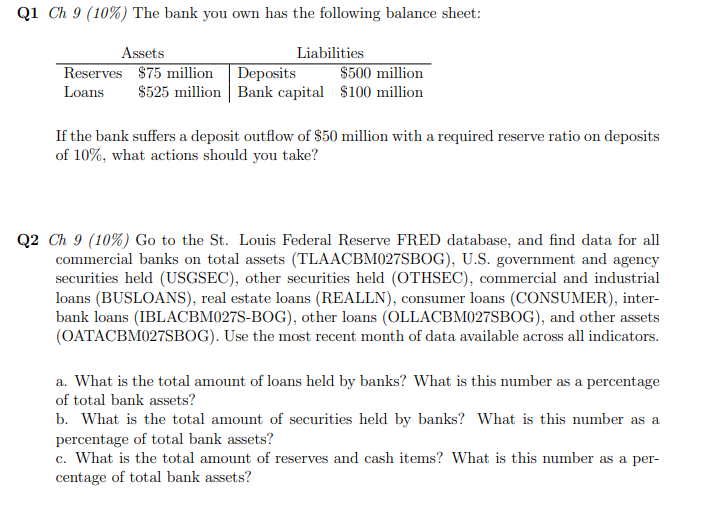

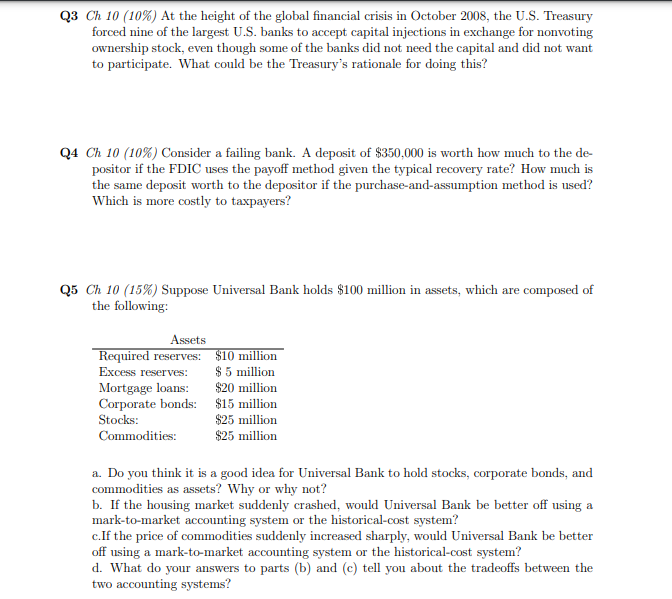

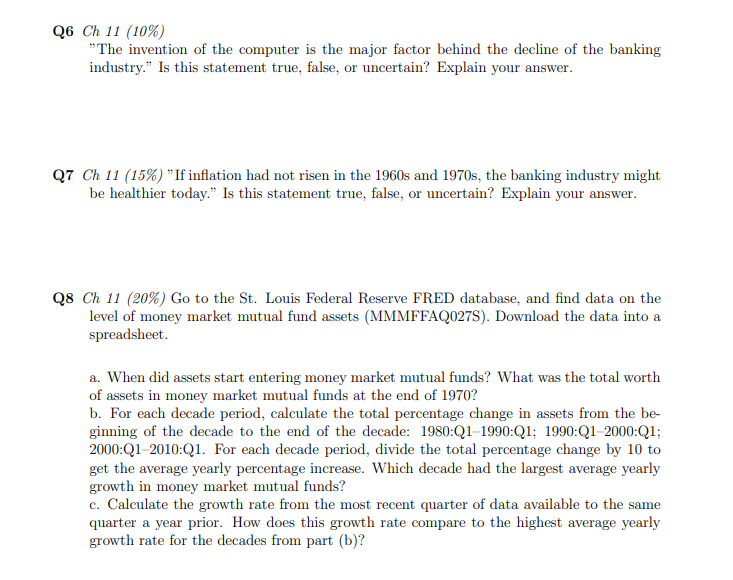

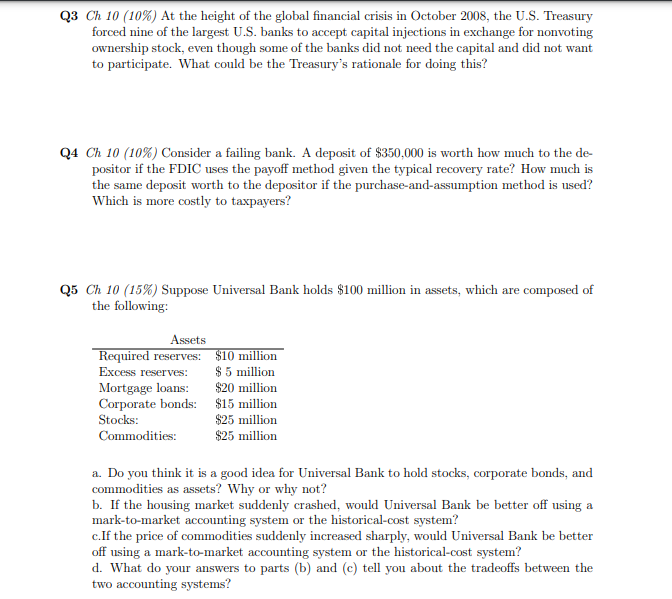

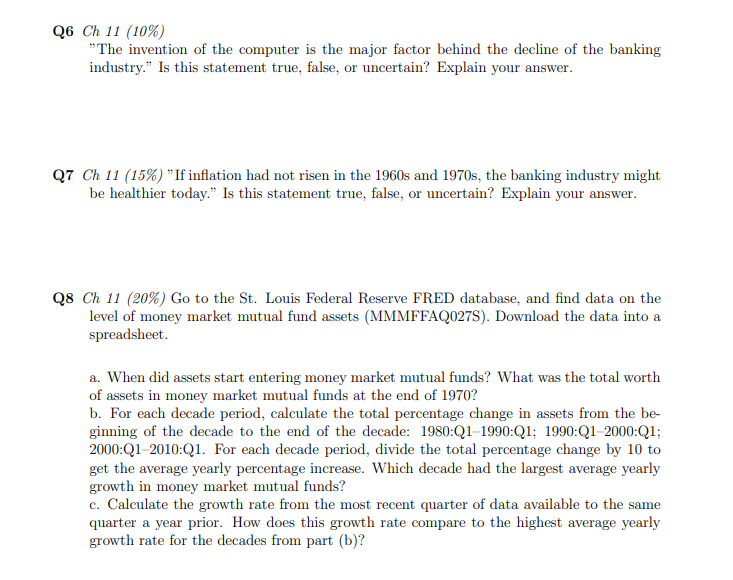

Q1 Ch 9 (10%) The bank you own has the following balance sheet: Assets Liabilities Reserves $75 million Deposits $500 million Loans $525 million Bank capital $100 million If the bank suffers a deposit outflow of $50 million with a required reserve ratio on deposits of 10%, what actions should you take? Q2 Ch 9 (10%) Go to the St. Louis Federal Reserve FRED database, and find data for all commercial banks on total assets (TLAACBM027SBOG), U.S. government and agency securities held (USGSEC), other securities held (OTHSEC), commercial and industrial loans (BUSLOANS), real estate loans (REALLN), consumer loans (CONSUMER), inter- bank loans (IBLACBM027S-BOG), other loans (OLLACBM027SBOG), and other assets (OATACBM027SBOG). Use the most recent month of data available across all indicators. a. What is the total amount of loans held by banks? What is this number as a percentage of total bank assets? b. What is the total amount of securities held by banks? What is this number as a percentage of total bank assets? c. What is the total amount of reserves and cash items? What is this number as a per- centage of total bank assets? Q3 Ch 10 (10%) At the height of the global financial crisis in October 2008, the U.S. Treasury forced nine of the largest U.S. banks to accept capital injections in exchange for nonvoting ownership stock, even though some of the banks did not need the capital and did not want to participate. What could be the Treasury's rationale for doing this? Q4 Ch 10 (10%) Consider a failing bank. A deposit of $350,000 is worth how much to the de positor if the FDIC uses the payoff method given the typical recovery rate? How much is the same deposit worth to the depositor if the purchase-and-assumption method is used? Which is more costly to taxpayers? Q5 Ch 10 (15%) Suppose Universal Bank holds $100 million in assets, which are composed of the following: Assets Required reserves: $10 million Excess reserves: $ 5 million Mortgage loans: $20 million Corporate bonds: $15 million Stocks: $25 million Commodities: $25 million a a. Do you think it is a good idea for Universal Bank to hold stocks, corporate bonds, and commodities as assets? Why or why not? b. If the housing market suddenly crashed, would Universal Bank be better off using a mark-to-market accounting system or the historical-cost system? c. If the price of commodities suddenly increased sharply, would Universal Bank be better off using a mark-to-market accounting system or the historical-cost system? d. What do your answers to parts (b) and (c) tell you about the tradeoffs between the two accounting systems? Q6 Ch 11 (10%) "The invention of the computer is the major factor behind the decline of the banking industry." Is this statement true, false, or uncertain? Explain your answer. Q7 Ch 11 (15%) "If inflation had not risen in the 1960s and 1970s, the banking industry might be healthier today." Is this statement true, false, or uncertain? Explain your answer. Q8 Ch 11 (20%) Go to the St. Louis Federal Reserve FRED database, and find data on the level of money market mutual fund assets (MMMFFAQ0278). Download the data into a spreadsheet a. When did assets start entering money market mutual funds? What was the total worth of assets in money market mutual funds at the end of 1970? b. For each decade period, calculate the total percentage change in assets from the be- ginning of the decade to the end of the decade: 1980:Q1-1990:Q1; 1990:Q1-2000:Q1; 2000:Q1-2010:01. For each decade period, divide the total percentage change by 10 to get the average yearly percentage increase. Which decade had the largest average yearly growth in money market mutual funds? c. Calculate the growth rate from the most recent quarter of data available to the same quarter a year prior. How does this growth rate compare to the highest average yearly growth rate for the decades from part (b)? Q1 Ch 9 (10%) The bank you own has the following balance sheet: Assets Liabilities Reserves $75 million Deposits $500 million Loans $525 million Bank capital $100 million If the bank suffers a deposit outflow of $50 million with a required reserve ratio on deposits of 10%, what actions should you take? Q2 Ch 9 (10%) Go to the St. Louis Federal Reserve FRED database, and find data for all commercial banks on total assets (TLAACBM027SBOG), U.S. government and agency securities held (USGSEC), other securities held (OTHSEC), commercial and industrial loans (BUSLOANS), real estate loans (REALLN), consumer loans (CONSUMER), inter- bank loans (IBLACBM027S-BOG), other loans (OLLACBM027SBOG), and other assets (OATACBM027SBOG). Use the most recent month of data available across all indicators. a. What is the total amount of loans held by banks? What is this number as a percentage of total bank assets? b. What is the total amount of securities held by banks? What is this number as a percentage of total bank assets? c. What is the total amount of reserves and cash items? What is this number as a per- centage of total bank assets? Q3 Ch 10 (10%) At the height of the global financial crisis in October 2008, the U.S. Treasury forced nine of the largest U.S. banks to accept capital injections in exchange for nonvoting ownership stock, even though some of the banks did not need the capital and did not want to participate. What could be the Treasury's rationale for doing this? Q4 Ch 10 (10%) Consider a failing bank. A deposit of $350,000 is worth how much to the de positor if the FDIC uses the payoff method given the typical recovery rate? How much is the same deposit worth to the depositor if the purchase-and-assumption method is used? Which is more costly to taxpayers? Q5 Ch 10 (15%) Suppose Universal Bank holds $100 million in assets, which are composed of the following: Assets Required reserves: $10 million Excess reserves: $ 5 million Mortgage loans: $20 million Corporate bonds: $15 million Stocks: $25 million Commodities: $25 million a a. Do you think it is a good idea for Universal Bank to hold stocks, corporate bonds, and commodities as assets? Why or why not? b. If the housing market suddenly crashed, would Universal Bank be better off using a mark-to-market accounting system or the historical-cost system? c. If the price of commodities suddenly increased sharply, would Universal Bank be better off using a mark-to-market accounting system or the historical-cost system? d. What do your answers to parts (b) and (c) tell you about the tradeoffs between the two accounting systems? Q6 Ch 11 (10%) "The invention of the computer is the major factor behind the decline of the banking industry." Is this statement true, false, or uncertain? Explain your answer. Q7 Ch 11 (15%) "If inflation had not risen in the 1960s and 1970s, the banking industry might be healthier today." Is this statement true, false, or uncertain? Explain your answer. Q8 Ch 11 (20%) Go to the St. Louis Federal Reserve FRED database, and find data on the level of money market mutual fund assets (MMMFFAQ0278). Download the data into a spreadsheet a. When did assets start entering money market mutual funds? What was the total worth of assets in money market mutual funds at the end of 1970? b. For each decade period, calculate the total percentage change in assets from the be- ginning of the decade to the end of the decade: 1980:Q1-1990:Q1; 1990:Q1-2000:Q1; 2000:Q1-2010:01. For each decade period, divide the total percentage change by 10 to get the average yearly percentage increase. Which decade had the largest average yearly growth in money market mutual funds? c. Calculate the growth rate from the most recent quarter of data available to the same quarter a year prior. How does this growth rate compare to the highest average yearly growth rate for the decades from part (b)