Answered step by step

Verified Expert Solution

Question

1 Approved Answer

! For each scenario below, identify: (1) The best filing status, (2) The amount of standard deduction (watch out for additional amount related to

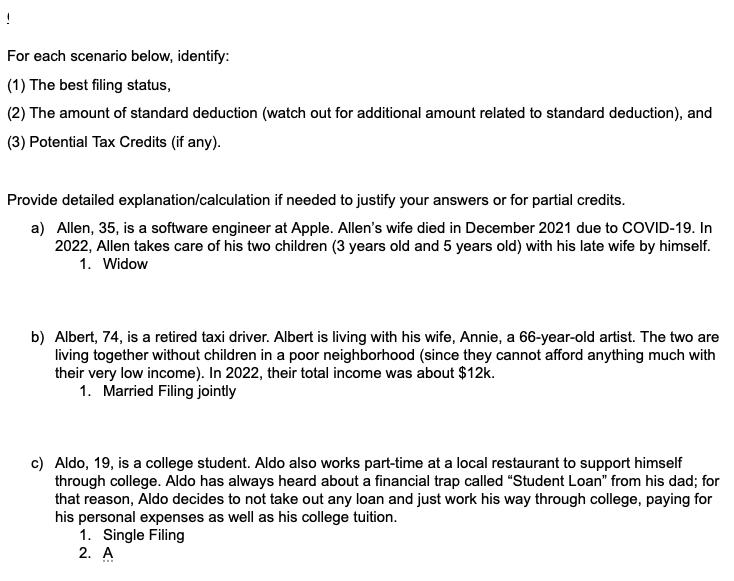

! For each scenario below, identify: (1) The best filing status, (2) The amount of standard deduction (watch out for additional amount related to standard deduction), and (3) Potential Tax Credits (if any). Provide detailed explanation/calculation if needed to justify your answers or for partial credits. a) Allen, 35, is a software engineer at Apple. Allen's wife died in December 2021 due to COVID-19. In 2022, Allen takes care of his two children (3 years old and 5 years old) with his late wife by himself. 1. Widow b) Albert, 74, is a retired taxi driver. Albert is living with his wife, Annie, a 66-year-old artist. The two are living together without children in a poor neighborhood (since they cannot afford anything much with their very low income). In 2022, their total income was about $12k. 1. Married Filing jointly c) Aldo, 19, is a college student. Aldo also works part-time at a local restaurant to support himself through college. Aldo has always heard about a financial trap called "Student Loan" from his dad; for that reason, Aldo decides to not take out any loan and just work his way through college, paying for his personal expenses as well as his college tuition. 1. Single Filing 2. A

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Step 11 Solutions A For Allen Best filling status Q...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started