Question

For each stage of financing write the letter for the best match with the stage of business development. One match for each Bootstrap financing ___

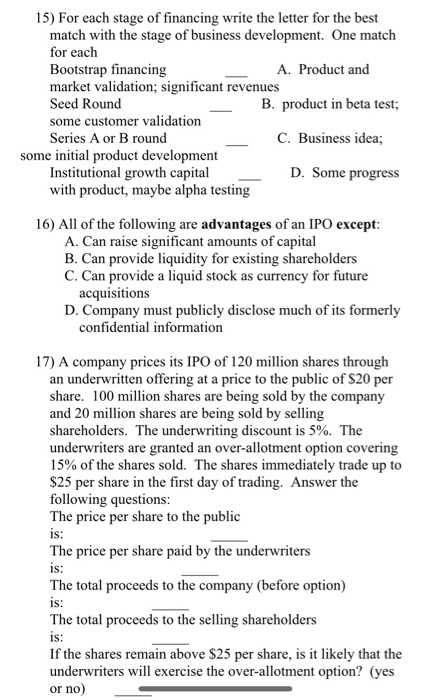

- For each stage of financing write the letter for the best match with the stage of business development. One match for each

Bootstrap financing ___ A. Product and market validation; significant revenues

Seed Round ___ B. product in beta test; some customer validation

Series A or B round ___ C. Business idea; some initial product development

Institutional growth capital ___ D. Some progress with product, maybe alpha testing

- All of the following are advantages of an IPO except:

- Can raise significant amounts of capital

- Can provide liquidity for existing shareholders

- Can provide a liquid stock as currency for future acquisitions

- Company must publicly disclose much of its formerly confidential information

- A company prices its IPO of 120 million shares through an underwritten offering at a price to the public of $20 per share. 100 million shares are being sold by the company and 20 million shares are being sold by selling shareholders. The underwriting discount is 5%. The underwriters are granted an over-allotment option covering 15% of the shares sold. The shares immediately trade up to $25 per share in the first day of trading. Answer the following questions:

The price per share to the public is: _____

The price per share paid by the underwriters is: _____

The total proceeds to the company (before option) is: _____

The total proceeds to the selling shareholders is: _____

If the shares remain above $25 per share, is it likely that the

underwriters will exercise the over-allotment option? (yes or no) _____

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started